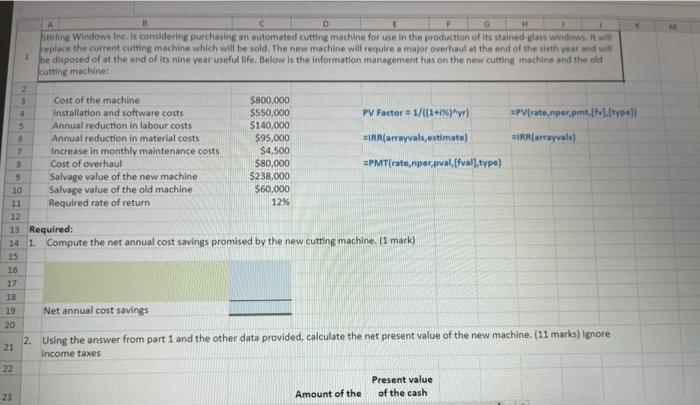

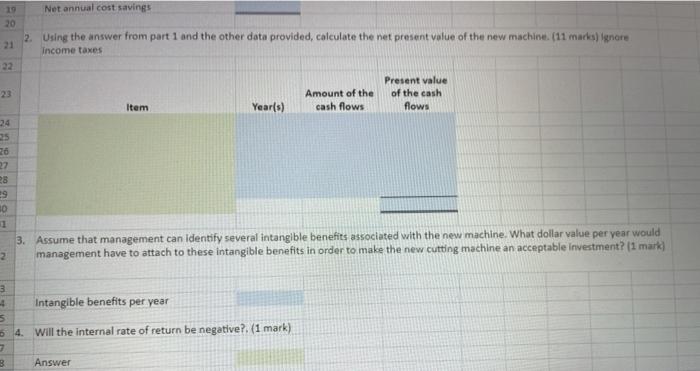

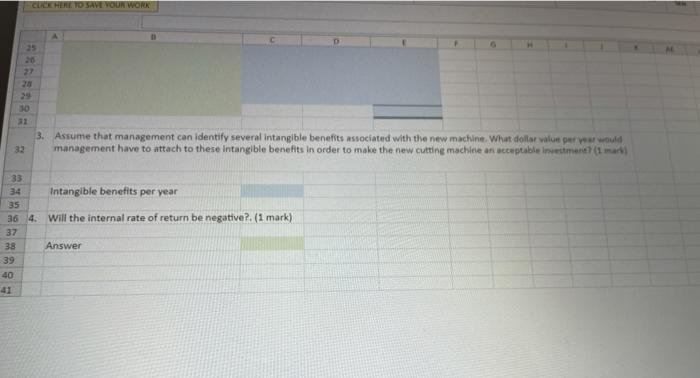

4 D H Burling Windows Ines considering purchasing an automated cutting machine for use in the production of its stained glass windows. It will replace the current cutting machine which will be sold. The new machine will require a major overhaul at the end of the sixth year and will be disposed of at the end of its nine year useful life. Below is the information management has on the new cutting machine and the old kutting machine 2 Cost of the machine $800.000 Installation and software costs $550.000 PV Factor = 1/{{1+216)** *Piratenperpmt.tv.ltype 5 Annual reduction in labour costs $140,000 0 Annual reduction in material costs $95.000 =IRR(arrayvals estimate) HIRR(arrayval) 2 Increase in monthly maintenance costs $4,500 Cost of overhaul $80,000 =PMTratenpur,pval,[fvall, type) Salvage value of the new machine $238.000 10 Salvage value of the old machine $60,000 11 Required rate of return 12% 12 13 Required: 14 1. Compute the net annual cost savings promised by the new cutting machine. (1 mark) 15 16 17 18 Net annual cost savings 20 2. Using the answer from part 1 and the other data provided, calculate the net present value of the new machine. (11 marks) Ignore 21 income taxes Present value of the cash 23 Amount of the Net annual cost savings 19 20 21 2. Using the answer from part 1 and the other data provided, calculate the net present volue of the new machine. (11 markas) ignore Income taxes Present value of the cash flows Amount of the cash flows Item Year(s) 24 25 26 27 28 10 1 3. Assume that management can Identify several intangible benefits associated with the new machine. What dollar value per year would management have to attach to these intangible benefits in order to make the new cutting machine an acceptable investment? [1 mark) 2 3 -- Intangible benefits per year 4. Will the internal rate of return be negative? (1 mark) B Answer CUCCHERE TO SAVE YOUR WORK 22 28 30 32 3. Assume that management can identify several intangible benefits associated with the new machine. What dollar value per a would management have to attach to these intangible benefits in order to make the new cutting machine an acceptable investment (1 33 Intangible benefits per year 35 36 4. Will the internal rate of return be negative? (1 mark) 37 38 Answer 39 40