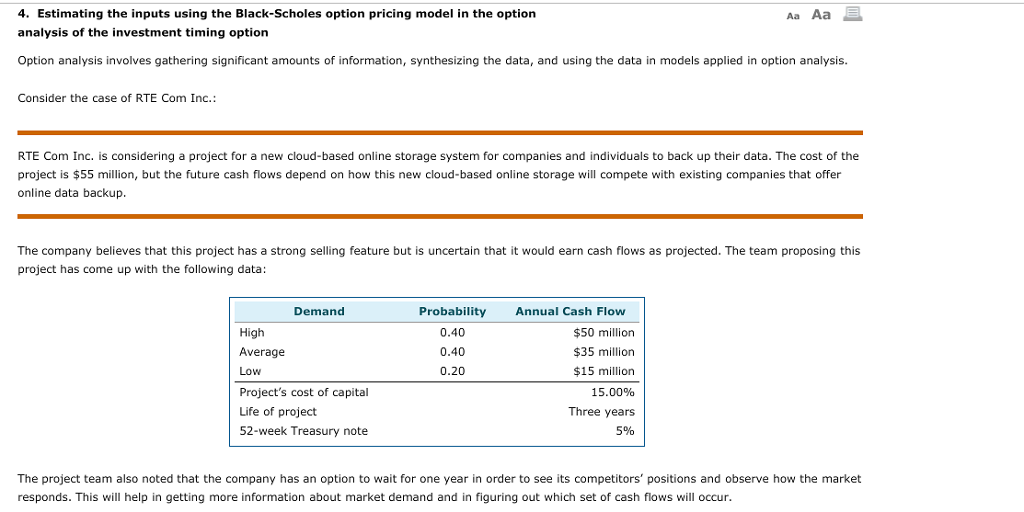

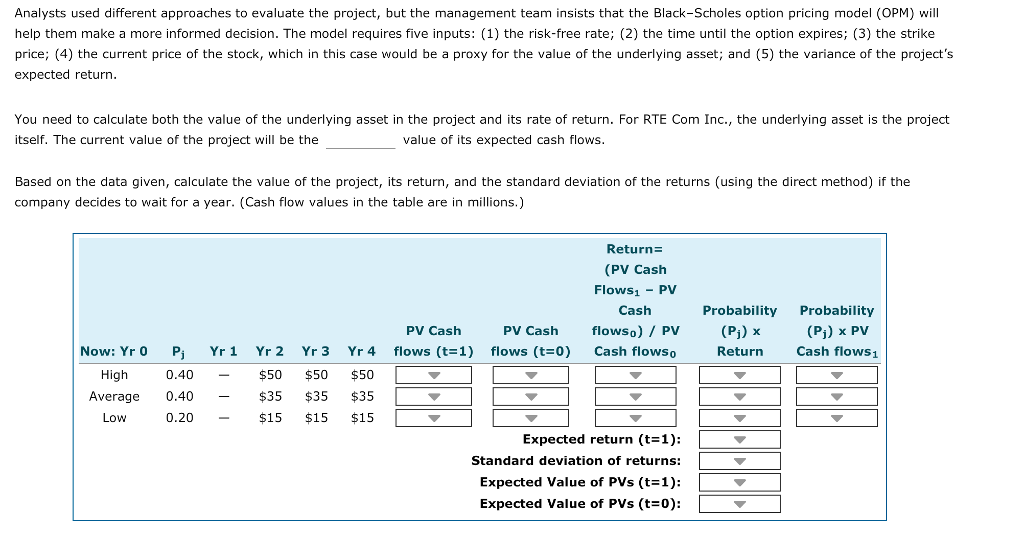

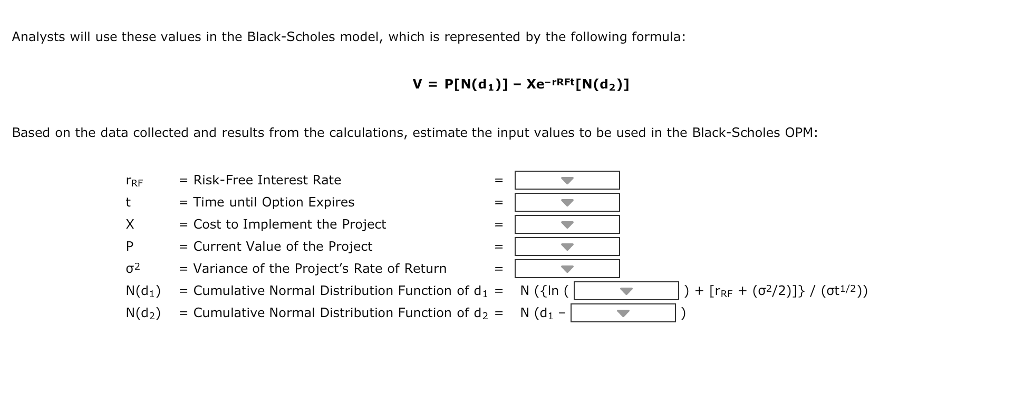

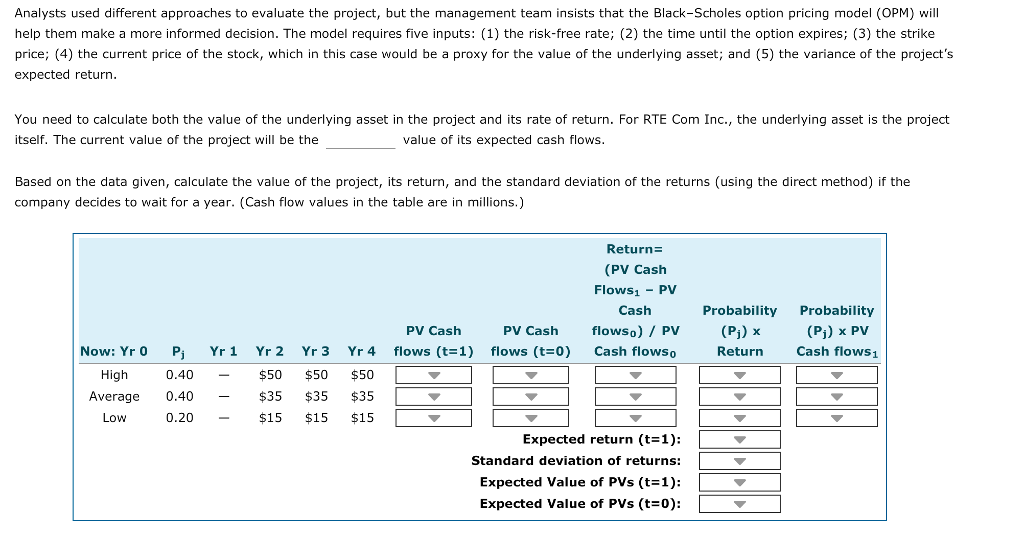

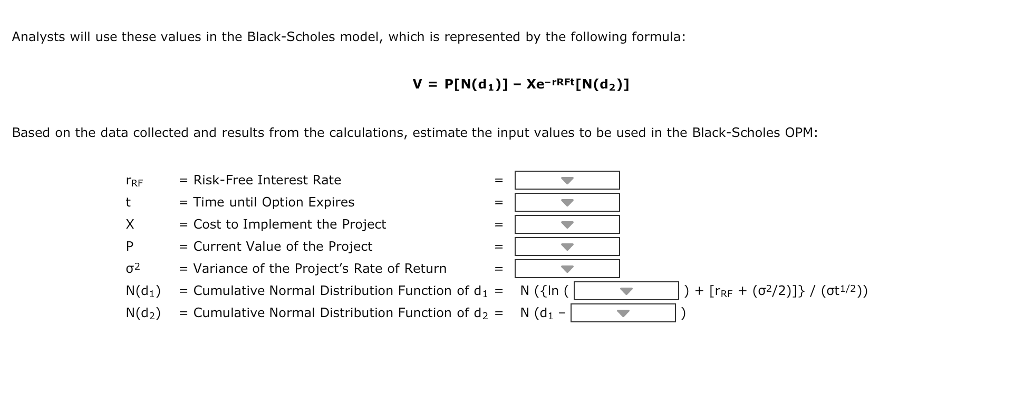

4. Estimating the inputs using the Black-Scholes option pricing model in the option Aa Aa analysis of the investment timing option Option analysis involves gathering significant amounts of information, synthesizing the data, and using the data in models applied in option analysis. Consider the case of RTE Com Inc.: RTE Com Inc. is considering a project for a new cloud-based online storage system for companies and individuals to back up their data. The cost of the project is $55 million, but the future cash flows depend on how this new cloud-based online storage will compete with existing companies that offer online data backup. The company believes that this project has a strong selling feature but is uncertain that it would earn cash flows as projected. The team proposing this project has come up with the following data: Demand Probability Annual Cash Flow $50 million High 0.40 Average 0.40 $35 million Low 0.20 $15 million Project's cost of capital 15.00% Three years Life of project 52-week Treasury note 5% The project team also noted that the company has an option to wait for one year in order to see its competitors' positions and observe how the market responds. This will help in getting more information about market demand and in figuring out which set of cash flows will occur. 4. Estimating the inputs using the Black-Scholes option pricing model in the option Aa Aa analysis of the investment timing option Option analysis involves gathering significant amounts of information, synthesizing the data, and using the data in models applied in option analysis. Consider the case of RTE Com Inc.: RTE Com Inc. is considering a project for a new cloud-based online storage system for companies and individuals to back up their data. The cost of the project is $55 million, but the future cash flows depend on how this new cloud-based online storage will compete with existing companies that offer online data backup. The company believes that this project has a strong selling feature but is uncertain that it would earn cash flows as projected. The team proposing this project has come up with the following data: Demand Probability Annual Cash Flow $50 million High 0.40 Average 0.40 $35 million Low 0.20 $15 million Project's cost of capital 15.00% Three years Life of project 52-week Treasury note 5% The project team also noted that the company has an option to wait for one year in order to see its competitors' positions and observe how the market responds. This will help in getting more information about market demand and in figuring out which set of cash flows will occur