Question: 4. Capital structure decisions and firm value Aa Aa Why focus on the optimal capital structure? A company's capital structure decisions address the ways a

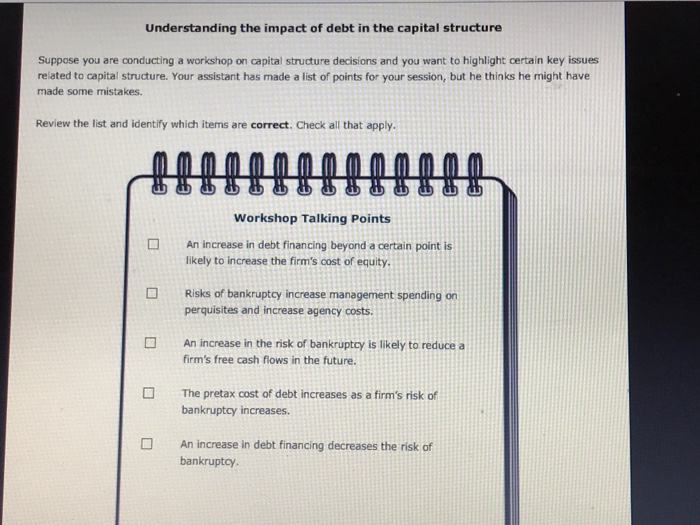

4. Capital structure decisions and firm value Aa Aa Why focus on the optimal capital structure? A company's capital structure decisions address the ways a firm's assets are financed (using debt, prefered stock, and common equity capital) and is often presented as a percentage of the type of financing used. As with all financial decisions, a firm should try to establish a capital structure that maximizes the stock price, or shareholder value. This is called the optimal capital structure; it is also the debt-equity mix that: Minimizes the firm's weighted average cost of capital O Maximizes the firm's weighted average cost of capital OMaximizes the company's net income OMaximizes the firm's dividends Understanding the impact of debt in the capital structure Suppose you are conducting a workshop on capital structure decisions and you want to highlight certain key issues related to capital structure. Your assistant has made a list of points for your session, but he thinks he might have made some mistakes. Review the list and identify which items are correct. Check all that apply. Workshop Talking Points An increase in debt financing beyond a certain point is likely to increase the firm's cost of equity. Understanding the impact of debt in the capital structure Suppose you are conducting a workshop on capital structure decisions and you related to capital structure. Your assistant has made a list of points for your session, but he thin ks he might have want to highlight certain key issues made some mistakes. the list and identify which items are correct. Check all that apply. Workshop Talking Points An increase in debt financing beyond a certain point is likely to increase the firm's cost of equity. Risks of bankruptcy increase management spending on perquisites and increase agency costs An increase in the risk of bankruptcy is likely to reduce a firm's free cash flows in the future. The pretax cost of debt increases as a firm's risk of bankruptcy increases. An increase in debt financing decreases the risk of bankruptcy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts