Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#4 basics 4. Modified internal rate of return (MTRR) The IRR evaluation method assumes that cash flows from the project are reirvested at the same

#4 basics

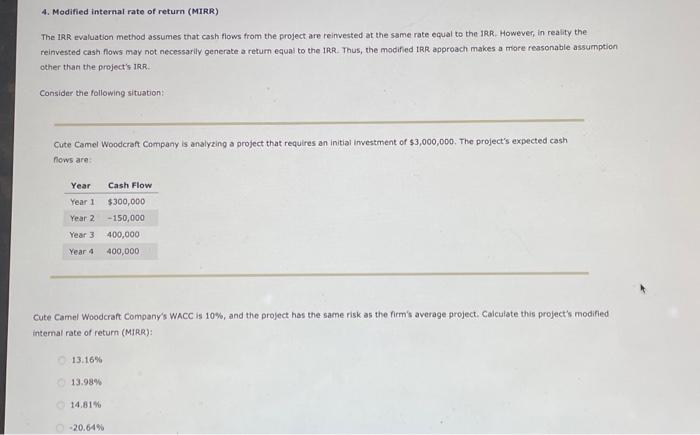

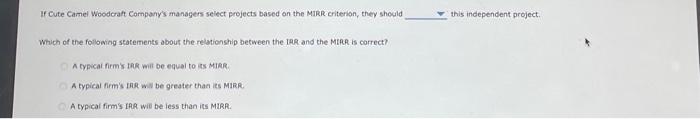

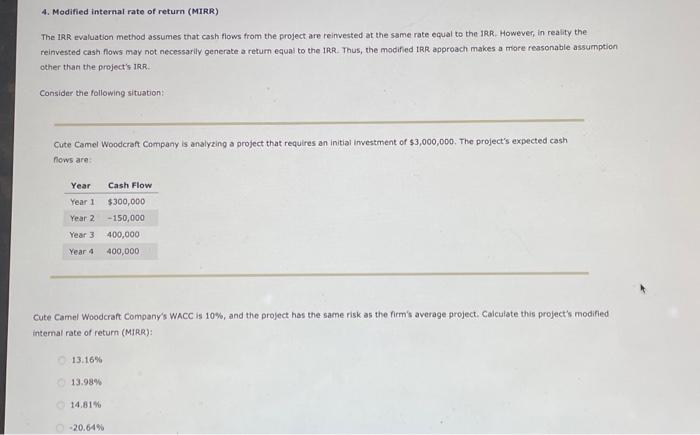

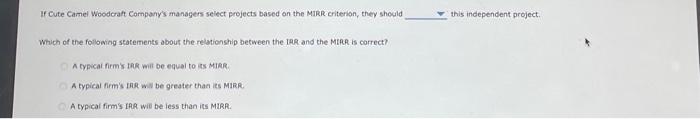

4. Modified internal rate of return (MTRR) The IRR evaluation method assumes that cash flows from the project are reirvested at the same rate equal to the IRR. However, in reality the reinvested cash fows may not necessarily generate a retum equal to the IRR. Thus, the modified tRR approach makes a more reasonable assumption other than the project's IRR. Consider the following situation: Cute Camel Woodcraf Company is analyzing a project that requires an initial investment of $3,000,000, The project's expected cash nows are: Cute Camel Woodcraft Company's WACC is 10%, and the project has the same risk as the firm's average project. Colculate this project's modified intemal rate of return (MIRR): 13.16% 13.98% 14.81% 20.64% If Cute Camei Woodorat Company's managers seiect projects based on the MIRR criterion, they showid this independent project. Which of the following statements about the relationship between the IRR and the MLRR is correct? A tyacal firms toR wit be equal to is MIRR. A typical firm's IBR wil be greater than ies MIRR: A typical firm's IPR wir be less then its MIRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started