Question

4) Berring Inc. recently reported operating income of $2.3 million, depreciation of $1.20 million, and had a tax rate of 20%. The firm's expenditures on

4) Berring Inc. recently reported operating income of $2.3 million, depreciation of $1.20 million, and had a tax rate of 20%. The firm's expenditures on fixed assets and net operating working capital totaled $0.60 million. How much was its free cash flow, in millions? Group of answer choices

a)$2.06 b)$2.44 c)$1.96 d)$2.22 e)$2.325

5) Which of the following would generally indicate an improvement in a company's financial position, holding other things constant? Group of answer choices

a)The TIE declines. b)The total assets turnover decreases. c)The current ratio declines. d)The DSO increases. e)The quick ratio increases.

6) (Exhibit 4.1) The balance sheet and income statement shown below are for Gray Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

Balance Sheet (Millions of $) Assets 2021

Cash and securities $3,000

Accounts receivable 15,000

Inventories 18,000

Total current assets $36,000

Net plant and equipment $24,000

Total assets $60,000

Liabilities and Equity Accounts payable $17,160

Accruals 9,240

Notes payable 6,000

Total current liabilities $32,400

Long-term bonds $12,000

Total liabilities $44,400

Common stock $3,900

Retained earnings 11,700

Total common equity $15,600

Total liabilities and equity $60,000

Income Statement (Millions of $) 2021 Net sales $66,000

Operating costs except depreciation 61,380

Depreciation 1,320

Earnings before interest and taxes (EBIT) $3,300

Less interest 1,080

Earnings before taxes (EBT) $2,220

Taxes (25%) 555

Net income $1,665

Other data: Shares outstanding (millions) 500.00

Common dividends (millions of $) $582.75

Int. rate on notes payable & L-T bonds 6%

Federal plus state income tax rate 25%

Year-end stock price $39.96

Refer to Exhibit 4.1. What is the firm's current ratio? Do not round your intermediate calculations. Group of answer choices

a)1.06 b)0.84 c)1.20 d)1.11 e)1.37

7) Free cash flow (FCF) is, essentially, the cash flow that is available for interest and dividends after the company has made the investments in current and fixed assets that are necessary to sustain ongoing operations. Group of answer choices

True

False

8) If a firm's ROE is equal to 9% and its ROA is equal to 6%, its equity multiplier must be 1.5. Group of answer choices

True

False

9) The balance sheet and income statement shown below are for Gray Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

Balance Sheet (Millions of $) Assets 2021

Cash and securities $3,000

Accounts receivable 15,000

Inventories 18,000

Total current assets $36,000

Net plant and equipment $24,000

Total assets $60,000

Liabilities and Equity Accounts payable $17,160

Accruals 9,240

Notes payable 6,000

Total current liabilities $32,400

Long-term bonds $12,000

Total liabilities $44,400

Common stock $3,900

Retained earnings 11,700

Total common equity $15,600

Total liabilities and equity $60,000

Income Statement (Millions of $) 2021 Net sales $66,000

Operating costs except depreciation 61,380

Depreciation 1,320

Earnings before interest and taxes (EBIT) $3,300

Less interest 1,080

Earnings before taxes (EBT) $2,220

Taxes (25%) 555

Net income $1,665

Other data: Shares outstanding (millions) 500.00

Common dividends (millions of $) $582.75

Int. rate on notes payable & L-T bonds 6%

Federal plus state income tax rate 25%

Year-end stock price $39.96

Refer to Exhibit 4.1. What is the firm's total assets turnover? Do not round your intermediate calculations. Group of answer choices

