Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. APPLICATION The case study indicates that the City of Lakeview will not have any additional debt capacity two years from now. The additional

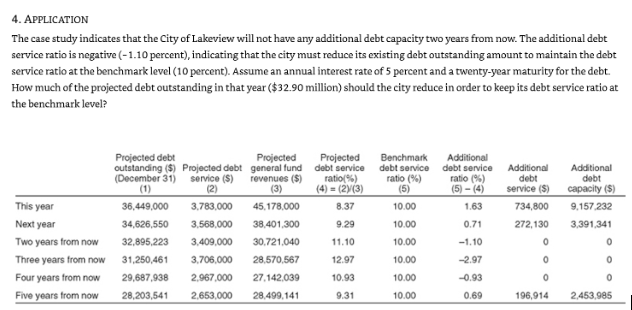

4. APPLICATION The case study indicates that the City of Lakeview will not have any additional debt capacity two years from now. The additional debt service ratio is negative (-1.10 percent), indicating that the city must reduce its existing debt outstanding amount to maintain the debt service ratio at the benchmark level (10 percent). Assume an annual interest rate of 5 percent and a twenty-year maturity for the debt. How much of the projected debt outstanding in that year ($32.90 million) should the city reduce in order to keep its debt service ratio at the benchmark level? Projected debt outstanding ($) Projected debt (December 31) service (S) Projected general fund Projected debt service Benchmark debt service revenues ($) (1) (2) (3) ratio(%) (4)=(2)/(3) ratio (%) (5) Additional debt service ratio (%) (5)-(4) Additional debt Additional debt service ($) capacity ($) This year 36,449,000 3,783,000 45,178,000 8.37 10.00 1.63 734,800 9,157,232 Next year 34,626,550 3,568,000 38,401,300 9.29 10.00 0.71 272,130 3,391,341 Two years from now 32,895,223 3,409,000 30,721,040 11.10 10.00 -1.10 Three years from now 31,250,461 3,706,000 28,570,567 12.97 10.00 -2.97 0 Four years from now 29,687,938 2,967,000 27,142,039 10.93 10.00 -0.93 Five years from now 28,203,541 2,653,000 28,499,141 9.31 10.00 0.69 196,914 2,453,985

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started