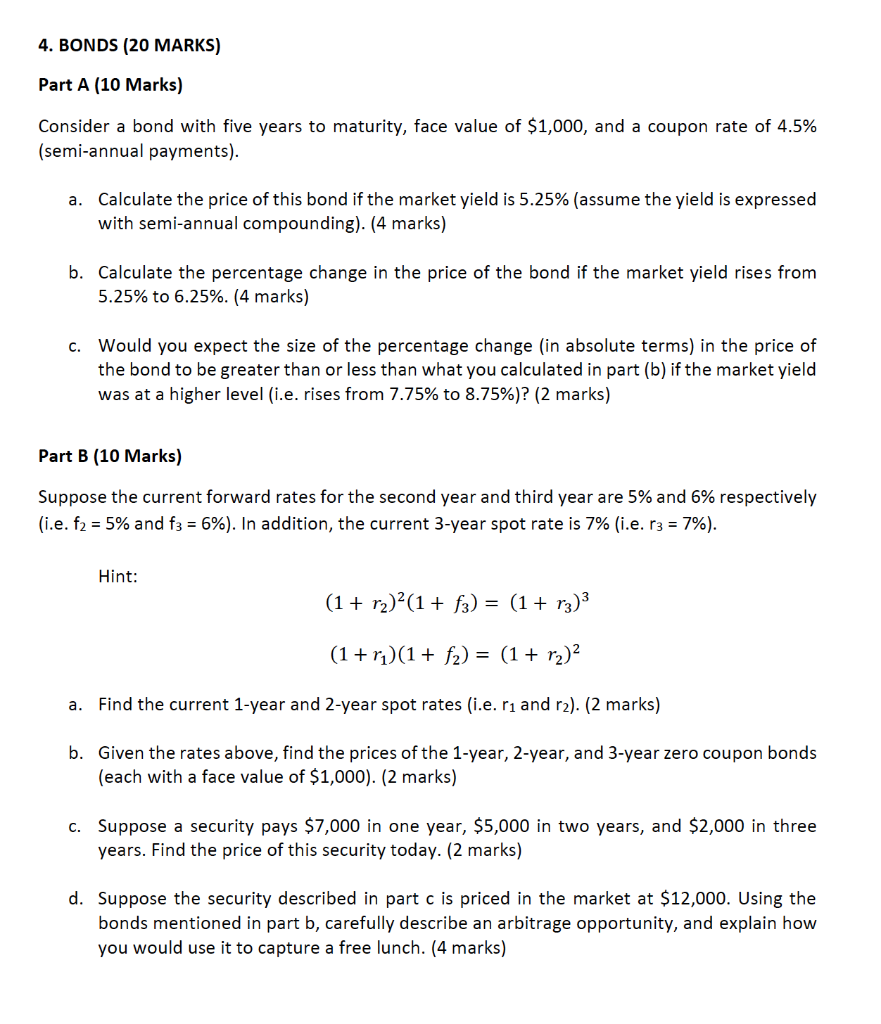

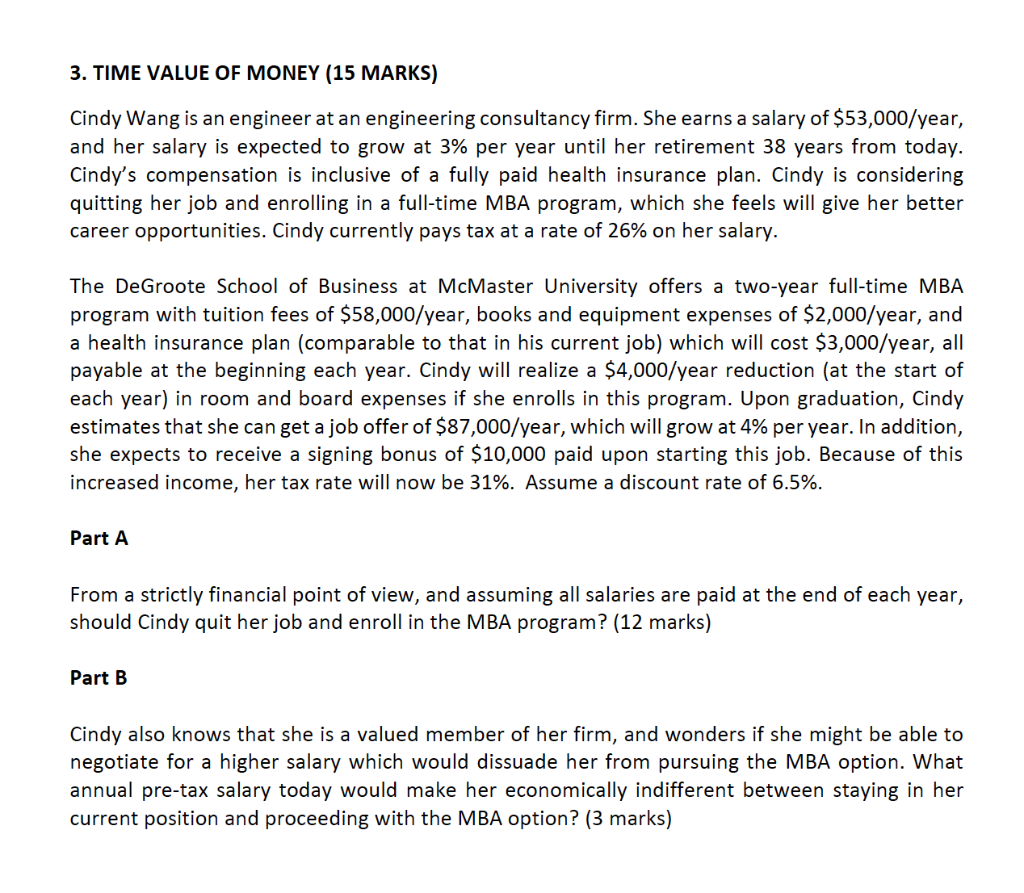

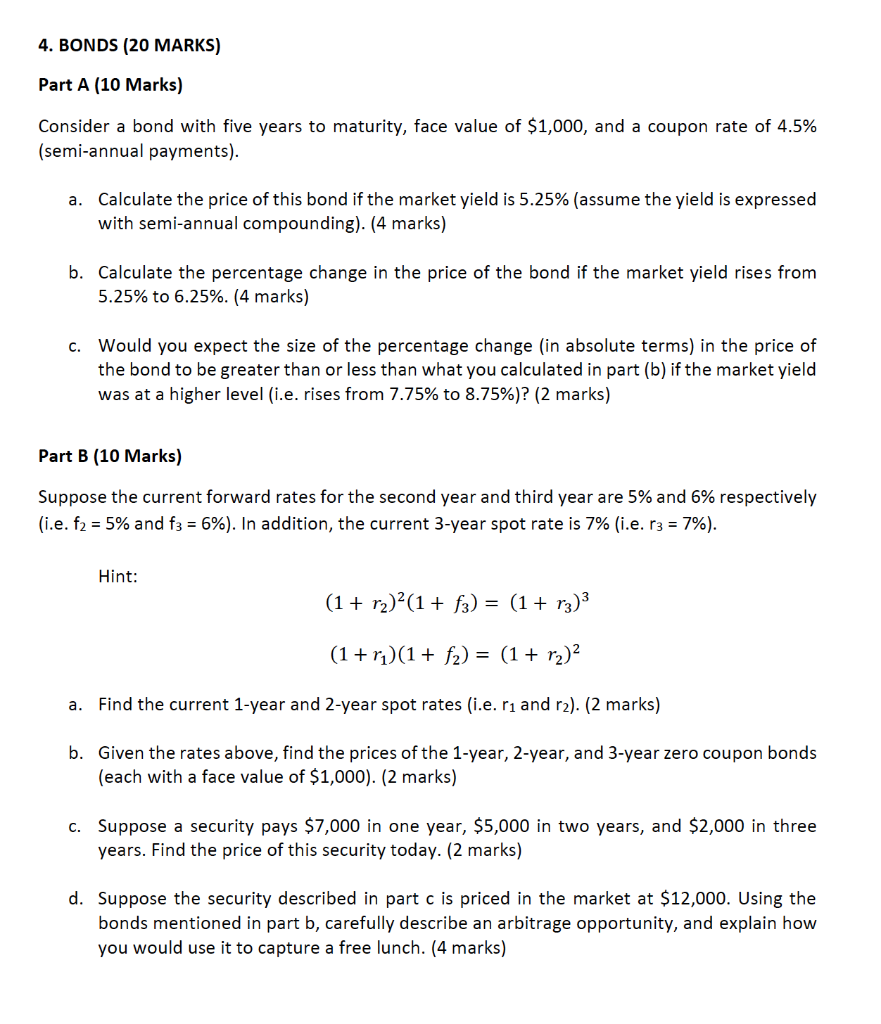

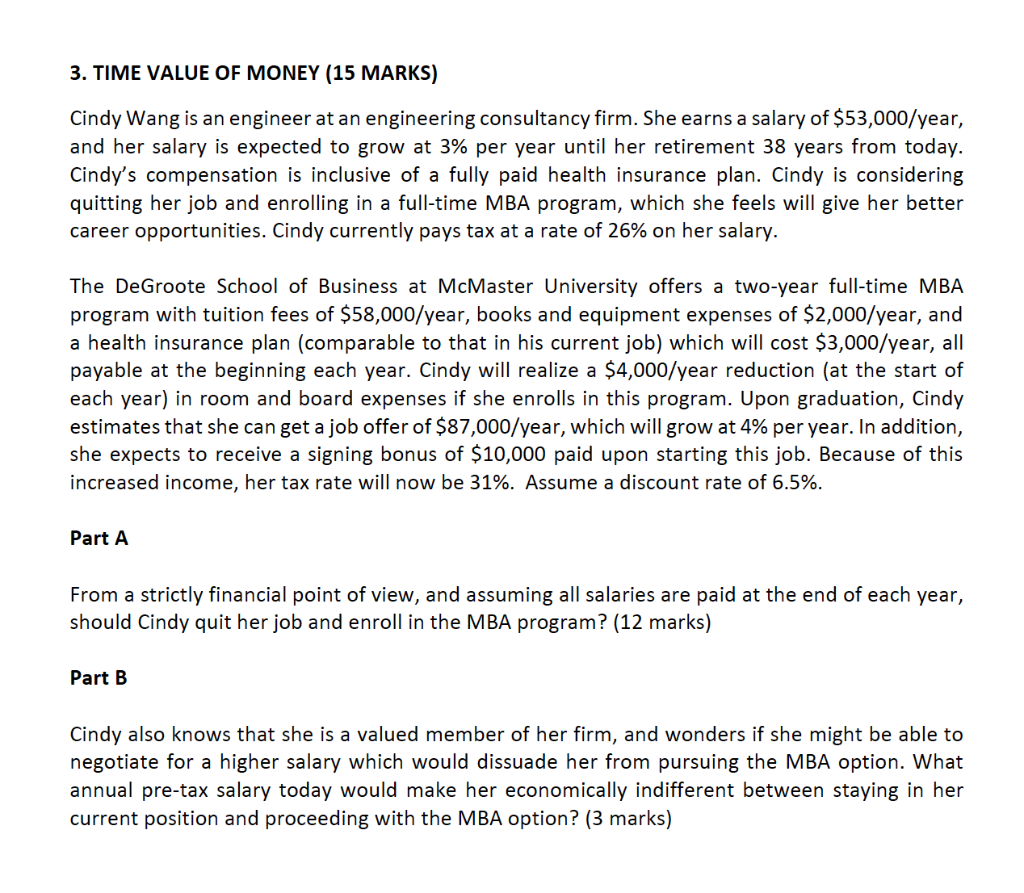

4. BONDS (20 MARKS) Part A (10 Marks) Consider a bond with five years to maturity, face value of $1,000, and a coupon rate of 4.5% (semi-annual payments). a. Calculate the price of this bond if the market yield is 5.25% (assume the yield is expressed with semi-annual compounding). (4 marks) b. Calculate the percentage change in the price of the bond if the market yield rises from 5.25% to 6.25%. (4 marks) C. Would you expect the size of the percentage change (in absolute terms) in the price of the bond to be greater than or less than what you calculated in part (b) if the market yield was at a higher level (i.e. rises from 7.75% to 8.75%)? (2 marks) Part B (10 Marks) Suppose the current forward rates for the second year and third year are 5% and 6% respectively (i.e. f2 = 5% and f3 = 6%). In addition, the current 3-year spot rate is 7% (i.e. 13 = 7%). Hint: (1 + r)?