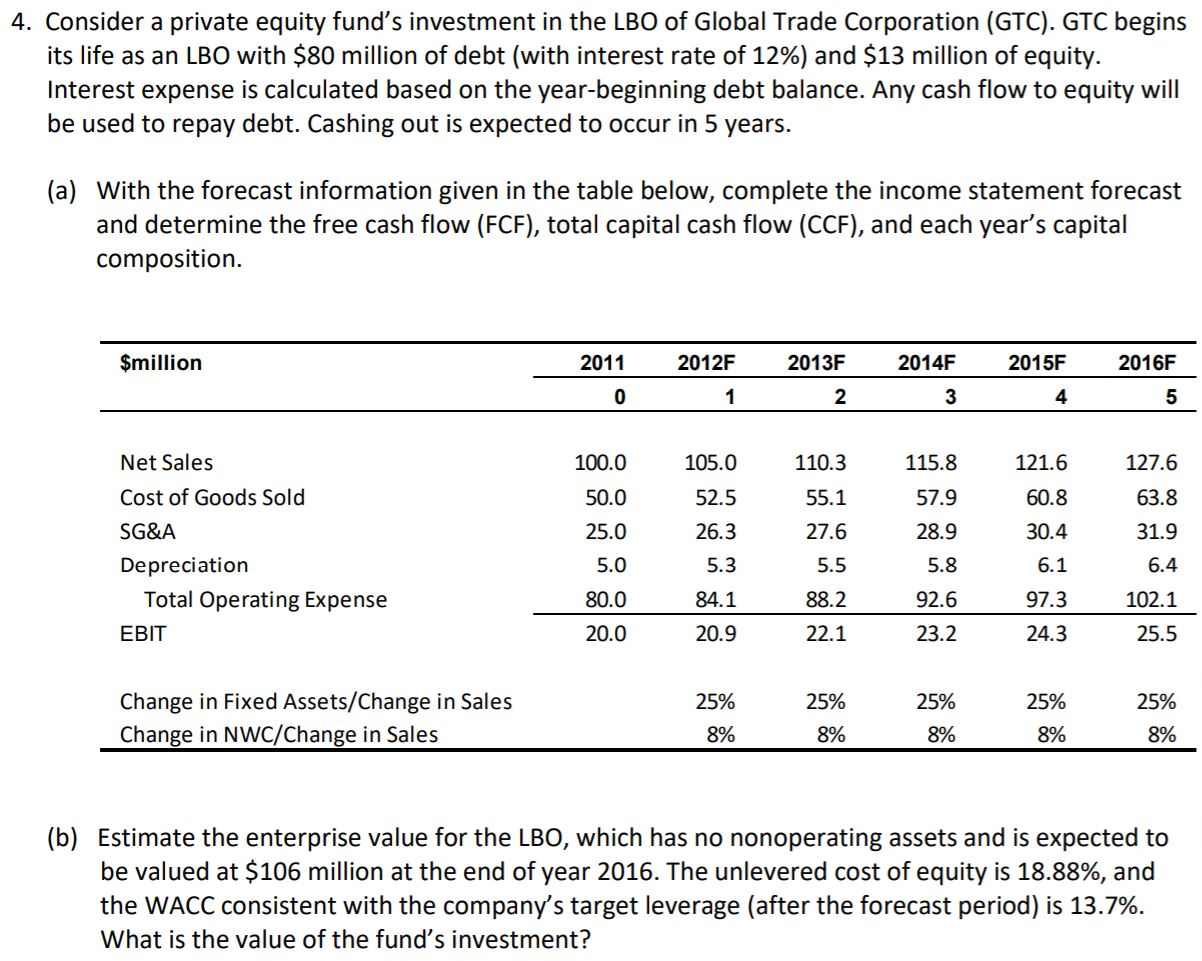

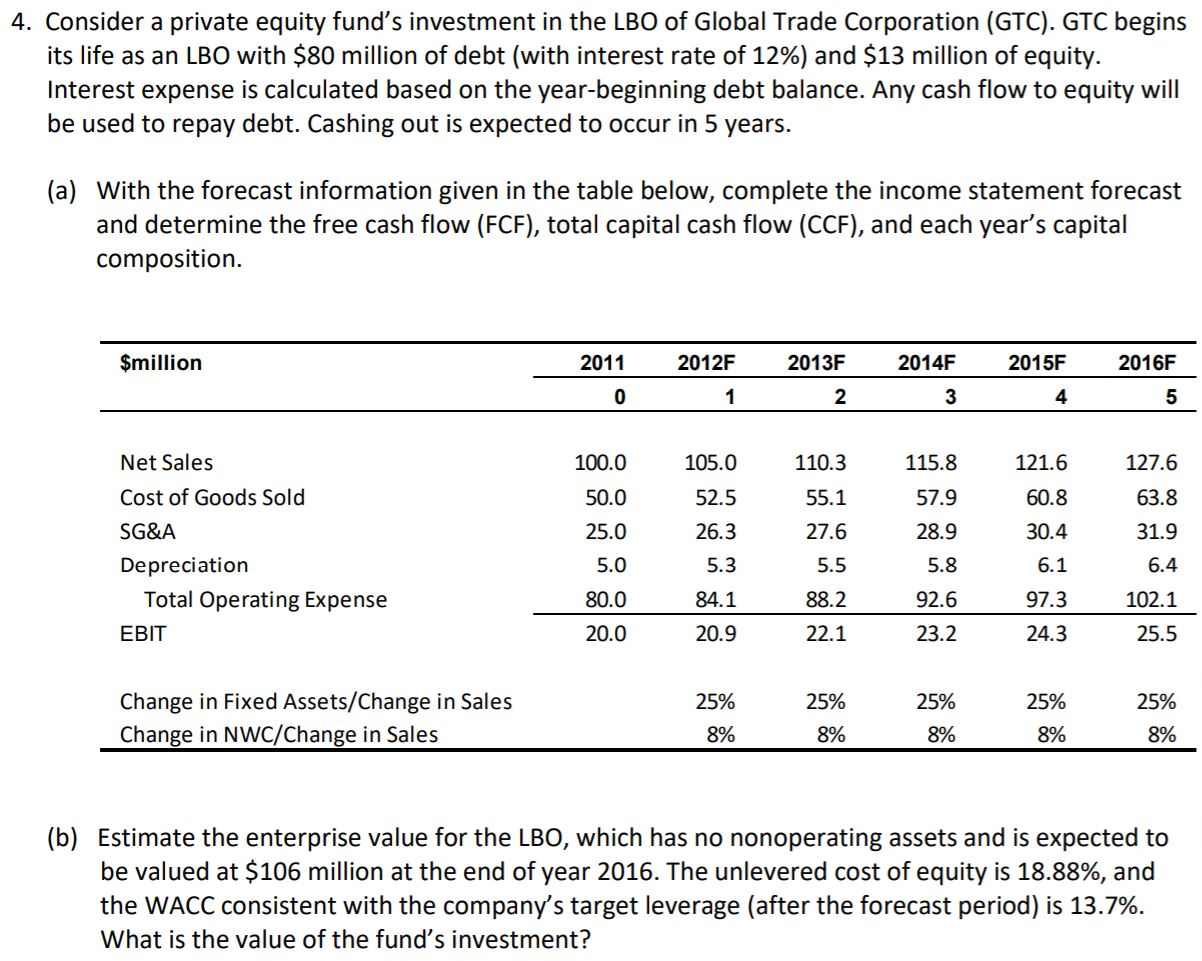

4. Consider a private equity fund's investment in the LBO of Global Trade Corporation (GTC). GTC begins its life as an LBO with $80 million of debt (with interest rate of 12%) and $13 million of equity. Interest expense is calculated based on the year-beginning debt balance. Any cash flow to equity will be used to repay debt. Cashing out is expected to occur in 5 years. (a) With the forecast information given in the table below, complete the income statement forecast and determine the free cash flow (FCF), total capital cash flow (CCF), and each year's capital composition. $million 2011 0 2012 1 2013F 2 2014F 3 2015F 4 2016F 5 105.0 127.6 Net Sales Cost of Goods Sold SG&A Depreciation Total Operating Expense EBIT 100.0 50.0 25.0 5.0 80.0 20.0 52.5 26.3 5.3 84.1 20.9 110.3 55.1 27.6 5.5 88.2 22.1 115.8 57.9 28.9 5.8 92.6 23.2 121.6 60.8 30.4 6.1 97.3 24.3 63.8 31.9 6.4 102.1 25.5 25% Change in Fixed Assets/Change in Sales Change in NWC/Change in Sales 25% 8% 25% 8% 25% 8% 25% 8% 8% (b) Estimate the enterprise value for the LBO, which has no nonoperating assets and is expected to be valued at $106 million at the end of year 2016. The unlevered cost of equity is 18.88%, and the WACC consistent with the company's target leverage (after the forecast period) is 13.7%. What is the value of the fund's investment? 