Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 different questions. You are the financial analyst for a tennis racket manufacturer. The company is considering using a graphitelike material in its tennis rackets.

4 different questions.

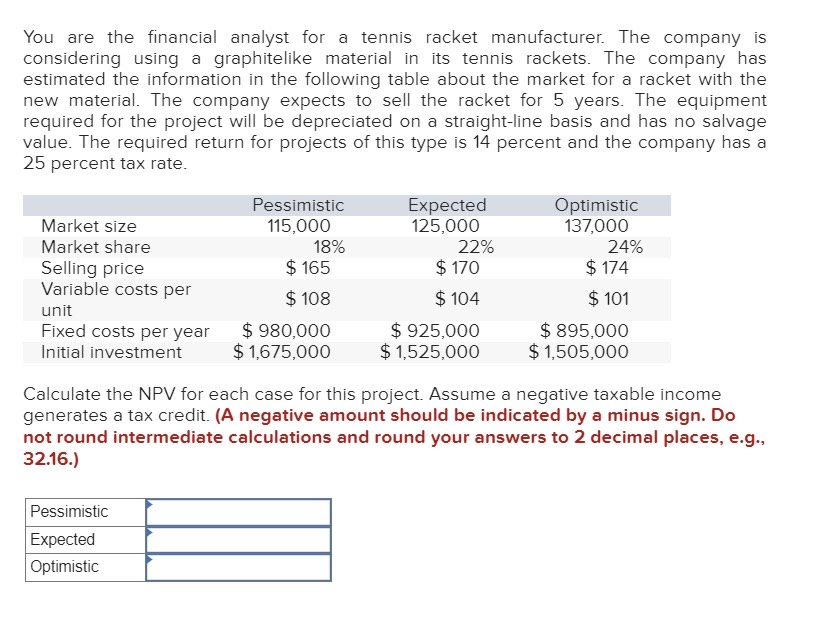

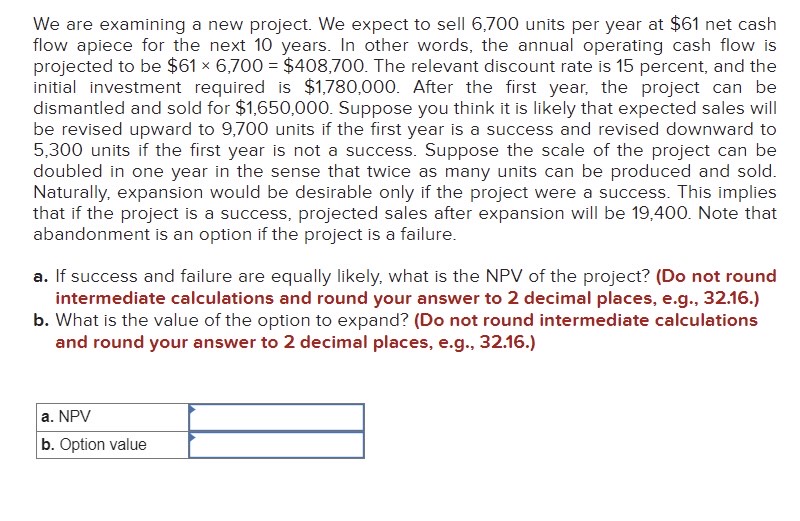

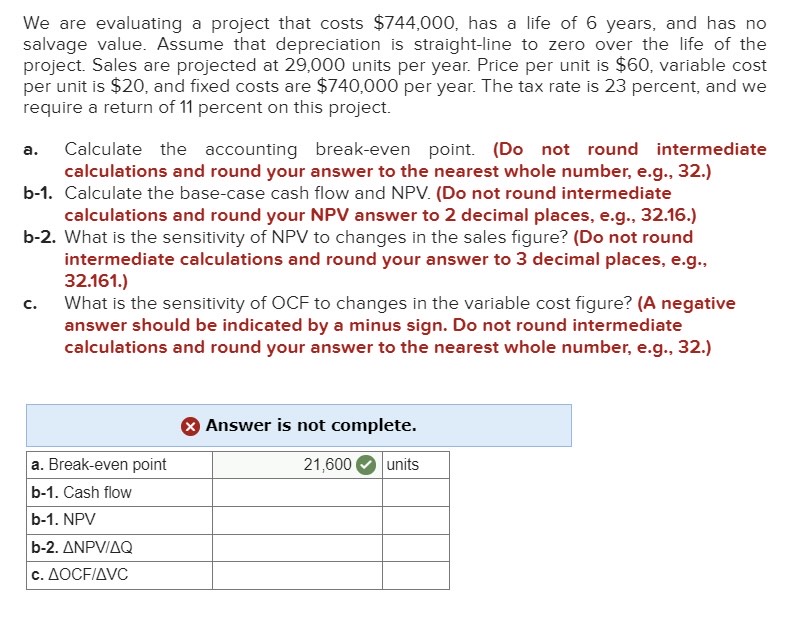

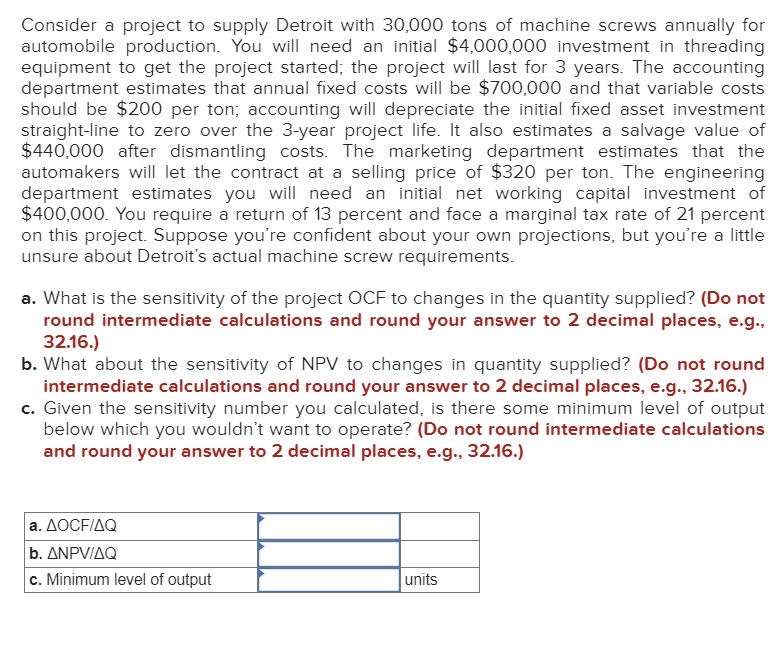

You are the financial analyst for a tennis racket manufacturer. The company is considering using a graphitelike material in its tennis rackets. The company has estimated the information in the following table about the market for a racket with the new material. The company expects to sell the racket for 5 years. The equipment required for the project will be depreciated on a straight-line basis and has no salvage value. The required return for projects of this type is 14 percent and the company has a 25 percent tax rate. Calculate the NPV for each case for this project. Assume a negative taxable income generates a tax credit. (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Consider a project to supply Detroit with 30,000 tons of machine screws annually for automobile production. You will need an initial $4,000,000 investment in threading equipment to get the project started; the project will last for 3 years. The accounting department estimates that annual fixed costs will be $700,000 and that variable costs should be $200 per ton; accounting will depreciate the initial fixed asset investment straight-line to zero over the 3 -year project life. It also estimates a salvage value of $440,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $320 per ton. The engineering department estimates you will need an initial net working capital investment of $400,000. You require a return of 13 percent and face a marginal tax rate of 21 percent on this project. Suppose you're confident about your own projections, but you're a little unsure about Detroit's actual machine screw requirements. a. What is the sensitivity of the project OCF to changes in the quantity supplied? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What about the sensitivity of NPV to changes in quantity supplied? