Answered step by step

Verified Expert Solution

Question

1 Approved Answer

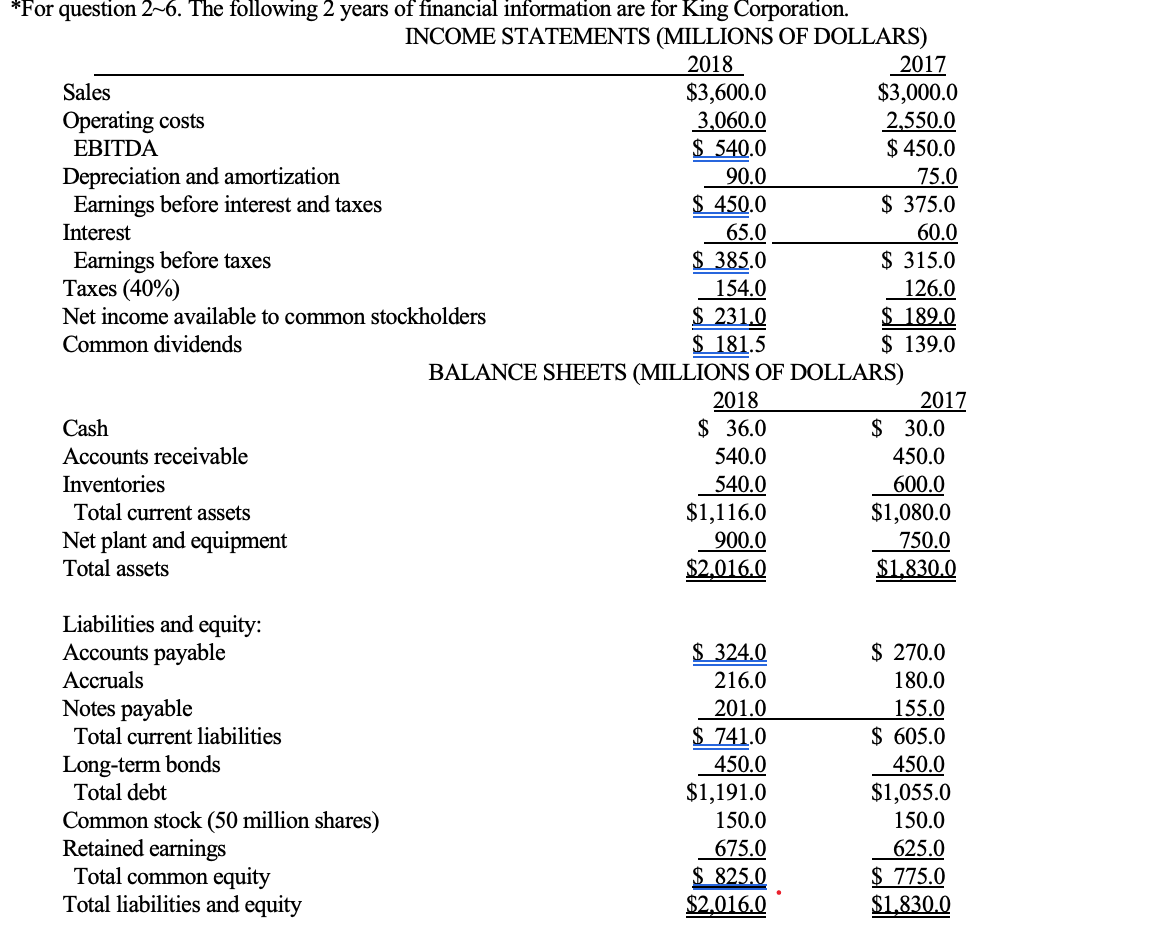

4. Calculate the ROIC for 2018 and interpret the result if cost of capital (WACC) = 10%. 3pts ROIC = NOPAT / Operating Capital *For

4. Calculate the ROIC for 2018 and interpret the result if cost of capital (WACC) = 10%. 3pts

ROIC = NOPAT / Operating Capital

*For question 2-6. The following 2 years of financial information are for King Corporation. INCOME STATEMENTS (MILLIONS OF DOLLARS) 2018 2017 Sales $3,600.0 $3,000.0 Operating costs 3,060.0 2,550.0 EBITDA $ 540.0 $ 450.0 Depreciation and amortization 90.0 75.0 Earnings before interest and taxes $_450.0 $ 375.0 Interest 65.0 60.0 Earnings before taxes $ 385.0 $ 315.0 Taxes (40%) 154.0 126.0 Net income available to common stockholders $ 231.0 $ 189.0 Common dividends $ 181.5 $ 139.0 BALANCE SHEETS (MILLIONS OF DOLLARS) 2018 2017 Cash $ 36.0 $ 30.0 Accounts receivable 540.0 450.0 Inventories 540.0 600.0 Total current assets $1,116.0 $1,080.0 Net plant and equipment 900.0 750.0 Total assets $2.016.0 $1.830.0 Liabilities and equity: Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total debt Common stock (50 million shares) Retained earnings Total common equity Total liabilities and equity $ 324.0 216.0 201.0 $ 741.0 450.0 $1,191.0 150.0 675.0 $ 825.0 $2.016.0 $ 270.0 180.0 155.0 $ 605.0 450.0 $1,055.0 150.0 625.0 $ 775.0 $1.830.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started