Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Calculate the company's inventory turnover ratio (if applicable) for both this year and the prior year. Show your computations This year Cost of

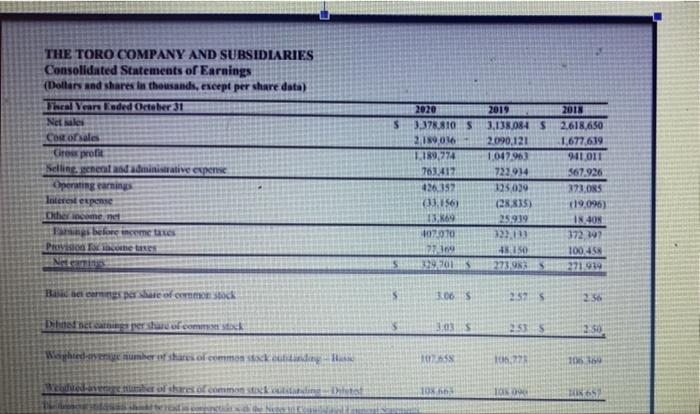

4. Calculate the company's inventory turnover ratio (if applicable) for both this year and the prior year. Show your computations This year Cost of goods sold Average inventory Last year Explain what information this ratio provides Use complete sentences Has the inventory turnover ratio improved or worsened? Explain. Use complete sentences. Evaluate the company's inventory management. In your answer, consider the type of product(s) the company makes and sells, the industry in which the company operates and the type of customer it serves Refer to the information obtained in your research and ratio analysis. In reviewing the asset section of the balance sheet, in which assets does the company have the most significant investment? B) Locate the company's income statement What is the page on which the income statement appears. 5. Calculate the company's gross profit percentage ratio for both this year and the prior year. Show your computations This year THE TORO COMPANY AND SUBSIDIARIES Consolidated Statements of Earnings (Dollars and shares in thousands, except per share data) Theal Years Eaded Octeber 31 2020 2019 2018 Net sales 3378.810 S 3,138,084 S 2.618,650 Cor of sales Grew profit 2,189.036 L.189,774 2.090,121 1,677,639 941.011 1047.963 Selling, general and administrative expense Operating rarnings 763,417 722.934 567.926 426.352 325029 373.085 Joterest expense (33.1561 (28,835) 19,096) Chher income net Famagbelore inceme taxes 25939 18.408 407070 372 397 PRIVisio Fx cone taes 77169 329.701 5 100 458 48150 273.983 5 271.919 Ba he cernngs perhare of cerm Stock 3.06 S 257 S 256 Dihted het canings per shau of commn stock 3.03 S 253 S 12.50 Waghted-avere aumber nf shares of common stskouttindgHa 107658 106.278 Weldwed-avenge ber ol shares of common stck titatdinghtot

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer 4 Inventory turnover ratio Cost of goods sold Average inventory ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started