Question

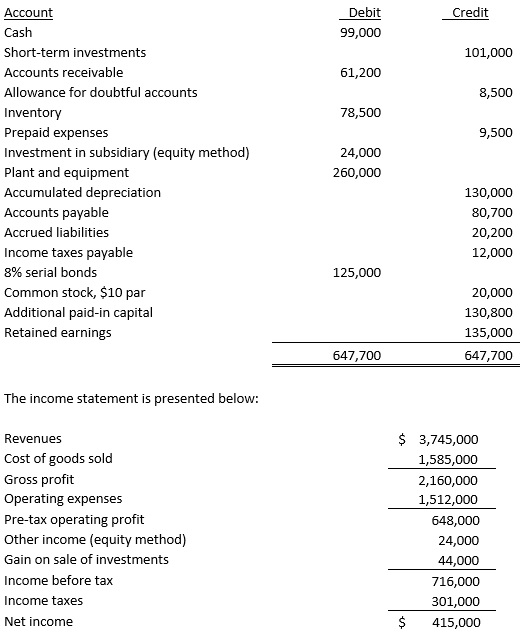

4. Below are the changes in account balances for balance sheet accounts and the income statement for The Five Brothers Pizza Chains, Inc. Please prepare

4. Below are the changes in account balances for balance sheet accounts and the income statement for The Five Brothers Pizza Chains, Inc. Please prepare cash flow statements on both the indirect and direct basis.

Additional information:

a. On January 2, 2015 short-term investments costing $101,000 were sold for $145,000.

b. The company paid a cash dividend on February 1, 2015.

c. No assets were retired during 2015.

d. The company owns 20% of Clark & Co. and accounts for its share of net income under the equity method. They received no dividends during the year.

e. At January 1, 2013, the cash balance was $100,000.

Debit Credit Account Cash Short-term investments Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Investment in subsidiary (equity method) Plant and equipment Accumulated depreciation Accounts payable Accrued liabilities Income taxes payable 896 serial bonds Common stock, $10 par Additional paid-in capital Retained earnings 99,000 101,000 61,200 8,500 78,500 9,500 24,000 260,000 130,000 80,700 20,200 12,000 125,000 20,000 130,800 135,000 647,700 647,700 The income statement is presented below Revenues Cost of goods sold Gross profit Operating expenses Pre-tax operating profit Other income (equity method) Gain on sale of investments Income before tax Income taxes Net income $ 3,745,000 1,585,000 2,160,000 1,512,000 648,000 24,000 44,000 716,000 301,000 $415,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started