Answered step by step

Verified Expert Solution

Question

1 Approved Answer

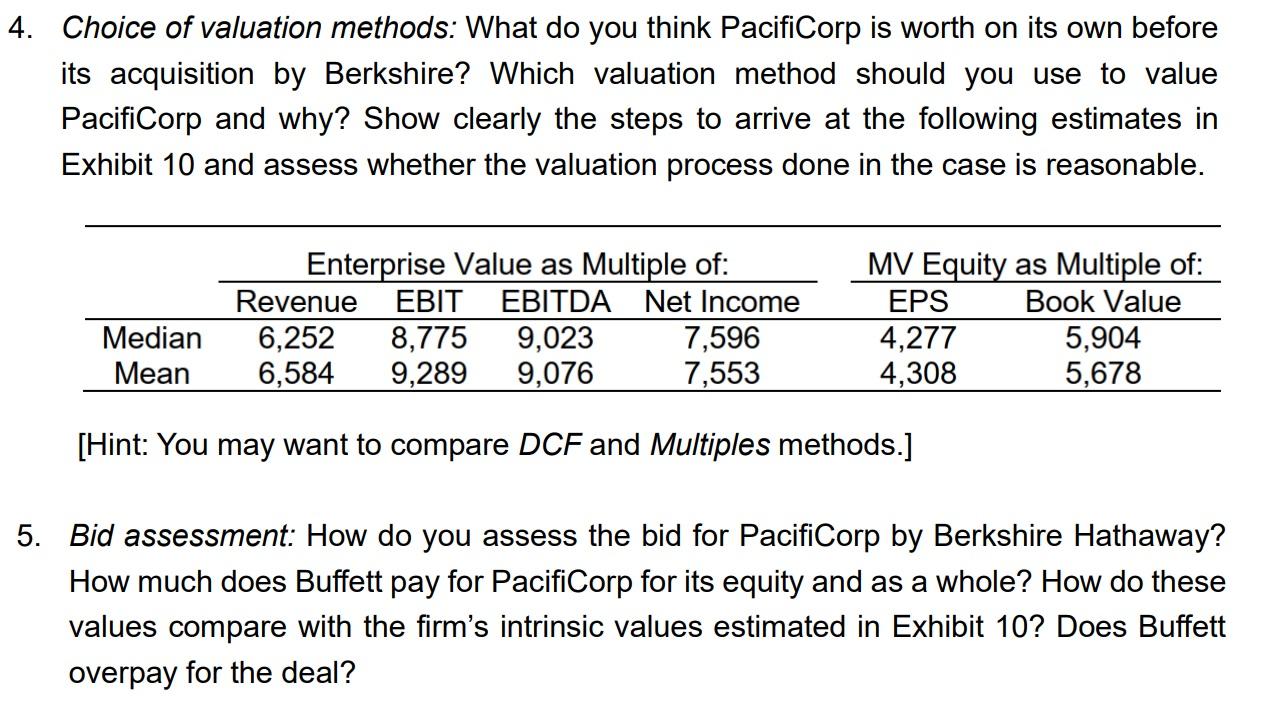

4. Choice of valuation methods: What do you think PacifiCorp is worth on its own before its acquisition by Berkshire? Which valuation method should you

