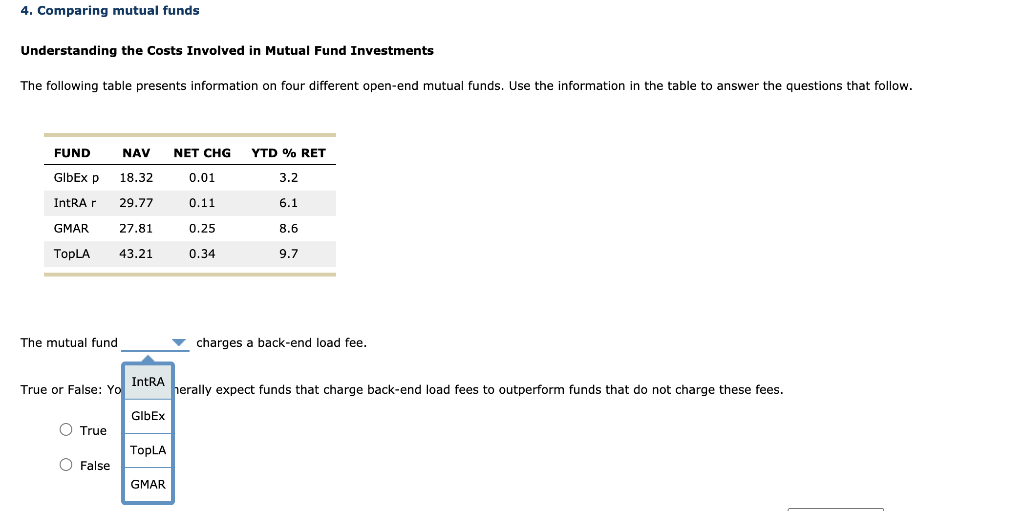

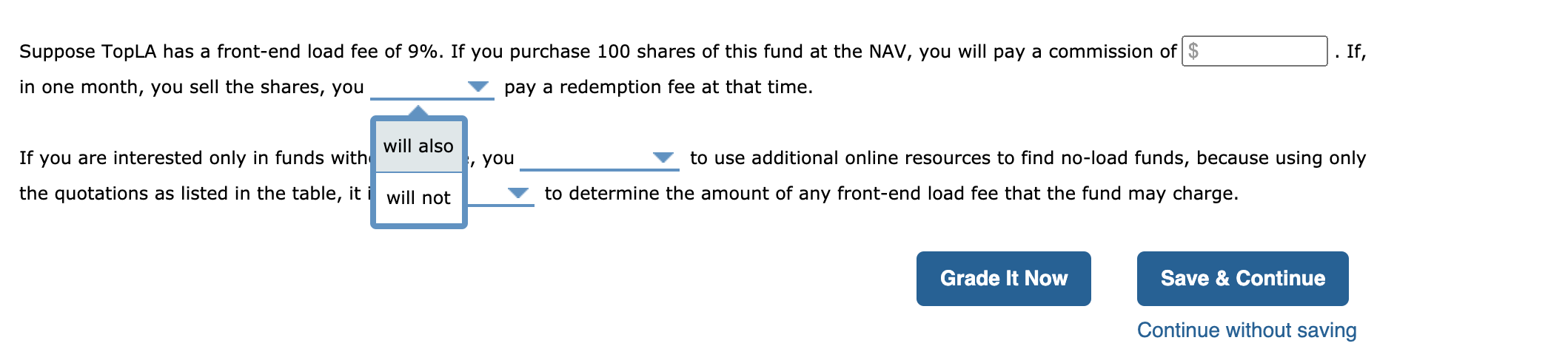

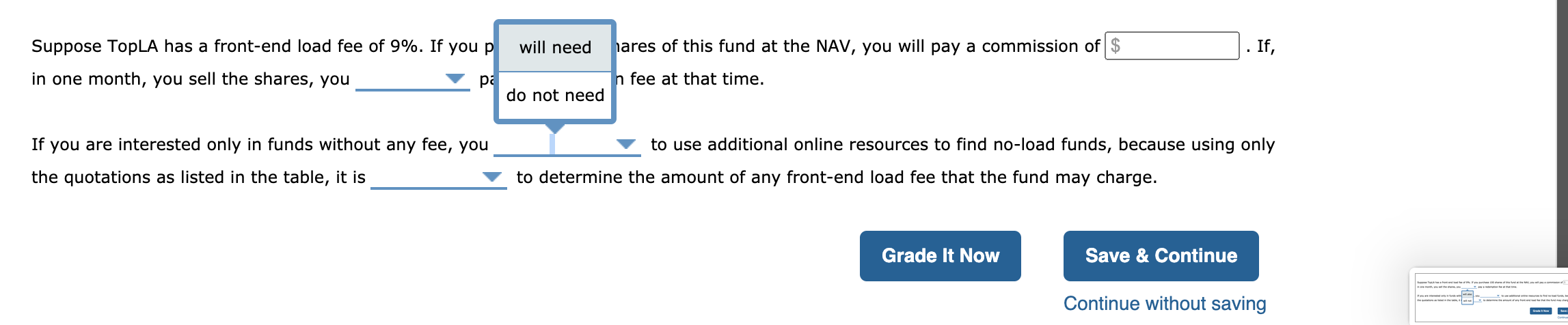

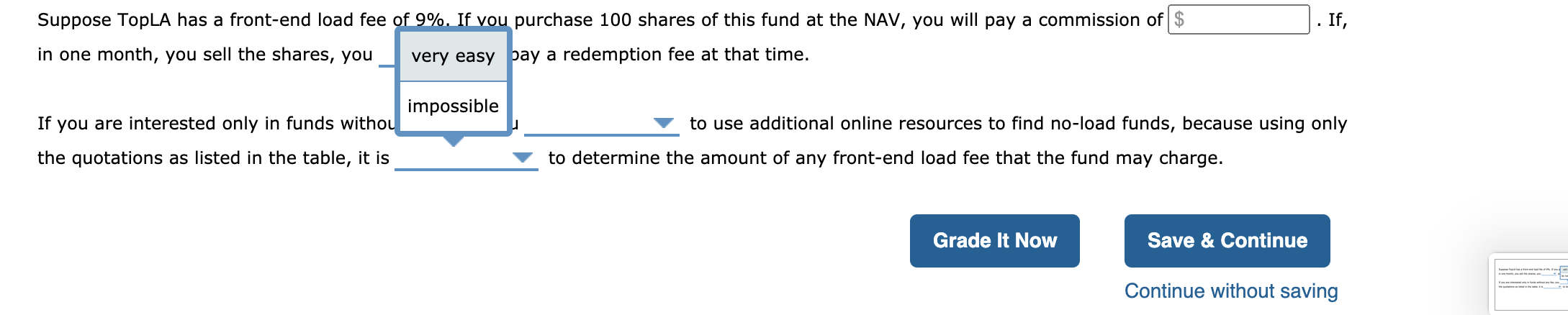

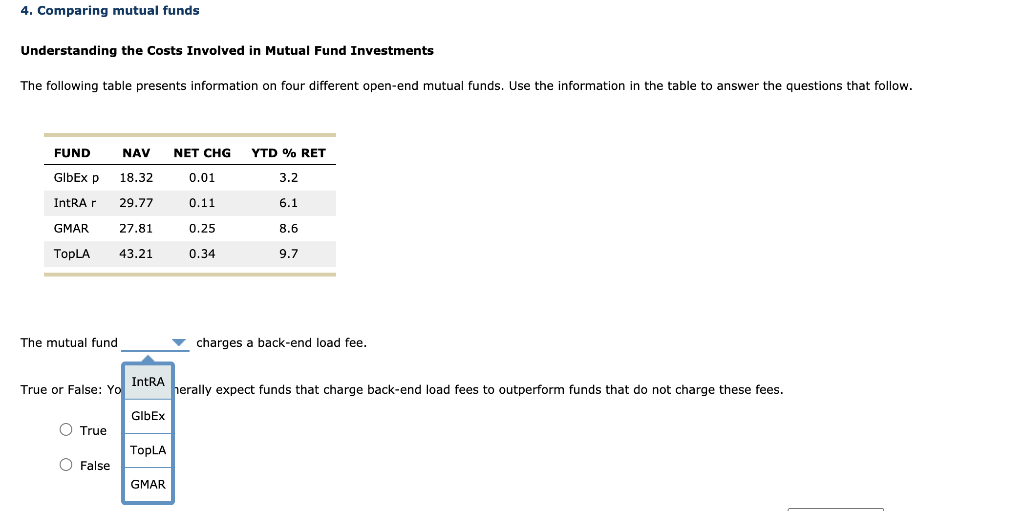

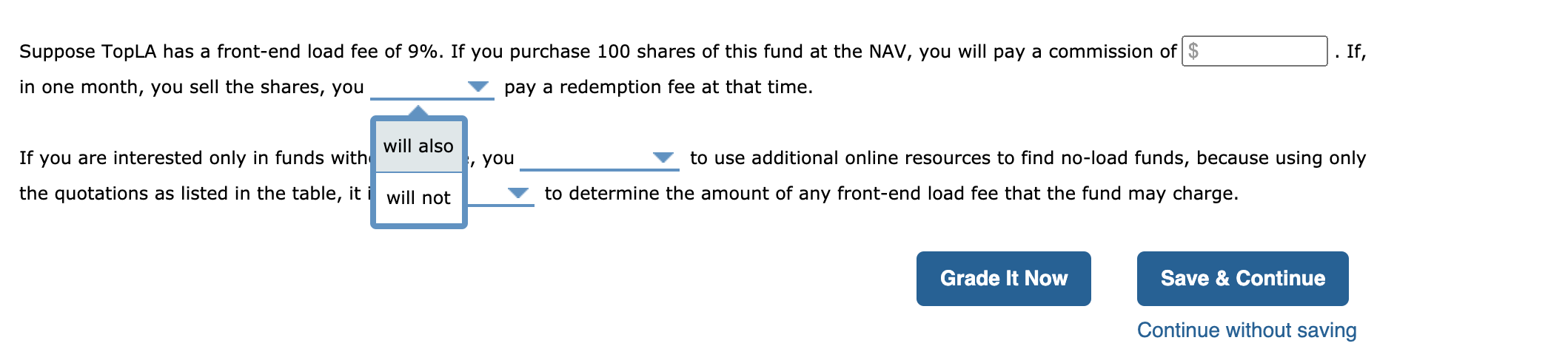

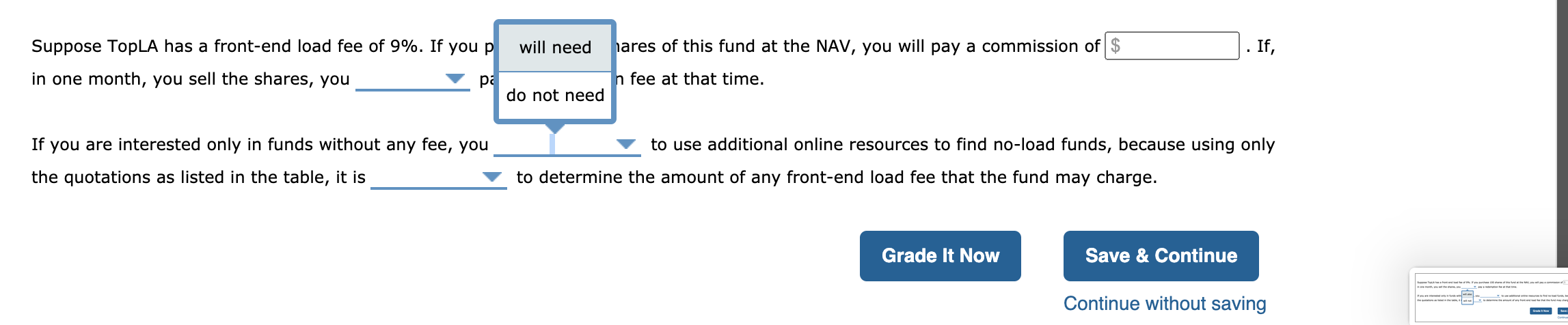

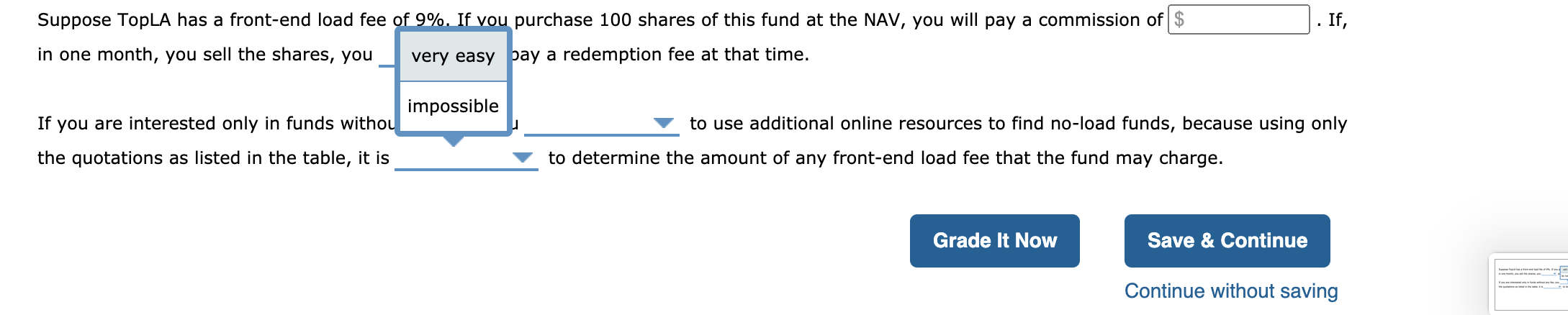

4. Comparing mutual funds Understanding the Costs Involved in Mutual Fund Investments The following table presents information on four different open-end mutual funds. Use the information in the table to answer the questions that follow. FUND NAV NET CHG YTD % RET GbEx p 18.32 0.01 3.2 IntRA 29.77 0.11 6.1 GMAR 27.81 0.25 8.6 TOPLA 43.21 0.34 9.7 The mutual fund charges a back-end load fee. IntRA True or False: Yo herally expect funds that charge back-end load fees to outperform funds that do not charge these fees. GIbEx O True TopLA O False GMAR If, Suppose TopLA has a front-end load fee of 9%. If you purchase 100 shares of this fund at the NAV, you will pay a commission of $ in one month, you sell the shares, you pay a redemption fee at that time. will also If you are interested only in funds