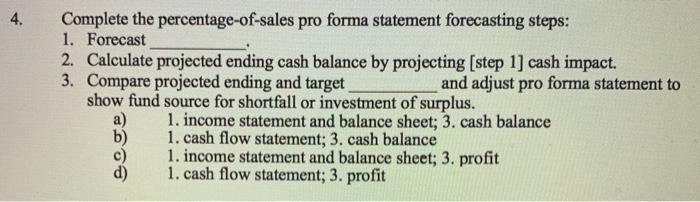

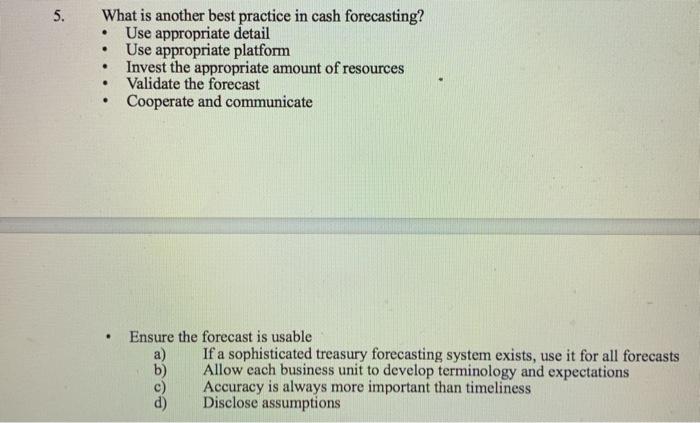

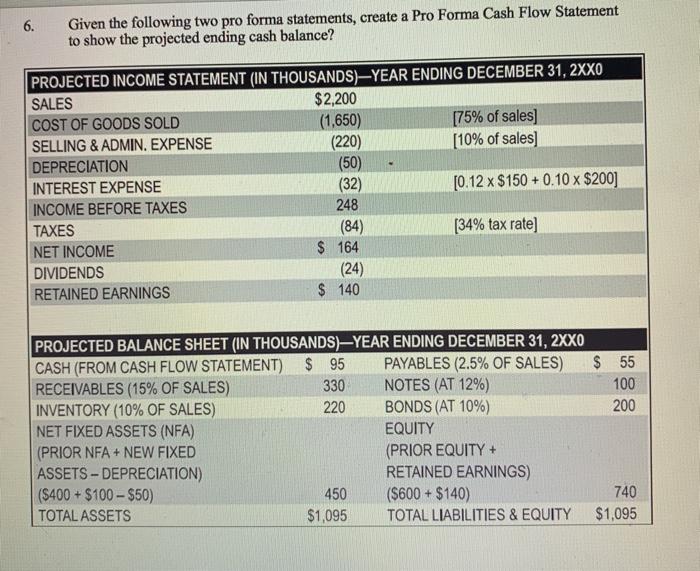

4. Complete the percentage-of-sales pro forma statement forecasting steps: 1. Forecast 2. Calculate projected ending cash balance by projecting (step 1) cash impact. 3. Compare projected ending and target and adjust pro forma statement to show fund source for shortfall or investment of surplus. a) 1. income statement and balance sheet; 3. cash balance 1. cash flow statement; 3. cash balance 1. income statement and balance sheet; 3. profit 1. cash flow statement; 3. profit 5. . What is another best practice in cash forecasting? Use appropriate detail Use appropriate platform Invest the appropriate amount of resources Validate the forecast Cooperate and communicate . . . Ensure the forecast is usable If a sophisticated treasury forecasting system exists, use it for all forecasts Allow cach business unit to develop terminology and expectations Accuracy is always more important than timeliness Disclose assumptions 6. Given the following two pro forma statements, create a Pro Forma Cash Flow Statement to show the projected ending cash balance? PROJECTED INCOME STATEMENT (IN THOUSANDS)YEAR ENDING DECEMBER 31, 2XXO SALES $2,200 COST OF GOODS SOLD (1,650) [75% of sales] SELLING & ADMIN. EXPENSE (220) [10% of sales) DEPRECIATION (50) INTEREST EXPENSE (32) [0.12 x $150 +0.10 x $200] INCOME BEFORE TAXES 248 TAXES (84) [34% tax rate) NET INCOME $ 164 DIVIDENDS (24) RETAINED EARNINGS $ 140 $ 55 100 200 PROJECTED BALANCE SHEET (IN THOUSANDS)-YEAR ENDING DECEMBER 31, 2XXO CASH (FROM CASH FLOW STATEMENT) $ 95 PAYABLES (2.5% OF SALES) RECEIVABLES (15% OF SALES) 330 NOTES (AT 12%) INVENTORY (10% OF SALES) 220 BONDS (AT 10%) NET FIXED ASSETS (NFA) EQUITY (PRIOR NFA + NEW FIXED (PRIOR EQUITY + ASSETS-DEPRECIATION) RETAINED EARNINGS) ($400 + $100 - $50) 450 ($600 + $140) TOTAL ASSETS $1,095 TOTAL LIABILITIES & EQUITY 740 $1,095 4. Complete the percentage-of-sales pro forma statement forecasting steps: 1. Forecast 2. Calculate projected ending cash balance by projecting (step 1) cash impact. 3. Compare projected ending and target and adjust pro forma statement to show fund source for shortfall or investment of surplus. a) 1. income statement and balance sheet; 3. cash balance 1. cash flow statement; 3. cash balance 1. income statement and balance sheet; 3. profit 1. cash flow statement; 3. profit 5. . What is another best practice in cash forecasting? Use appropriate detail Use appropriate platform Invest the appropriate amount of resources Validate the forecast Cooperate and communicate . . . Ensure the forecast is usable If a sophisticated treasury forecasting system exists, use it for all forecasts Allow cach business unit to develop terminology and expectations Accuracy is always more important than timeliness Disclose assumptions 6. Given the following two pro forma statements, create a Pro Forma Cash Flow Statement to show the projected ending cash balance? PROJECTED INCOME STATEMENT (IN THOUSANDS)YEAR ENDING DECEMBER 31, 2XXO SALES $2,200 COST OF GOODS SOLD (1,650) [75% of sales] SELLING & ADMIN. EXPENSE (220) [10% of sales) DEPRECIATION (50) INTEREST EXPENSE (32) [0.12 x $150 +0.10 x $200] INCOME BEFORE TAXES 248 TAXES (84) [34% tax rate) NET INCOME $ 164 DIVIDENDS (24) RETAINED EARNINGS $ 140 $ 55 100 200 PROJECTED BALANCE SHEET (IN THOUSANDS)-YEAR ENDING DECEMBER 31, 2XXO CASH (FROM CASH FLOW STATEMENT) $ 95 PAYABLES (2.5% OF SALES) RECEIVABLES (15% OF SALES) 330 NOTES (AT 12%) INVENTORY (10% OF SALES) 220 BONDS (AT 10%) NET FIXED ASSETS (NFA) EQUITY (PRIOR NFA + NEW FIXED (PRIOR EQUITY + ASSETS-DEPRECIATION) RETAINED EARNINGS) ($400 + $100 - $50) 450 ($600 + $140) TOTAL ASSETS $1,095 TOTAL LIABILITIES & EQUITY 740 $1,095