a)0.83 b)1.07 c)1.27 d)1.10 e)0.95

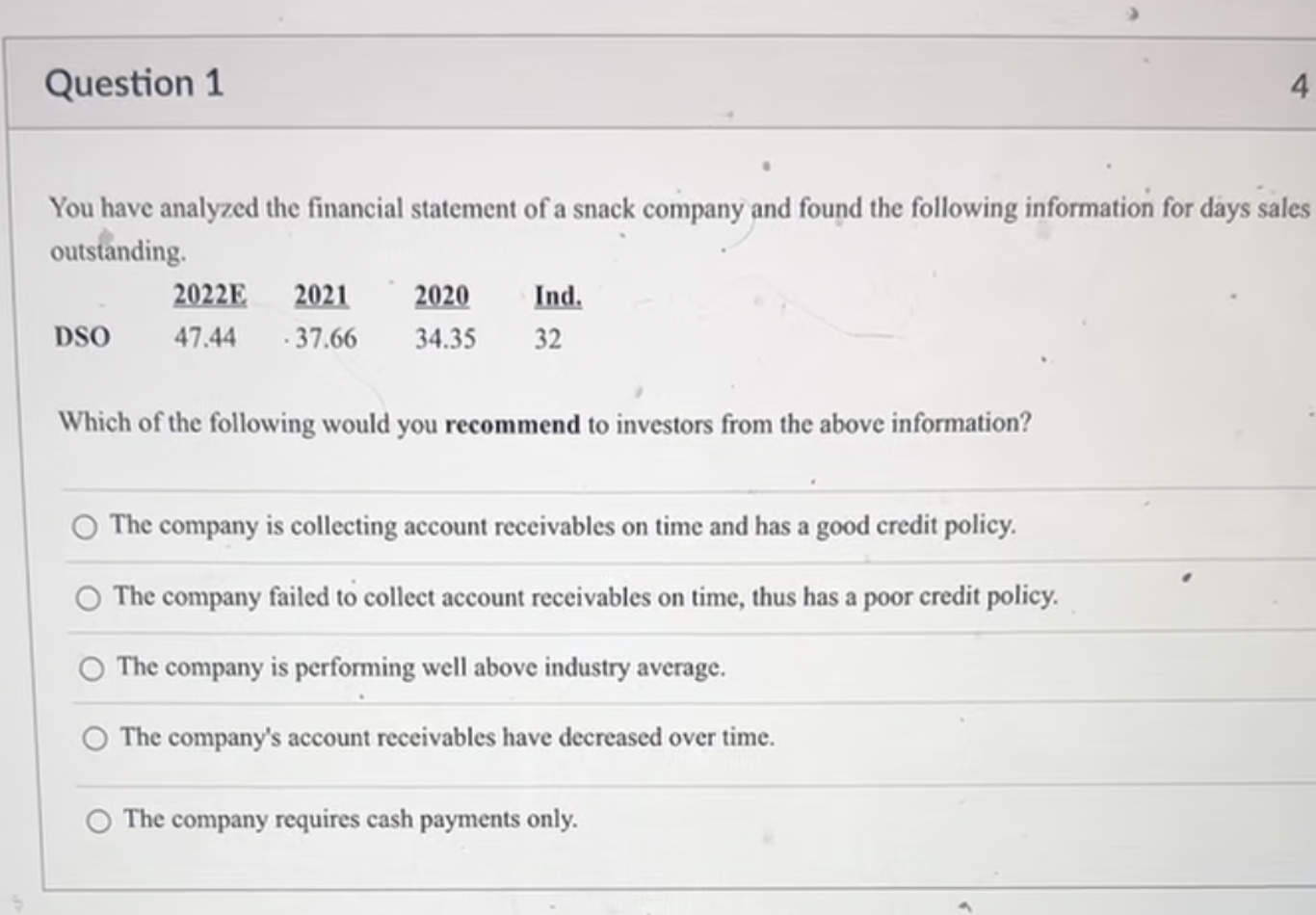

You have analyzed the financial statement of a snack company and found the following information for days sales outstanding. Which of the following would you recommend to investors from the above information? The company is collecting account receivables on time and has a good credit policy. The company failed to collect account receivables on time, thus has a poor credit policy. The company is performing well above industry average. The company's account receivables have decreased over time. The company requires cash payments only. Welch Timber has 2 million shares of common stock outstanding that sell for $17 a share. If the company has $35 million of common equity on its balance sheet, what is the company's Market Value Added (MVA)? Answer options are provided in whole dollar. $1,000,000 $850,000 $800,000 $1,150,000 $1,200,000 During 2022, Great Harvest Bakery paid out $33,525 of common dividends. It ended the year with $245,000 of retained earnings versus the prior year's retained earnings of $159,600. How much net income did the firm earn during the year? $101,086 $118,925 $95,140 $102,276 $108,222

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started