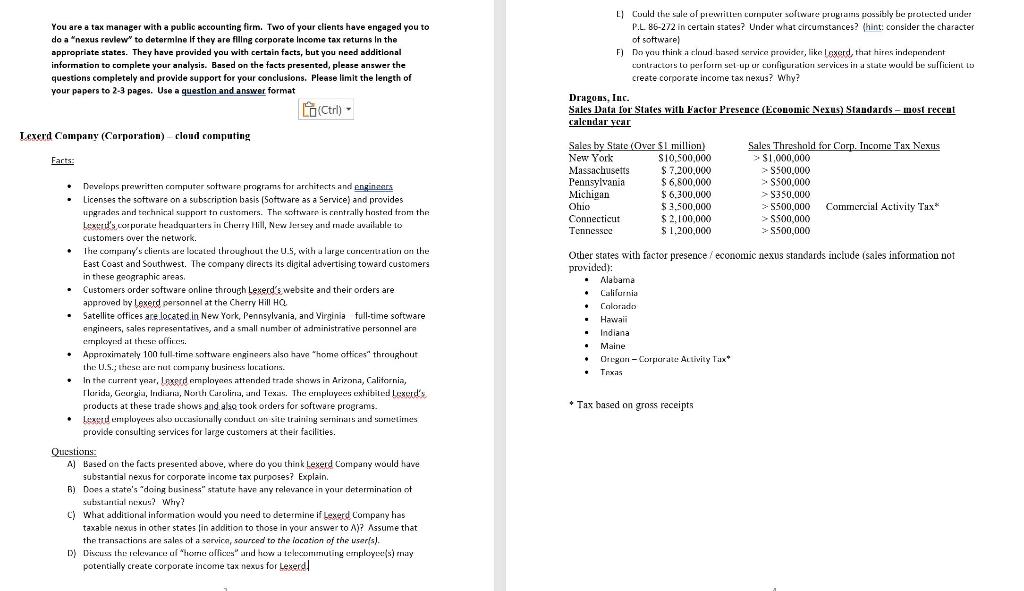

4) Could the sale of prewritten cornputer sof ware prugtams porsibly be protected urider You are a tax manager with a public accounting firm. Two of your clients have engaged you to P.L. 86-272 in certain states? Under what circumstances? (hint: consider the character do a "nexus revlew" to determine If they are fillng corporate Income tax returns in the of sottware) appropriate states. They have provided you with certain facts, but you need additional F) Do you think a clnud hasd service provider, like I I axerd, that hires independent information to complete your analysis. Based on the facts presented, please answer the contractors to perform set-up ur corfiguration services in a state would be sufficient to questions completely and provide support for your conclusions. Please limit the length of create corporate income tax nexus? Why? your papers to 2-3 pages. Use a question and answer format Dragons, Iuc. Sales Data tor States with Factor Presence (Economic Nexus) Standards - most recent calcudar fear Lexerd Company (Corporation) - cloud computing Farts: - Dowelops prewritten romputer cottware programs tor architents and enginzars - Licenses the software on a subscription basis (Sottware as a Service) and provides upgrades and terhinical support to rustomers. The cothware is rentrally hasted from the bexsud's conporate heasdquarters in Cherry Hill, New lensey and made available to customers over the network. - Ihe comrrany's clierits are located throughout the U.S, with a lar ge curicertiation on the Other states with factor presence / economic nexus standands include (sales information not East Coast and Southwest. The company clirects its digital advertisinc toward customers in these geographic areas. provided): - Alabama - Customers order software online through Leverd's website and their orders are - Calilurnia approved by lexed personnel at the Cherry Hill HO - Calorado - Satellite offices are located.in New York, Pennsylvania, and Virginia full-time software - Hawaii engineers, sales representatives, and a small number of administrative personnel are - Indiana empleysid it thesic offireri. - Maine - Approximately 100 tull-time sottware engineers also have "home ottices" throughout the U.5.; these are nut comparry bus:ircess lucations. - Oncgari - Lorparale Activily Tax - Trxas - In the curront year, Iexard emplovees attended trade shows in Arizona, Calitornia, rloridas, Gecur gia, Indiantis, North Carolirla, and Texis. The ernplapecus exhithited Lexerd's products at these trade shows and.alie took orders for software programs. + Tax hased on gross receipts - berged employees also uccasiunally condut on site training sernirias and sonetimes provide consulting services for large customers at their facilities. Questions: A) Based on the facts presented above, where do you think Lererd Company would have subitantial nexus for corporate income tax purposes? Explain. B) Does a state's "doing business" statute have any relevance in your determination of substartial nsxus? Why? C) What additional information would you need to determine if Lexerd Company has taxable nexus in other states lin addition to those in your answer to A )? Assume that the transactions are sales of a service, sourced to the locotion of the user(s). D) Discuss the relevance uf "home offices" and how a telexomurruting employes:(s) mayy potentially create corporate income tax nexus for Leserd