Question

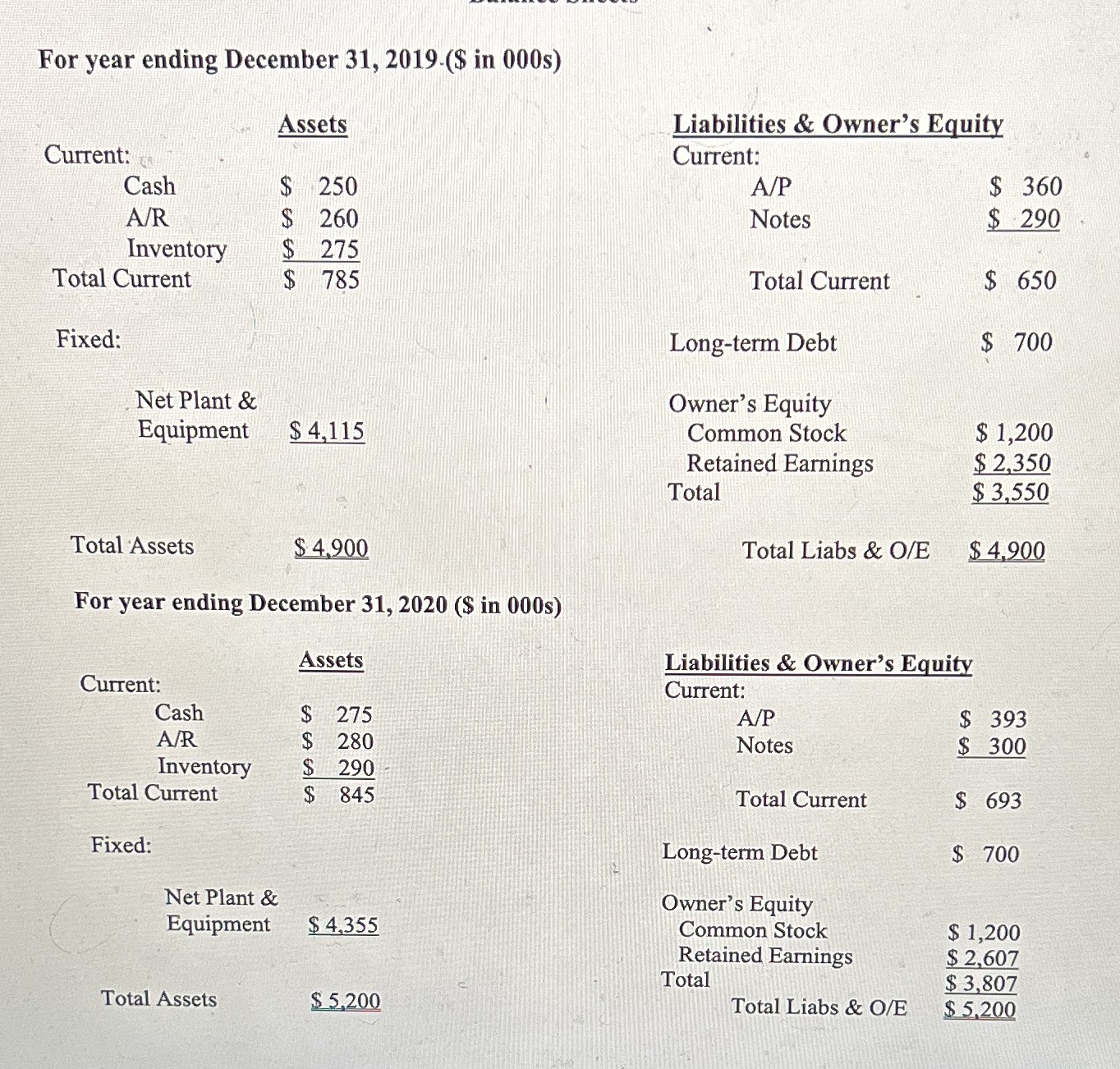

4. Assume that Tardis' 2020 Total Assets increase by 2.5% and that Net Income also increases by 2.5%. Current Liabilities, Long Term Debt and Common

4. Assume that Tardis' 2020 Total Assets increase by 2.5% and that Net Income also increases by 2.5%. Current Liabilities, Long Term Debt and Common Stock do not change, however Retained Earnings will increase by the proportion of Net Income that is retained by the company as Retained Earnings that you found in question 3. Now add up 2020 Current Liabilities, Long Term Debt, Common Stock and Retained Earnings and subtract that from 2020 total Assets. Which is larger, Total Assets or Total Liabilities and Owner's Equity? What is the size of the difference? 5. Repeat problem 4 using 6.0% as the increase in 2020 Total Assets and Net Income.6. Repeat problem 4 using 10% as the increase in 2020 Total Assets and Net Income.

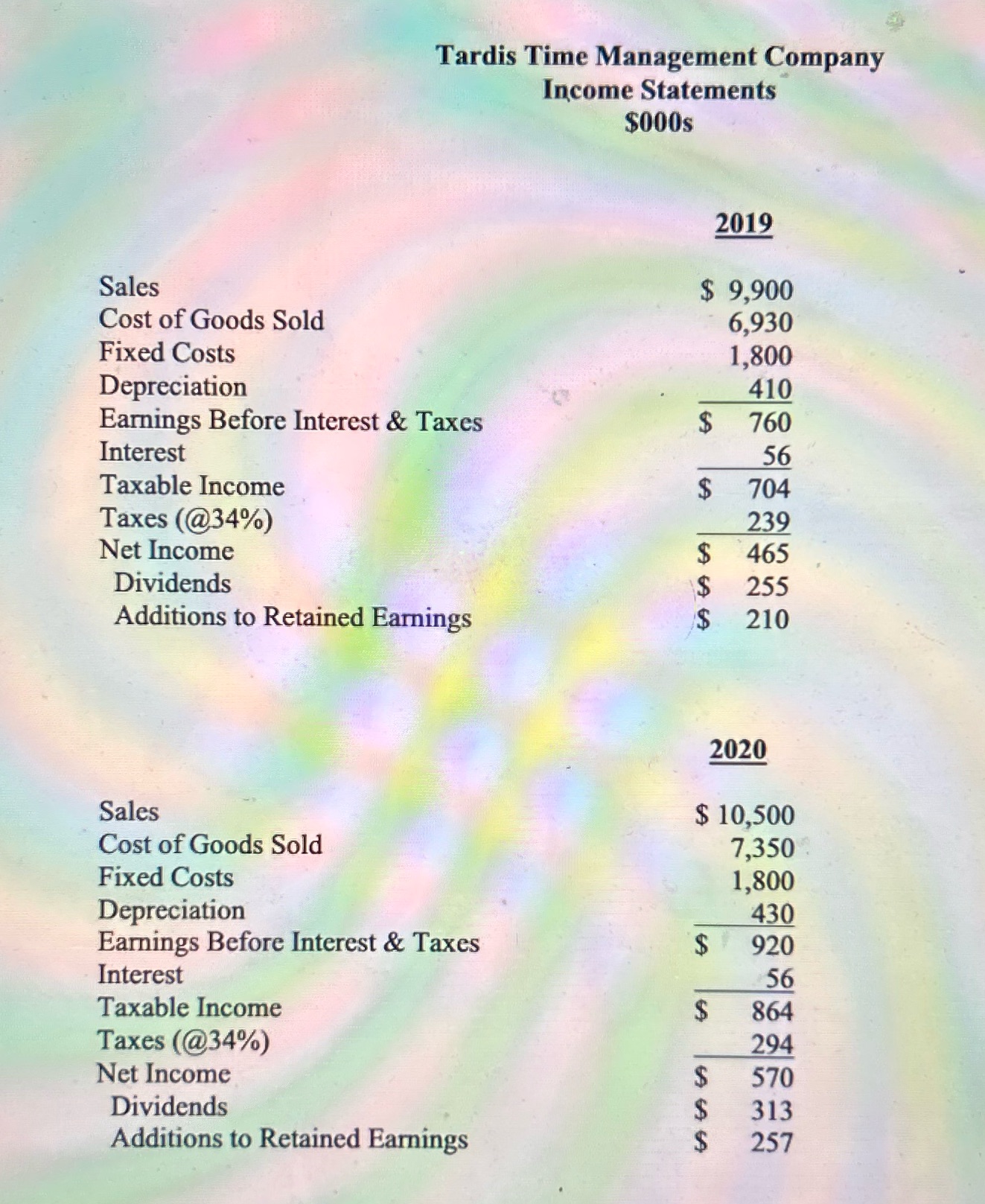

Tardis Time Management Company Income Statements $000s 2019 Sales $ 9,900 Cost of Goods Sold 6,930 Fixed Costs 1,800 Depreciation 410 Earnings Before Interest & Taxes $ 760 Interest 56 Taxable Income $ 704 Taxes (@34%) 239 Net Income $ 465 Dividends $ 255 Additions to Retained Earnings 210 2020 Sales $ 10,500 Cost of Goods Sold 7,350 Fixed Costs 1,800 Depreciation 430 Earnings Before Interest & Taxes $ 920 Interest 56 Taxable Income $ 864 Taxes (@34%) 294 Net Income $ 570 Dividends $ 313 Additions to Retained Earnings $ 257

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started