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Given the sensitivity number you calculated, is there some minimum level of output below which you wouldn't want to operate? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) We are evaluating a project that costs $744,000, has a life of 6 years, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 29,000 units per year. Price per unit is $60, variable cost per unit is $20, and fixed costs are $740,000 per year. The tax rate is 23 percent, and we require a return of 11 percent on this project. a. Calculate the accounting break-even point. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b-1. Calculate the base-case cash flow and NPV. (Do not round intermediate calculations and round your NPV answer to 2 decimal places, e.g., 32.16.) b-2. What is the sensitivity of NPV to changes in the sales figure? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) c. What is the sensitivity of OCF to changes in the variable cost figure? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) We are examining a new project. We expect to sell 6,700 units per year at $61 net cash flow apiece for the next 10 years. In other words, the annual operating cash flow is projected to be $616,700=$408,700. The relevant discount rate is 15 percent, and the initial investment required is $1,780,000. After the first year, the project can be dismantled and sold for $1,650,000. Suppose you think it is likely that expected sales will be revised upward to 9,700 units if the first year is a success and revised downward to 5,300 units if the first year is not a success. Suppose the scale of the project can be doubled in one year in the sense that twice as many units can be produced and sold. Naturally, expansion would be desirable only if the project were a success. This implies that if the project is a success, projected sales after expansion will be 19,400 . Note that abandonment is an option if the project is a failure. a. If success and failure are equally likely, what is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the value of the option to expand? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started