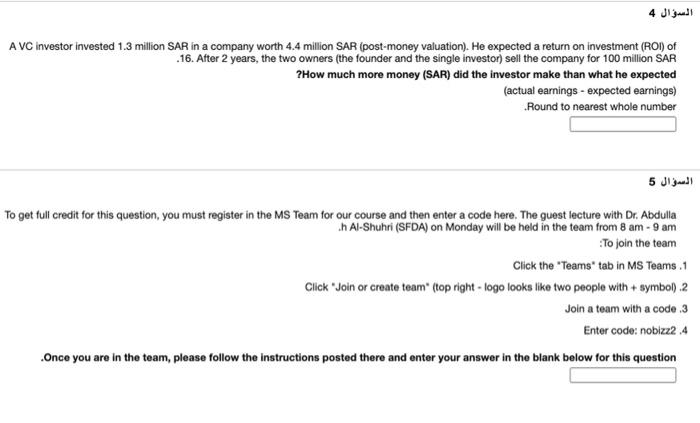

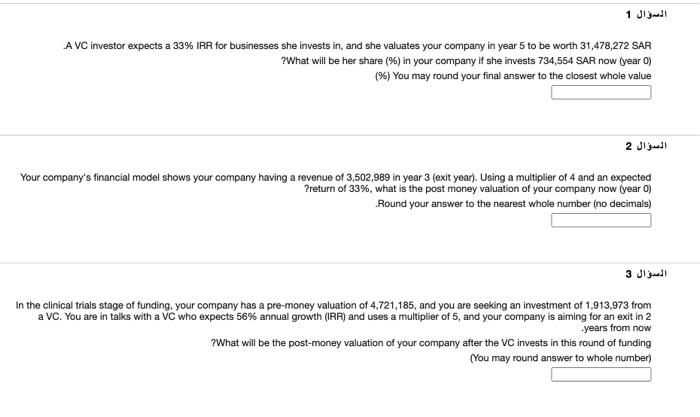

4 AVC investor invested 1.3 million SAR in a company worth 4.4 million SAR (post-money valuation). He expected a return on investment (ROI) of 16. After 2 years, the two owners (the founder and the single investor) sell the company for 100 million SAR ? How much more money (SAR) did the investor make than what he expected (actual earnings - expected earnings) Round to nearest whole number 5 To get full credit for this question, you must register in the MS Team for our course and then enter a code here. The guest lecture with Dr. Abdulla . Al-Shuhri (SFDA) on Monday will be held in the team from 8 am - 9 am To join the team Click the "Teams' tab in MS Teams .1 Click "Join or create team" (top right - logo looks like two people with + symbol.2 Join a team with a code 3 Enter code: nobizz2.4 Once you are in the team, please follow the instructions posted there and enter your answer in the blank below for this question 1 AVC investor expects a 33% IRR for businesses she invests in, and she valuates your company in year 5 to be worth 31,478,272 SAR ? What will be her share (%) in your company if she invests 734,554 SAR now (year ) (%) You may round your final answer to the closest whole value 2 Your company's financial model shows your company having a revenue of 3,502,989 in year 3 (exit year). Using a multiplier of 4 and an expected Preturn of 33%, what is the post money valuation of your company now (year ) Round your answer to the nearest whole number (no decimals) 3 In the clinical trials stage of funding, your company has a pre-money valuation of 4,721,185, and you are seeking an investment of 1,913,973 from a VC. You are in talks with a VC who expects 56% annual growth (IRR) and uses a multiplier of 5, and your company is aiming for an exit in 2 years from now ? What will be the post-money valuation of your company after the VC invests in this round of funding (You may round answer to whole number) 4 AVC investor invested 1.3 million SAR in a company worth 4.4 million SAR (post-money valuation). He expected a return on investment (ROI) of 16. After 2 years, the two owners (the founder and the single investor) sell the company for 100 million SAR ? How much more money (SAR) did the investor make than what he expected (actual earnings - expected earnings) Round to nearest whole number 5 To get full credit for this question, you must register in the MS Team for our course and then enter a code here. The guest lecture with Dr. Abdulla . Al-Shuhri (SFDA) on Monday will be held in the team from 8 am - 9 am To join the team Click the "Teams' tab in MS Teams .1 Click "Join or create team" (top right - logo looks like two people with + symbol.2 Join a team with a code 3 Enter code: nobizz2.4 Once you are in the team, please follow the instructions posted there and enter your answer in the blank below for this question 1 AVC investor expects a 33% IRR for businesses she invests in, and she valuates your company in year 5 to be worth 31,478,272 SAR ? What will be her share (%) in your company if she invests 734,554 SAR now (year ) (%) You may round your final answer to the closest whole value 2 Your company's financial model shows your company having a revenue of 3,502,989 in year 3 (exit year). Using a multiplier of 4 and an expected Preturn of 33%, what is the post money valuation of your company now (year ) Round your answer to the nearest whole number (no decimals) 3 In the clinical trials stage of funding, your company has a pre-money valuation of 4,721,185, and you are seeking an investment of 1,913,973 from a VC. You are in talks with a VC who expects 56% annual growth (IRR) and uses a multiplier of 5, and your company is aiming for an exit in 2 years from now ? What will be the post-money valuation of your company after the VC invests in this round of funding (You may round answer to whole number)