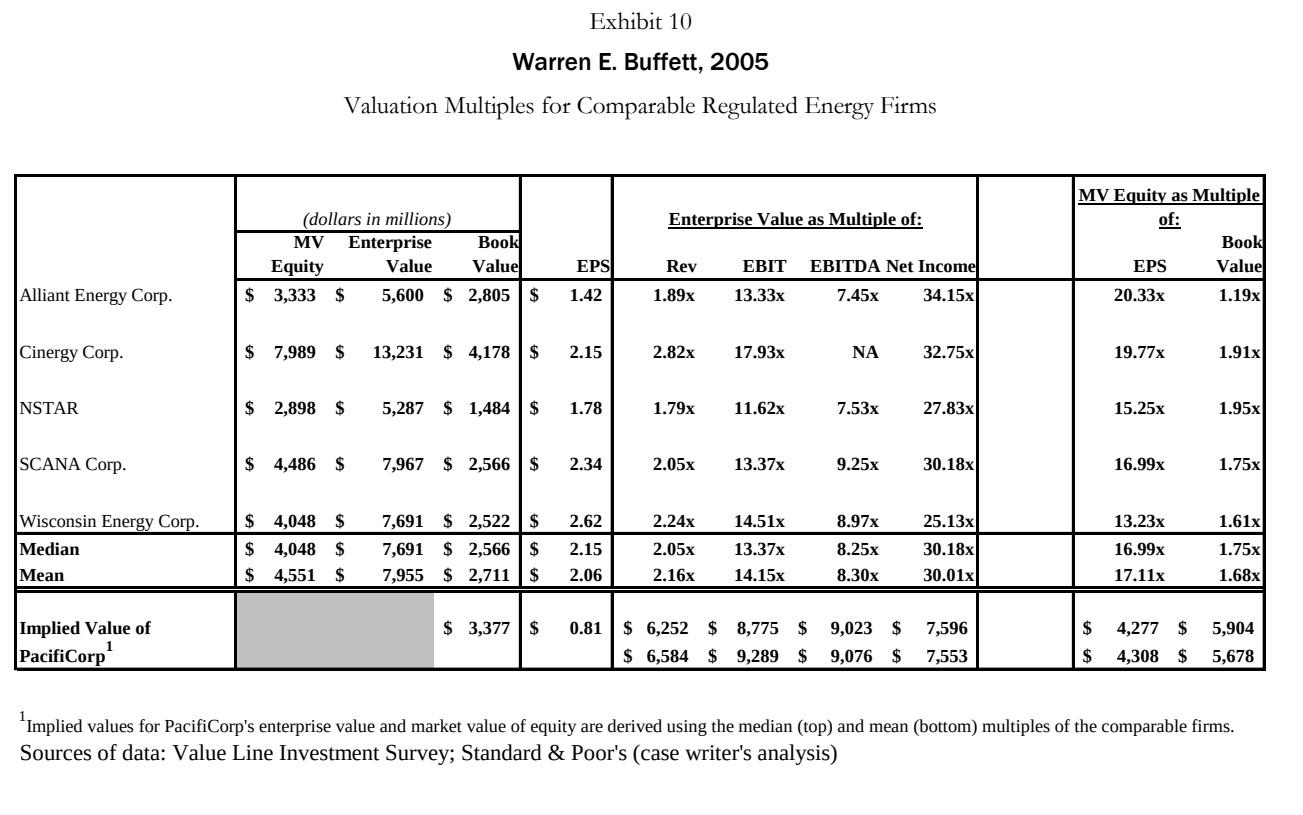

4. Choice of valuation methods: What do you think PacifiCorp is worth on its own before its acquisition by Berkshire? Which valuation method should you use to value PacifiCorp and why? Show clearly the steps to arrive at the following estimates in Exhibit 10 and assess whether the valuation process done in the case is reasonable. Enterprise Value as Multiple of: MV Equity as Multiple of: EPS Book Value Revenue EBIT EBITDA Net Income 6,252 8,775 9,023 7,596 4,277 Median Mean 5,904 6,584 9,289 9,076 7,553 4,308 5,678 [Hint: You may want to compare DCF and Multiples methods.] 5. Bid assessment: How do you assess the bid for PacifiCorp by Berkshire Hathaway? How much does Buffett pay for PacifiCorp for its equity and as a whole? How do these values compare with the firm's intrinsic values estimated in Exhibit 10? Does Buffett overpay for the deal? Exhibit 10 Warren E. Buffett, 2005 Valuation Multiples for Comparable Regulated Energy Firms MV Equity as Multiple of: (dollars in millions) Enterprise Value as Multiple of: MV Enterprise Book Book Value Equity Value Rev EBIT EBITDA Net Income EPS Value EPS 1.42 Alliant Energy Corp. $ 3,333 $ 5,600 $ 2,805 $ 1.89x 13.33x 7.45x 34.15x 20.33x 1.19x Cinergy Corp. $ 7,989 $ 13,231 $ 4,178 $ 2.15 2.82x 17.93x 32.75x 19.77x 1.91x NSTAR $ 2,898 $ 5,287 $1,484 $ 1.78 1.79x 11.62x 7.53x 27.83x 15.25x 1.95x SCANA Corp. $ 4,486 $ 7,967 $2,566 $ 2.34 2.05x 13.37x 9.25x 30.18x 16.99x 1.75x Wisconsin Energy Corp. 2.24x 14.51x 8.97x 25.13x 13.23x 1.61x $4,048 $ $4,048 $ Median 7,691 $2,522 $ 7,691 $2,566 $ 7,955 $2,711 $ 2.62 2.15 2.06 8.25x 30.18x 16.99x 1.75x 2.05x 13.37x 2.16x 14.15x Mean $ 4,551 $ 8.30x 30.01x 17.11x 1.68x $ 5,904 Implied Value of PacifiCorp $ 3,377 $ 0.81 $ 6,252 $8,775 $ $6,584 $ 9,289 $ 9,023 $ 7,596 9,076 $ 7,553 4,277 $ 5,678 $ 4,308 $ Implied values for PacifiCorp's enterprise value and market value of equity are derived using the median (top) and mean (bottom) multiples of the comparable firms. Sources of data: Value Line Investment Survey; Standard & Poor's (case writer's analysis) 4. Choice