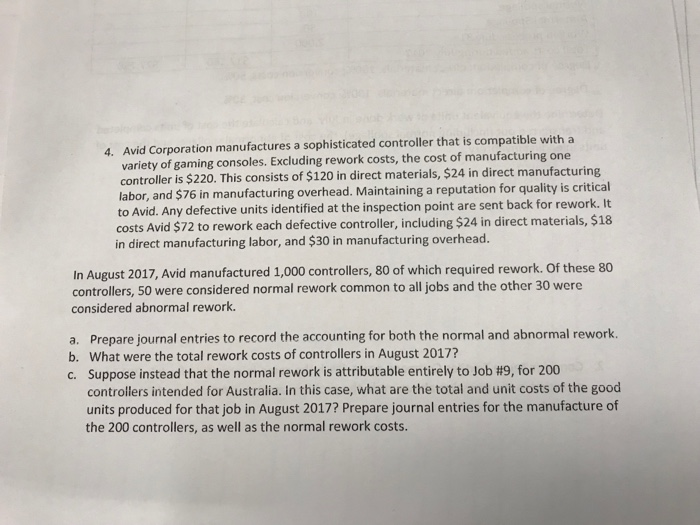

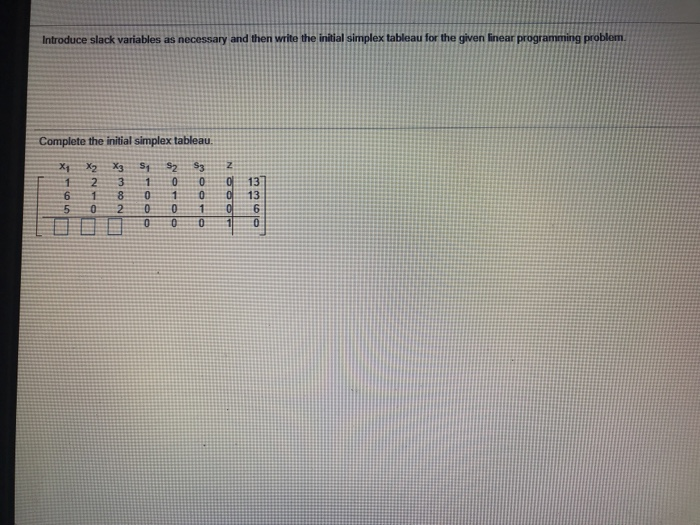

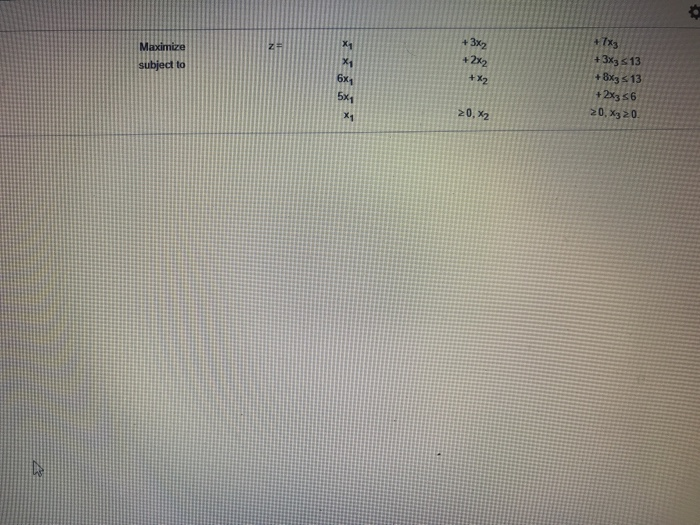

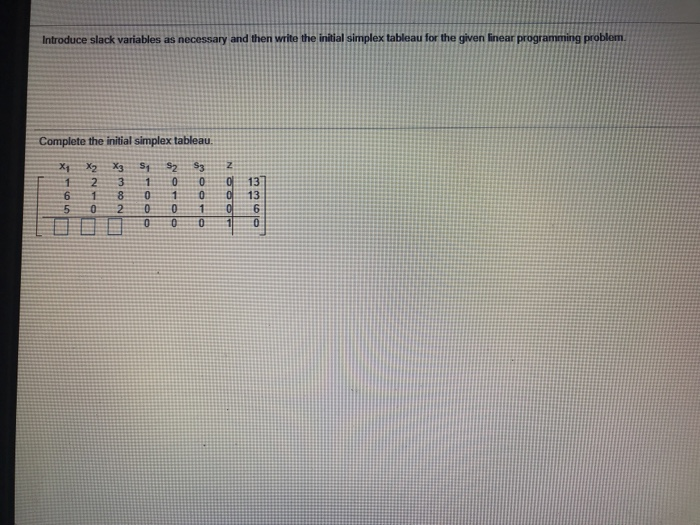

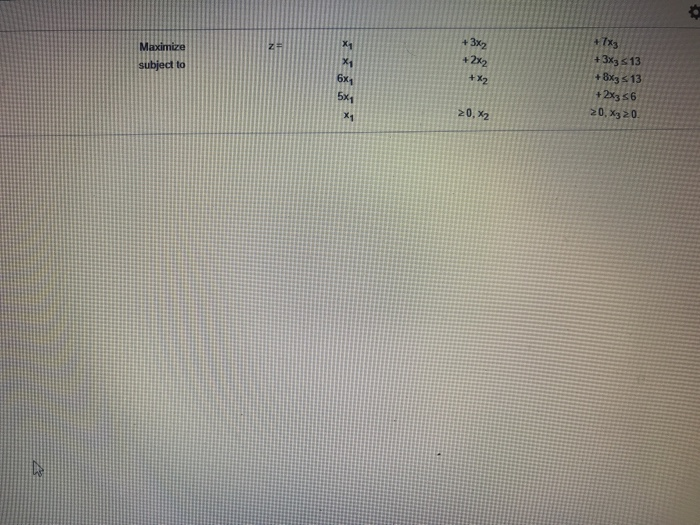

4. Avid Corporation manufactures a sophisticated controller that is compatible with a variety of gaming consoles. Excluding rework costs, the cost of manufacturing one controller is $220. This consists of $120 in direct materials, $24 in direct manufacturing labor, and $76 in manufacturing overhead. Maintaining a reputation for quality is critical to Avid. Any defective units identified at the inspection point are sent back for rework. It costs Avid $72 to rework each defective controller, including $24 in direct materials, $18 in direct manufacturing labor, and $30 in manufacturing overhead. In August 2017, Avid manufactured 1,000 controllers, 80 of which required rework. Of these 80 controllers, 50 were considered normal rework common to all jobs and the other 30 were considered abnormal rework. a. Prepare journal entries to record the accounting for both the normal and abnormal rework. b. What were the total rework costs of controllers in August 2017? C. Suppose instead that the normal rework is attributable entirely to Job #9, for 200 controllers intended for Australia. In this case, what are the total and unit costs of the good units produced for that job in August 2017? Prepare journal entries for the manufacture of the 200 controllers, as well as the normal rework costs. T* +3x3 513 + 8x35 13 +2x356 20,X320 0.X2 4. Avid Corporation manufactures a sophisticated controller that is compatible with a variety of gaming consoles. Excluding rework costs, the cost of manufacturing one controller is $220. This consists of $120 in direct materials, $24 in direct manufacturing labor, and $76 in manufacturing overhead. Maintaining a reputation for quality is critical to Avid. Any defective units identified at the inspection point are sent back for rework. It costs Avid $72 to rework each defective controller, including $24 in direct materials, $18 in direct manufacturing labor, and $30 in manufacturing overhead. In August 2017, Avid manufactured 1,000 controllers, 80 of which required rework. Of these 80 controllers, 50 were considered normal rework common to all jobs and the other 30 were considered abnormal rework. a. Prepare journal entries to record the accounting for both the normal and abnormal rework. b. What were the total rework costs of controllers in August 2017? C. Suppose instead that the normal rework is attributable entirely to Job #9, for 200 controllers intended for Australia. In this case, what are the total and unit costs of the good units produced for that job in August 2017? Prepare journal entries for the manufacture of the 200 controllers, as well as the normal rework costs. T* +3x3 513 + 8x35 13 +2x356 20,X320 0.X2