with the quotations as listed in the table, it i will not , you to use additional online resources to find no-load funds, because using only to determine the amount of any front-end load fee that the fund may charge. Grade It Now Save & Continue Continue without saving . If, Suppose TopLA has a front-end load fee of 9%. If you p will need hares of this fund at the NAV, you will pay a commission of $ in one month, you sell the shares, you pa n fee at that time. do not need If you are interested only in funds without any fee, you to use additional online resources to find no-load funds, because using only to determine the amount of any front-end load fee that the fund may charge. the quotations as listed in the table, it is Grade It Now Save & Continue Continue without saving If, Suppose TopLA has a front-end load fee of 9%. If you purchase 100 shares of this fund at the NAV, you will pay a commission of $ in one month, you sell the shares, you very easy pay a redemption fee at that time. impossible If you are interested only in funds withou to use additional online resources to find no-load funds, because using only to determine the amount of any front-end load fee that the fund may charge. the quotations as listed in the table, it is Grade It Now Save & Continue Continue without saving 4. Comparing mutual funds Understanding the Costs Involved in Mutual Fund Investments The following table presents information on four different open-end mutual funds. Use the information in the table to answer the questions that follow. FUND NAV NET CHG YTD % RET GbEx p 18.32 0.01 3.2 IntRA 29.77 0.11 6.1 GMAR 27.81 0.25 8.6 TOPLA 43.21 0.34 9.7 The mutual fund charges a back-end load fee. IntRA True or False: Yo herally expect funds that charge back-end load fees to outperform funds that do not charge these fees. GIbEx O True TopLA O False GMAR If, Suppose TopLA has a front-end load fee of 9%. If you purchase 100 shares of this fund at the NAV, you will pay a commission of $ in one month, you sell the shares, you pay a redemption fee at that time. will also If you are interested only in funds with the quotations as listed in the table, it i will not , you to use additional online resources to find no-load funds, because using only to determine the amount of any front-end load fee that the fund may charge. Grade It Now Save & Continue Continue without saving . If, Suppose TopLA has a front-end load fee of 9%. If you p will need hares of this fund at the NAV, you will pay a commission of $ in one month, you sell the shares, you pa n fee at that time. do not need If you are interested only in funds without any fee, you to use additional online resources to find no-load funds, because using only to determine the amount of any front-end load fee that the fund may charge. the quotations as listed in the table, it is Grade It Now Save & Continue Continue without saving If, Suppose TopLA has a front-end load fee of 9%. If you purchase 100 shares of this fund at the NAV, you will pay a commission of $ in one month, you sell the shares, you very easy pay a redemption fee at that time. impossible If you are interested only in funds withou to use additional online resources to find no-load funds, because using only to determine the amount of any front-end load fee that the fund may charge. the quotations as listed in the table, it is Grade It Now Save & Continue Continue without saving