(1 + f2) = (1 + r3)3 (1+r)(1 + f2) = (1 + ra)2 a. Find the current 1-year and 2-year spot rates (i.e. ri and r2). (2 marks) b. Given the rates above, find the prices of the 1-year, 2-year, and 3-year zero coupon bonds (each with a face value of $1,000). (2 marks) C. Suppose a security pays $7,000 in one year, $5,000 in two years, and $2,000 in three years. Find the price of this security today. (2 marks) d. Suppose the security described in part c is priced in the market at $12,000. Using the bonds mentioned in part b, carefully describe an arbitrage opportunity, and explain how you would use it to capture a free lunch. (4 marks) 3. TIME VALUE OF MONEY (15 MARKS) Cindy Wang is an engineer at an engineering consultancy firm. She earns a salary of $53,000/year, and her salary is expected to grow at 3% per year until her retirement 38 years from today. Cindy's compensation is inclusive of a fully paid health insurance plan. Cindy is considering quitting her job and enrolling in a full-time MBA program, which she feels will give her better career opportunities. Cindy currently pays tax at a rate of 26% on her salary. The DeGroote School of Business at McMaster University offers a two-year full-time MBA program with tuition fees of $58,000/year, books and equipment expenses of $2,000/year, and a health insurance plan (comparable to that in his current job) which will cost $3,000/year, all payable at the beginning each year. Cindy will realize a $4,000/year reduction (at the start of each year) in room and board expenses if she enrolls in this program. Upon graduation, Cindy estimates that she can get a job offer of $87,000/year, which will grow at 4% per year. In addition, she expects to receive a signing bonus of $10,000 paid upon starting this job. Because of this increased income, her tax rate will now be 31%. Assume a discount rate of 6.5%. Part A From a strictly financial point of view, and assuming all salaries are paid at the end of each year, should Cindy quit her job and enroll in the MBA program? (12 marks) Part B Cindy also knows that she is a valued member of her firm, and wonders if she might be able to negotiate for a higher salary which would dissuade her from pursuing the MBA option. What annual pre-tax salary today would make her economically indifferent between staying in her current position and proceeding with the MBA option