Answered step by step

Verified Expert Solution

Question

1 Approved Answer

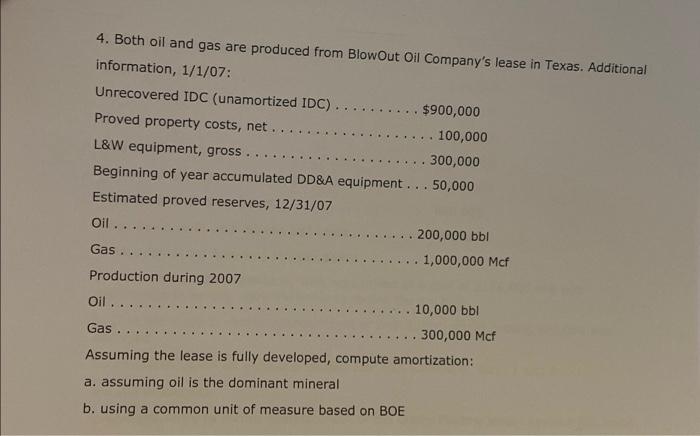

4. Both oil and gas are produced from Blow Out Oil Company's lease in Texas. Additional information, 1/1/07: Unrecovered IDC (unamortized IDC). $900,000 Proved property

4. Both oil and gas are produced from Blow Out Oil Company's lease in Texas. Additional information, 1/1/07: Unrecovered IDC (unamortized IDC). $900,000 Proved property costs, net .. . . 100,000 L&W equipment, gross . . 300,000 Beginning of year accumulated DD&A equipment ... 50,000 Estimated proved reserves, 12/31/07 Oil . . . Gas.. 200,000 bbl 1,000,000 Mcf Production during 2007 Oil . . Gas . . . . . 300,000 Mcf Assuming the lease is fully developed, compute amortization: a. assuming oil is the dominant mineral b. using a common unit of measure based on BOE ... 10,000 bbl

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started