4. Consider a private equity fund's investment in the LBO of Global Trade Corporation (GTC). GTC begins its life as an LBO with $80 million of debt (with interest rate of 12%) and $13 million of equity. Interest expense is calculated based on the year-beginning debt balance. Any cash flow to equity will be used to repay debt. Cashing out is expected to occur in 5 years. (a) With the forecast information given in the table below, complete the income statement forecast and determine the free cash flow (FCF), total capital cash flow (CCF), and each year's capital composition. $million 2011 0 2012 1 2013F 2 2014F 3 2015F 4 2016F 5 105.0 127.6 Net Sales Cost of Goods Sold SG&A Depreciation Total Operating Expense EBIT 100.0 50.0 25.0 5.0 80.0 20.0 52.5 26.3 5.3 84.1 20.9 110.3 55.1 27.6 5.5 88.2 22.1 115.8 57.9 28.9 5.8 92.6 23.2 121.6 60.8 30.4 6.1 97.3 24.3 63.8 31.9 6.4 102.1 25.5 25% Change in Fixed Assets/Change in Sales Change in NWC/Change in Sales 25% 8% 25% 8% 25% 8% 25% 8% 8% (b) Estimate the enterprise value for the LBO, which has no nonoperating assets and is expected to be valued at $106 million at the end of year 2016. The unlevered cost of equity is 18.88%, and the WACC consistent with the company's target leverage (after the forecast period) is 13.7%. What is the value of the fund's investment