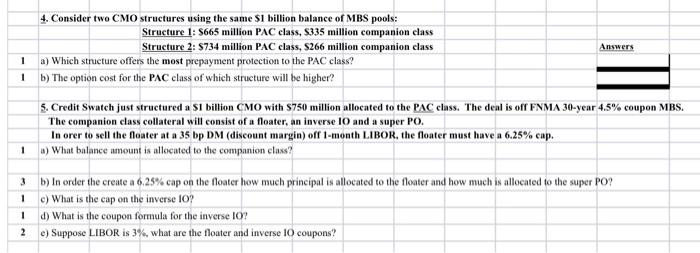

4. Consider two CMO structures using the same $1 billion balance of MBS pools: Structure 1: 5665 million PAC class, $335 million companion class Structure 2: S734 million PAC class, S266 million companion class 1 a) Which structure offers the most prepayment protection to the PAC class? 1 1 b) The option cost for the PAC class of which structure will be higher? Answers 5. Credit Swatch just structured a S1 billion CMO with S750 million allocated to the PAC class. The deal is off FNMA 30-year 4.5% coupon MBS. The companion class collateral will consist of a floater, an inverse 10 and a super PO. In orer to sell the floater at a 35 bp DM (discount margin) off 1-month LIBOR, the floater must have a 6.25% cap. 1) What balance amount is allocated to the companion class? 1 3 b) In order the create a 6.25% cap on the floater how much principal is allocated to the floater and how much is allocated to the super PO? 1 c) What is the cap on the inverse 10? d) What is the coupon formula for the inverse 10? e) Suppose LIBOR is 3%, what are the floater and inverse 10 coupons? 1 2 4. Consider two CMO structures using the same $1 billion balance of MBS pools: Structure 1: 5665 million PAC class, $335 million companion class Structure 2: S734 million PAC class, S266 million companion class 1 a) Which structure offers the most prepayment protection to the PAC class? 1 1 b) The option cost for the PAC class of which structure will be higher? Answers 5. Credit Swatch just structured a S1 billion CMO with S750 million allocated to the PAC class. The deal is off FNMA 30-year 4.5% coupon MBS. The companion class collateral will consist of a floater, an inverse 10 and a super PO. In orer to sell the floater at a 35 bp DM (discount margin) off 1-month LIBOR, the floater must have a 6.25% cap. 1) What balance amount is allocated to the companion class? 1 3 b) In order the create a 6.25% cap on the floater how much principal is allocated to the floater and how much is allocated to the super PO? 1 c) What is the cap on the inverse 10? d) What is the coupon formula for the inverse 10? e) Suppose LIBOR is 3%, what are the floater and inverse 10 coupons? 1 2