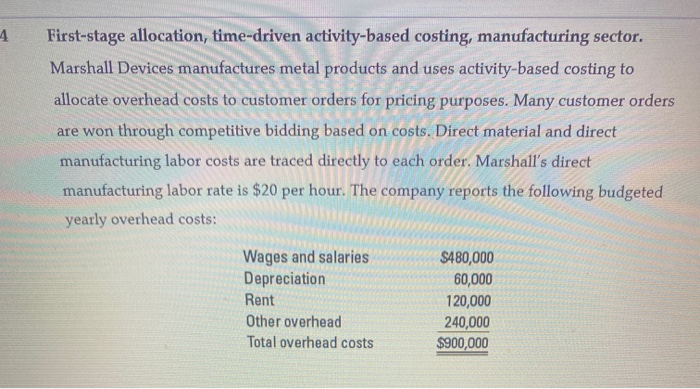

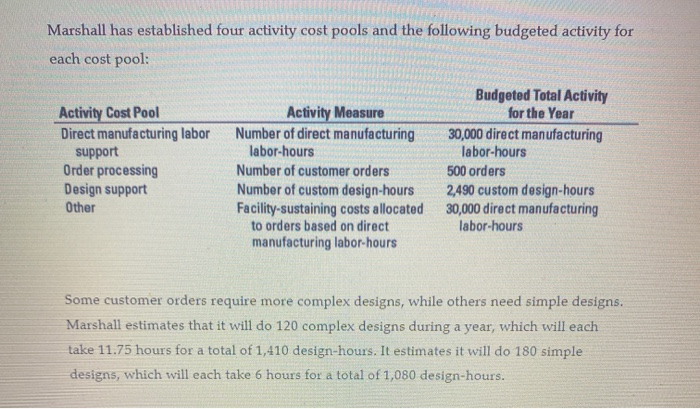

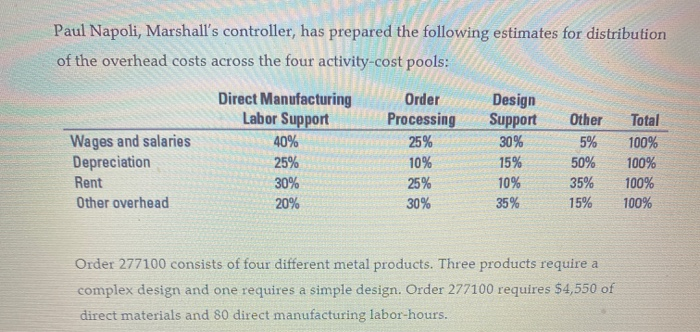

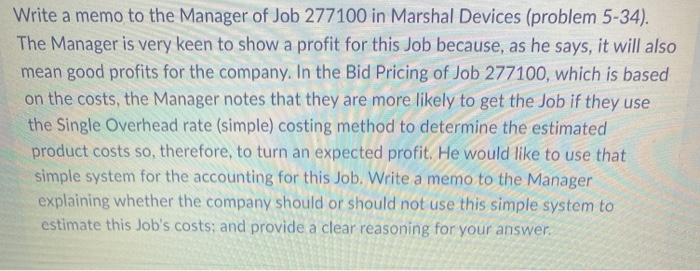

4 First-stage allocation, time-driven activity-based costing, manufacturing sector. Marshall Devices manufactures metal products and uses activity-based costing to allocate overhead costs to customer orders for pricing purposes. Many customer orders are won through competitive bidding based on costs. Direct material and direct manufacturing labor costs are traced directly to each order. Marshall's direct manufacturing labor rate is $20 per hour. The company reports the following budgeted yearly overhead costs: Wages and salaries Depreciation Rent Other overhead Total overhead costs $480,000 60,000 120,000 240,000 $900,000 Marshall has established four activity cost pools and the following budgeted activity for each cost pool: Budgeted Total Activity Activity Cost Pool Activity Measure for the Year Direct manufacturing labor Number of direct manufacturing 30,000 direct manufacturing support labor-hours labor-hours Order processing Number of customer orders 500 orders Design support Number of custom design-hours 2,490 custom design-hours Other Facility-sustaining costs allocated 30,000 direct manufacturing to orders based on direct labor-hours manufacturing labor-hours Some customer orders require more complex designs, while others need simple designs. Marshall estimates that it will do 120 complex designs during a year, which will each take 11.75 hours for a total of 1,410 design-hours. It estimates it will do 180 simple designs, which will each take 6 hours for a total of 1,080 design-hours. Paul Napoli, Marshall's controller, has prepared the following estimates for distribution of the overhead costs across the four activity-cost pools: Wages and salaries Depreciation Rent Other overhead Direct Manufacturing Labor Support 40% 25% 30% 20% Order Processing 25% 10% 25% 30% Design Support 30% 15% 10% 35% Other 5% 50% 35% 15% Total 100% 100% 100% 100% Order 277100 consists of four different metal products. Three products require a complex design and one requires a simple design. Order 277100 requires $4,550 of direct materials and 80 direct manufacturing labor-hours. Write a memo to the Manager of Job 277100 in Marshal Devices (problem 5-34). The Manager is very keen to show a profit for this Job because, as he says, it will also mean good profits for the company. In the Bid Pricing of Job 277100, which is based on the costs, the Manager notes that they are more likely to get the Job if they use the Single Overhead rate (simple) costing method to determine the estimated product costs so, therefore, to turn an expected profit. He would like to use that simple system for the accounting for this Job. Write a memo to the Manager explaining whether the company should or should not use this simple system to estimate this Job's costs; and provide a clear reasoning for your