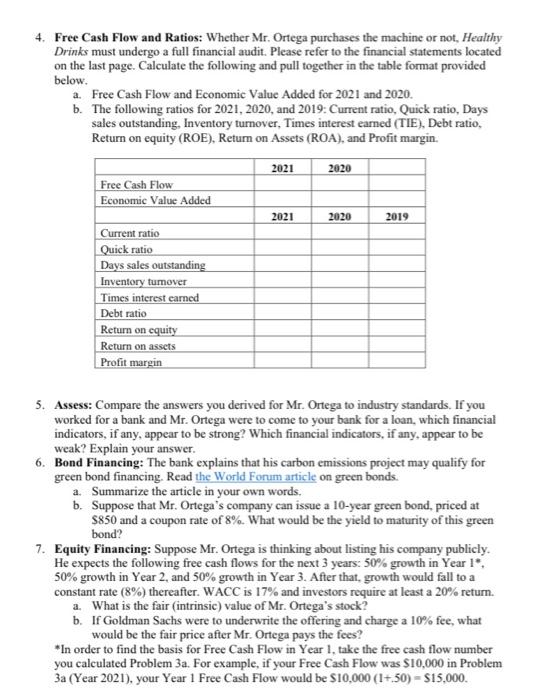

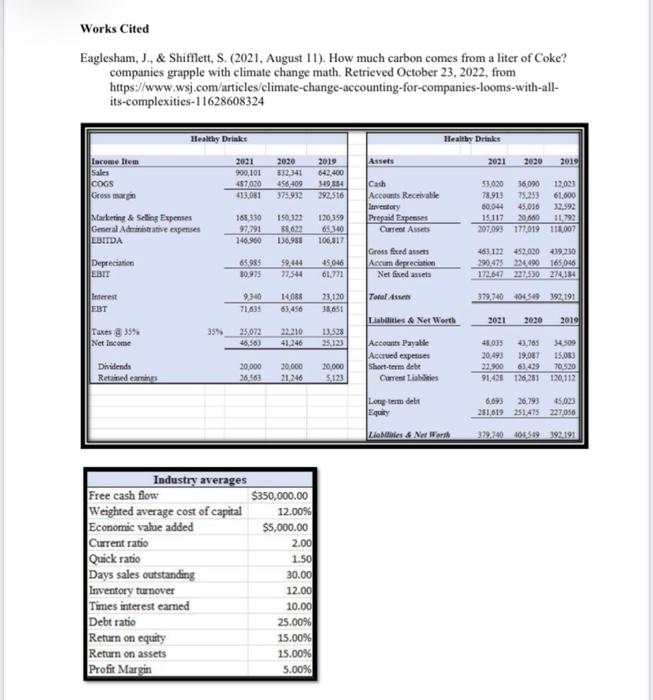

4. Free Cash Flow and Ratios: Whether Mr. Ortega purchases the machine or not, Healthy Drinks must undergo a full financial audit. Please refer to the financial statements located on the last page. Calculate the following and pull together in the table format provided below. a. Free Cash Flow and Economic Value Added for 2021 and 2020. b. The following ratios for 2021, 2020, and 2019: Current ratio, Quick ratio, Days sales outstanding, Inventory turnover, Times interest earned (TIE), Debt ratio, Return on equity (ROE), Return on Assets (ROA), and Profit margin. 5. Assess: Compare the answers you derived for Mr. Ortega to industry standards. If you worked for a bank and Mr. Ortega were to come to your bank for a loan, which financial indicators, if any, appear to be strong? Which financial indicators, if any, appear to be weak? Explain your answer. 6. Bond Financing: The bank explains that his carbon emissions project may qualify for green bond financing. Read the World Forum article on green bonds. a. Summarize the article in your own words. b. Suppose that Mr. Ortega's company can issue a 10-year green bond, priced at $850 and a coupon rate of 8%. What would be the yield to maturity of this green bond? 7. Equity Financing: Suppose Mr. Ortega is thinking about listing his company publicly. He expects the following free cash flows for the next 3 years: 50% growth in Year 1, 50% growth in Year 2, and 50% growth in Year 3. After that, growth would fall to a constant rate (8%) thereafter. WACC is 17% and investors require at least a 20% return. a. What is the fair (intrinsic) value of Mr. Ortega's stock? b. If Goldman Sachs were to underwrite the offering and charge a 10% fee, what would be the fair price after Mr. Ortega pays the fees? "In order to find the basis for Free Cash Flow in Year 1, take the free cash flow number you calculated Problem 3a. For example, if your Free Cash Flow was $10,000 in Problem 3a (Year 2021), your Year 1 Free Cash Flow would be $10,000(1+.50)=$15,000. Eaglesham, J., \& Shifflett, S. (2021, August 11). How much carbon comes from a liter of Coke? companies grapple with climate change math. Retrieved October 23, 2022, from https://www,wsj.com/articles/climate-change-accounting-for-companies-looms-with-allits-complexities-11628608324 4. Free Cash Flow and Ratios: Whether Mr. Ortega purchases the machine or not, Healthy Drinks must undergo a full financial audit. Please refer to the financial statements located on the last page. Calculate the following and pull together in the table format provided below. a. Free Cash Flow and Economic Value Added for 2021 and 2020. b. The following ratios for 2021, 2020, and 2019: Current ratio, Quick ratio, Days sales outstanding, Inventory turnover, Times interest earned (TIE), Debt ratio, Return on equity (ROE), Return on Assets (ROA), and Profit margin. 5. Assess: Compare the answers you derived for Mr. Ortega to industry standards. If you worked for a bank and Mr. Ortega were to come to your bank for a loan, which financial indicators, if any, appear to be strong? Which financial indicators, if any, appear to be weak? Explain your answer. 6. Bond Financing: The bank explains that his carbon emissions project may qualify for green bond financing. Read the World Forum article on green bonds. a. Summarize the article in your own words. b. Suppose that Mr. Ortega's company can issue a 10-year green bond, priced at $850 and a coupon rate of 8%. What would be the yield to maturity of this green bond? 7. Equity Financing: Suppose Mr. Ortega is thinking about listing his company publicly. He expects the following free cash flows for the next 3 years: 50% growth in Year 1, 50% growth in Year 2, and 50% growth in Year 3. After that, growth would fall to a constant rate (8%) thereafter. WACC is 17% and investors require at least a 20% return. a. What is the fair (intrinsic) value of Mr. Ortega's stock? b. If Goldman Sachs were to underwrite the offering and charge a 10% fee, what would be the fair price after Mr. Ortega pays the fees? "In order to find the basis for Free Cash Flow in Year 1, take the free cash flow number you calculated Problem 3a. For example, if your Free Cash Flow was $10,000 in Problem 3a (Year 2021), your Year 1 Free Cash Flow would be $10,000(1+.50)=$15,000. Eaglesham, J., \& Shifflett, S. (2021, August 11). How much carbon comes from a liter of Coke? companies grapple with climate change math. Retrieved October 23, 2022, from https://www,wsj.com/articles/climate-change-accounting-for-companies-looms-with-allits-complexities-11628608324