Question

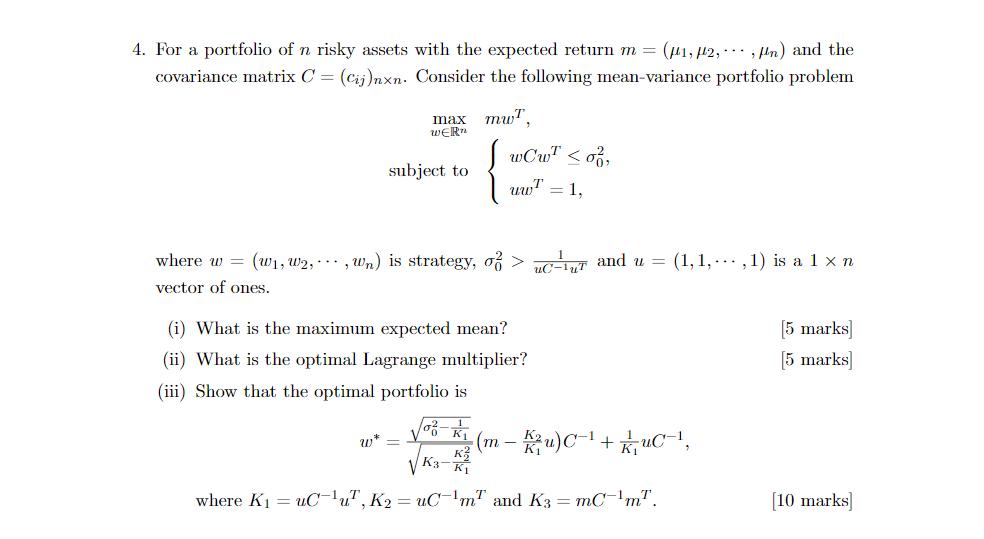

4. For a portfolio of n risky assets with the expected return m = (1, 2,,n) and the covariance matrix C = (Cij)nxn. Consider

4. For a portfolio of n risky assets with the expected return m = (1, 2,,n) and the covariance matrix C = (Cij)nxn. Consider the following mean-variance portfolio problem max mwT WER wCwo, subject to uw = 1, where w = (wi, w2,, wn) is strategy, > C-1 and u = (1, 1, 1) is a 1 x n vector of ones. (i) What is the maximum expected mean? (ii) What is the optimal Lagrange multiplier? (iii) Show that the optimal portfolio is o - k (m K u) C-1 + kuc, W* K V K3- where K = uCu, K2 = uCm and K3 = mCmT [5 marks] [5 marks] [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Probability And Stochastic Modeling

Authors: Vladimir I. Rotar

1st Edition

1439872066, 9781439872062

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App