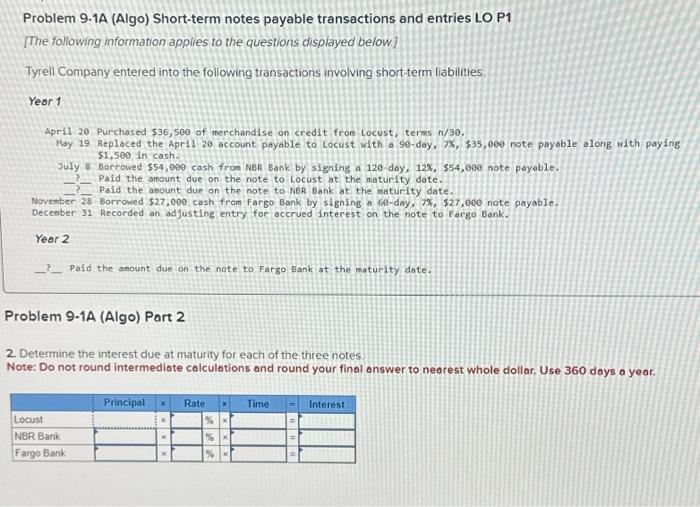

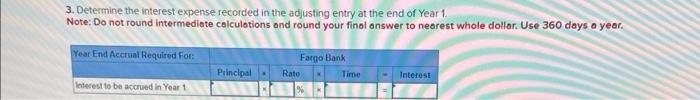

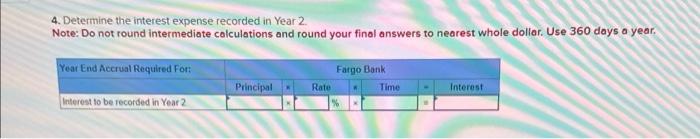

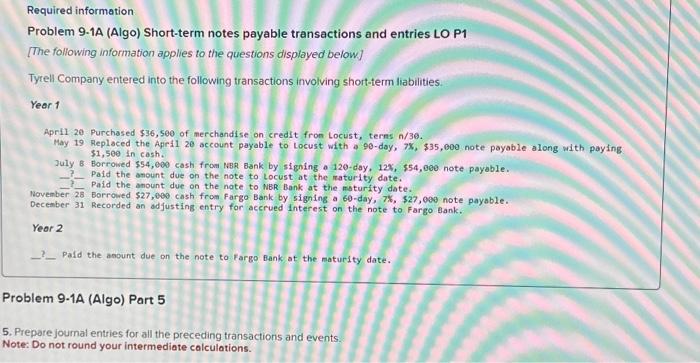

4. Determine the interest expense recorded in Year 2. Note: Do not round intermediate colculations and round your final answers to nearest whole dollar. Use 360 days a year. 3. Determine the interest expense recorded in the adjusting entry at the end of Year 1. Note: Do not round intermediate colculotions and round your final onswer to nearest whole dollar. Use 360 days a year. Problem 9-1A (Algo) Short-term notes payable transactions and entries LO P1 [The following information applies to the questions displayed below] Tyrell Company entered into the following transactions involving short-term liabilities. Year 1 April 20. Purchased $36,500 of merchandise on credit fron Locust, terns n/30. May 19 Replaced the April 20 occount payable to Locust with a 90 -day, 78,$35,000 note payable along with paying July 8 . Borroived $54,500 in - Pald the onount duesh from 1abh Bank by signing a 120-day, 12%, $54,000 note payable. - Paid the anount due on the note to locust at the maturity date. November 28 Borrowed $27, 098 , December 31 Recorded an adfusting entry for Bank by signing a 60 -day, 76 , $27,009 note payable. Yeor 2 - 2 Pafd the asount due on the note to Fargo Bank at the maturity date. Problem 9-1A (Algo) Part 5 5. Prepare journal entries for all the preceding transactions and events. Note: Do not round your intermediate calculations. Problem 9.1A (Algo) Short-term notes payable transactions and entries LOP1 [The following information applies to the questions displayed below] Tyrell Company entered into the following transactions involving short-term liabilities. Year 1 April 20 Purchased $36,500 of merchandise on credit fron Locust, terms n/30. May 19 Replaced the Apr11 20 account payable to Locust with o 90-doy, 7x, \$35, 000 note payable along with paying $1,500 in cash. July 8 Borrowed $54,000 cash from Nen Bank by signing a 120 day, 12%,$54,000 note payable. - Paid the amount due on the note to locust at the maturity date. Pald the amount due on the note to NeR Bank at the maturity date. November 28 Borrowed $27,000 cash from Fargo Bank by signing o 60-day, 7X, $27, edo note payable. Decenber 31 Recorded an adjusting eritry for accrued interest on the note to Fargo Eank. Year 2 - - Paid the amount due on the note to Fargo Bank at the maturity date. Problem 9-1A (Algo) Part 2 2. Determine the interest due at maturity for each of the three notes Note: Do not round intermediate calculations and round your final answer to neorest whole dollar. Use 360 doys a year. 4. Determine the interest expense recorded in Year 2. Note: Do not round intermediate colculations and round your final answers to nearest whole dollar. Use 360 days a year. 3. Determine the interest expense recorded in the adjusting entry at the end of Year 1. Note: Do not round intermediate colculotions and round your final onswer to nearest whole dollar. Use 360 days a year. Problem 9-1A (Algo) Short-term notes payable transactions and entries LO P1 [The following information applies to the questions displayed below] Tyrell Company entered into the following transactions involving short-term liabilities. Year 1 April 20. Purchased $36,500 of merchandise on credit fron Locust, terns n/30. May 19 Replaced the April 20 occount payable to Locust with a 90 -day, 78,$35,000 note payable along with paying July 8 . Borroived $54,500 in - Pald the onount duesh from 1abh Bank by signing a 120-day, 12%, $54,000 note payable. - Paid the anount due on the note to locust at the maturity date. November 28 Borrowed $27, 098 , December 31 Recorded an adfusting entry for Bank by signing a 60 -day, 76 , $27,009 note payable. Yeor 2 - 2 Pafd the asount due on the note to Fargo Bank at the maturity date. Problem 9-1A (Algo) Part 5 5. Prepare journal entries for all the preceding transactions and events. Note: Do not round your intermediate calculations. Problem 9.1A (Algo) Short-term notes payable transactions and entries LOP1 [The following information applies to the questions displayed below] Tyrell Company entered into the following transactions involving short-term liabilities. Year 1 April 20 Purchased $36,500 of merchandise on credit fron Locust, terms n/30. May 19 Replaced the Apr11 20 account payable to Locust with o 90-doy, 7x, \$35, 000 note payable along with paying $1,500 in cash. July 8 Borrowed $54,000 cash from Nen Bank by signing a 120 day, 12%,$54,000 note payable. - Paid the amount due on the note to locust at the maturity date. Pald the amount due on the note to NeR Bank at the maturity date. November 28 Borrowed $27,000 cash from Fargo Bank by signing o 60-day, 7X, $27, edo note payable. Decenber 31 Recorded an adjusting eritry for accrued interest on the note to Fargo Eank. Year 2 - - Paid the amount due on the note to Fargo Bank at the maturity date. Problem 9-1A (Algo) Part 2 2. Determine the interest due at maturity for each of the three notes Note: Do not round intermediate calculations and round your final answer to neorest whole dollar. Use 360 doys a year