of valuation methods: What do you think PacifiCorp is worth on its own before its acquisition by Berkshire? Which valuation method should you use to value PacifiCorp and why? Show clearly the steps to arrive at the following estimates in Exhibit 10 and assess whether the valuation process done in the case is reasonable. Enterprise Value as Multiple of: MV Equity as Multiple of: EPS Book Value Revenue EBIT EBITDA Net Income 6,252 8,775 9,023 7,596 4,277 Median Mean 5,904 6,584 9,289 9,076 7,553 4,308 5,678 [Hint: You may want to compare DCF and Multiples methods.] 5. Bid assessment: How do you assess the bid for PacifiCorp by Berkshire Hathaway? How much does Buffett pay for PacifiCorp for its equity and as a whole? How do these values compare with the firm's intrinsic values estimated in Exhibit 10? Does Buffett overpay for the deal? Exhibit 10 Warren E. Buffett, 2005 Valuation Multiples for Comparable Regulated Energy Firms MV Equity as Multiple of: (dollars in millions) Enterprise Value as Multiple of: MV Enterprise Book Book Value Equity Value Rev EBIT EBITDA Net Income EPS Value EPS 1.42 Alliant Energy Corp. $ 3,333 $ 5,600 $ 2,805 $ 1.89x 13.33x 7.45x 34.15x 20.33x 1.19x Cinergy Corp. $ 7,989 $ 13,231 $ 4,178 $ 2.15 2.82x 17.93x 32.75x 19.77x 1.91x NSTAR $ 2,898 $ 5,287 $1,484 $ 1.78 1.79x 11.62x 7.53x 27.83x 15.25x 1.95x SCANA Corp. $ 4,486 $ 7,967 $2,566 $ 2.34 2.05x 13.37x 9.25x 30.18x 16.99x 1.75x Wisconsin Energy Corp. 2.24x 14.51x 8.97x 25.13x 13.23x 1.61x $4,048 $ $4,048 $ Median 7,691 $2,522 $ 7,691 $2,566 $ 7,955 $2,711 $ 2.62 2.15 2.06 8.25x 30.18x 16.99x 1.75x 2.05x 13.37x 2.16x 14.15x Mean $ 4,551 $ 8.30x 30.01x 17.11x 1.68x $ 5,904 Implied Value of PacifiCorp $ 3,377 $ 0.81 $ 6,252 $8,775 $ $6,584 $ 9,289 $ 9,023 $ 7,596 9,076 $ 7,553 4,277 $ 5,678 $ 4,308 $ Implied values for PacifiCorp's enterprise value and market value of equity are derived using the median (top) and mean (bottom) multiples of the comparable firms. Sources of data: Value Line Investment Survey; Standard & Poor's (case writer's analysis)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started