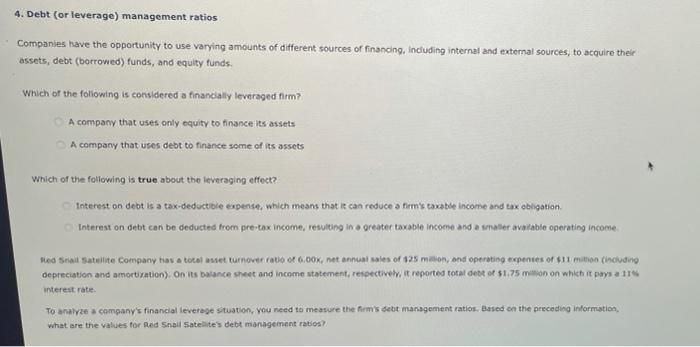

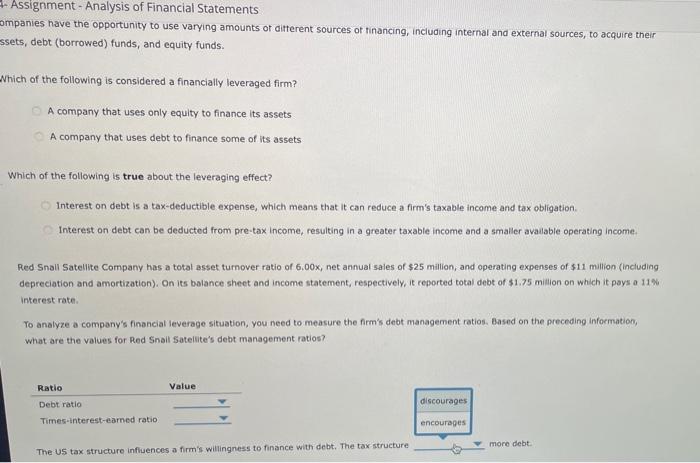

4. Debt (or leverage) management ratios Companies have the opportunity to use varying amounts of different sources of financing, including internal and external sources, to acquire their assets, debt (borrowed) funds, and equity funds. Which of the following is considered a financially leveraged firm? A company that uses only equity to finance its assets A company that uses debt to finance some of its assets Which of the following is true about the leveraging effect? Interest on debt is a tax deductible expense, which means that can reduce a tem's taxable income and tax obligation Interest on debt can be deducted from pre-tax income, resulting in a greater taxable income and a smaller available operating income. Red Sea Satellite Company has a total set turnover ratio of 6.00, net annual sales of 425 million, and operating expenses of $11 milion (including depreciation and amortization). On its balance sheet and income statement, respectively, it reported total dede of $1.75 mon on which pays a 114 interest rate To analyze a company's financial leverage Stuation, you need to measure the firm's debt management ratios. Based on the preceding information, what are the values for Red Snail Satelite's debt management ratios? Assignment - Analysis of Financial Statements companies have the opportunity to use varying amounts of different sources of financing, including internal and external sources, to acquire their ssets, debt (borrowed) funds, and equity funds. Which of the following is considered a financially leveraged firm? A company that uses only equity to finance its assets A company that uses debt to finance some of its assets Which of the following is true about the leveraging effect? Interest on debt is a tax-deductible expense, which means that it can reduce a firm's taxable income and tax obligation Interest on debt can be deducted from pre-tax income, resulting in a greater taxable income and a smaller available operating Income Red Snail Satellite Company has a total asset turnover ratio of 6:00x, net annual sales of $25 million, and operating expenses of $11 million (including depreciation and amortization). On its balance sheet and income statement, respectively, it reported total debt of $1.75 million on which it pays a 11% interest rate To analyze a company's financial leverage situation, you need to measure the firm's debt management ratios. Based on the preceding Information, what are the values for Red Snail Satellite's debt management ratios? Ratio Value Debt ratio discourages Times-interest-earned ratio encourages more debt The US tax structure influences a firm's willingness to finance with debt. The tax structure