Question: 4. Calculations. Points as indicated. You must show your work to receive credit for your answer. It is in your best interest to show

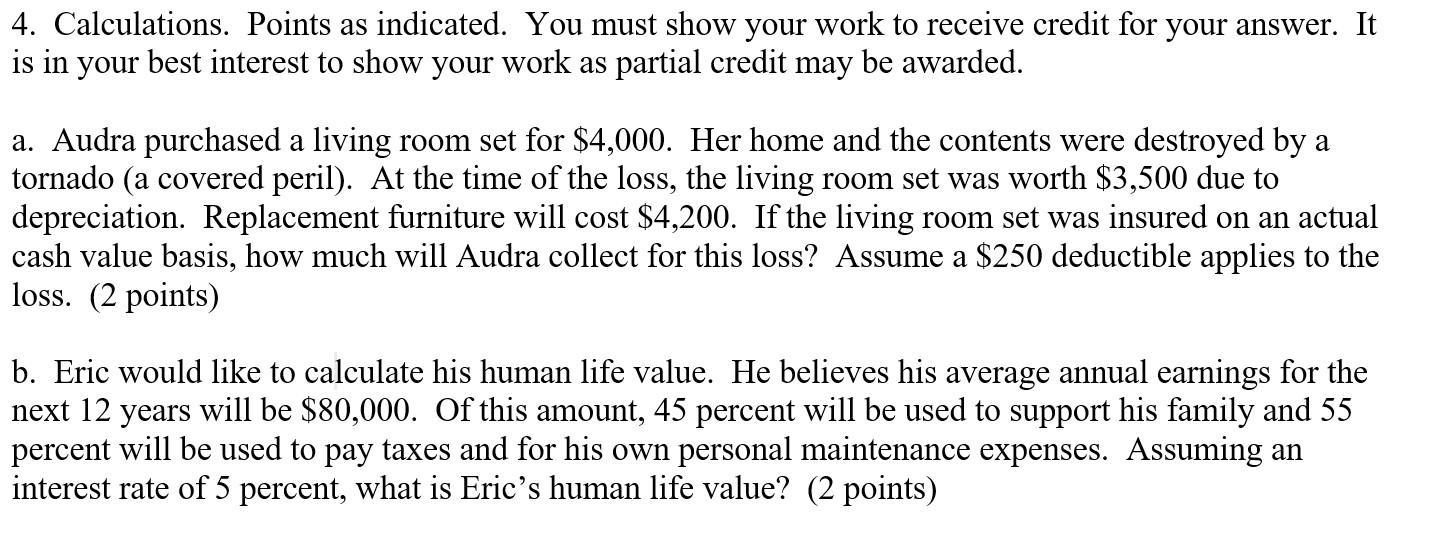

4. Calculations. Points as indicated. You must show your work to receive credit for your answer. It is in your best interest to show your work as partial credit may be awarded. a. Audra purchased a living room set for $4,000. Her home and the contents were destroyed by a tornado (a covered peril). At the time of the loss, the living room set was worth $3,500 due to depreciation. Replacement furniture will cost $4,200. If the living room set was insured on an actual cash value basis, how much will Audra collect for this loss? Assume a $250 deductible applies to the loss. (2 points) b. Eric would like to calculate his human life value. He believes his average annual earnings for the next 12 years will be $80,000. Of this amount, 45 percent will be used to support his family and 55 percent will be used to pay taxes and for his own personal maintenance expenses. Assuming an interest rate of 5 percent, what is Eric's human life value? (2 points)

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

1 Insurance carried on Actual cash value therefore Actual cash value Replac... View full answer

Get step-by-step solutions from verified subject matter experts