Answered step by step

Verified Expert Solution

Question

1 Approved Answer

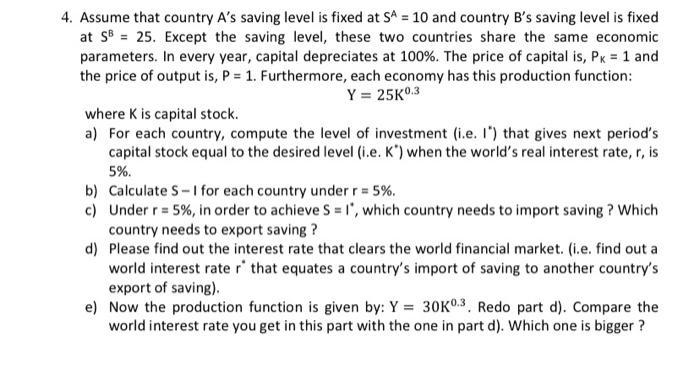

4. Assume that country A's saving level is fixed at SA = 10 and country B's saving level is fixed at SB 25. Except

4. Assume that country A's saving level is fixed at SA = 10 and country B's saving level is fixed at SB 25. Except the saving level, these two countries share the same economic parameters. In every year, capital depreciates at 100%. The price of capital is, PK = 1 and the price of output is, P = 1. Furthermore, each economy has this production function: Y = 25K0.3 where K is capital stock. a) For each country, compute the level of investment (i.e. I") that gives next period's capital stock equal to the desired level (i.e. K") when the world's real interest rate, r, is 5%. b) Calculate S-1 for each country under r = 5%. c) Under r5%, in order to achieve S = 1', which country needs to import saving? Which country needs to export saving? d) Please find out the interest rate that clears the world financial market. (i.e. find out a world interest rate r' that equates a country's import of saving to another country's export of saving). e) Now the production function is given by: Y = 30K03. Redo part d). Compare the world interest rate you get in this part with the one in part d). Which one is bigger?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started