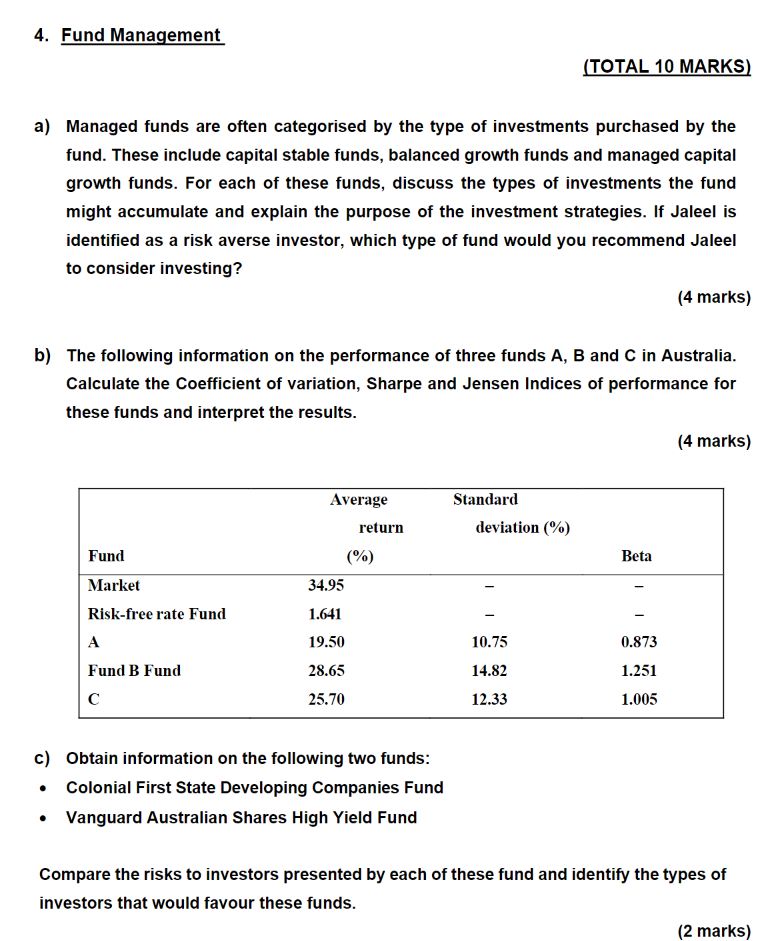

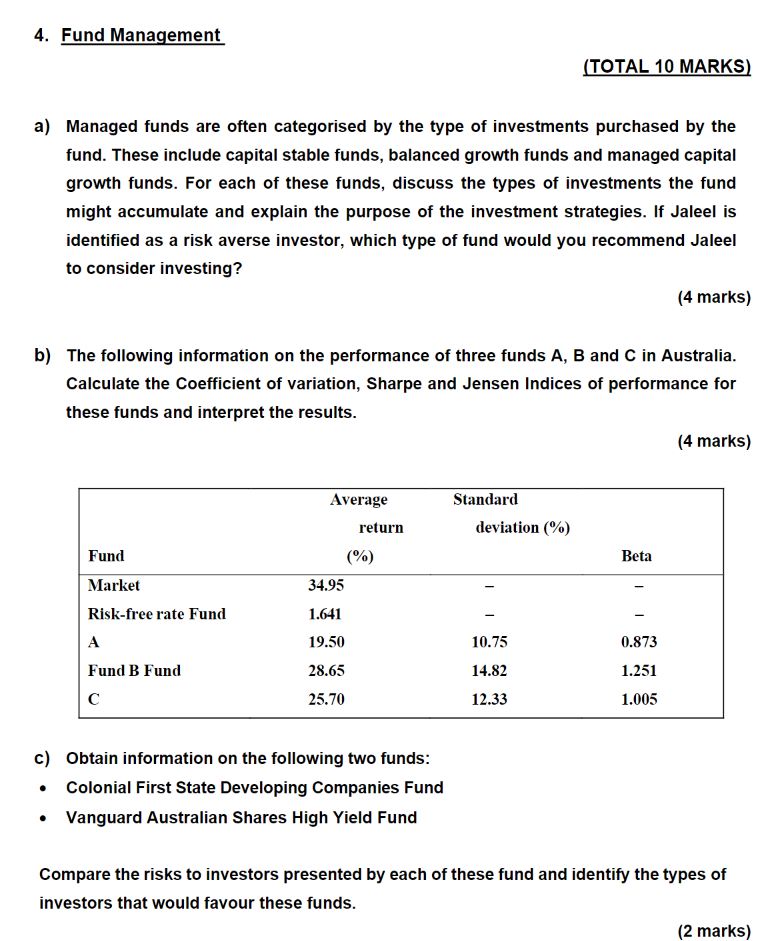

4. Fund Management (TOTAL 10 MARKS) a) Managed funds are often categorised by the type of investments purchased by the fund. These include capital stable funds, balanced growth funds and managed capital growth funds. For each of these funds, discuss the types of investments the fund might accumulate and explain the purpose of the investment strategies. If Jaleel is identified as a risk averse investor, which type of fund would you recommend Jaleel to consider investing? (4 marks) b) The following information on the performance of three funds A, B and C in Australia. Calculate the Coefficient of variation, Sharpe and Jensen Indices of performance for these funds and interpret the results. (4 marks) Average return Standard deviation (%) (%) Beta 34.95 1.641 - Fund Market Risk-free rate Fund A Fund B Fund 19.50 10.75 0.873 14.82 28.65 25.70 1.251 1.005 12.33 c) Obtain information on the following two funds: Colonial First State Developing Companies Fund Vanguard Australian Shares High Yield Fund . Compare the risks to investors presented by each of these fund and identify the types of investors that would favour these funds. (2 marks) 4. Fund Management (TOTAL 10 MARKS) a) Managed funds are often categorised by the type of investments purchased by the fund. These include capital stable funds, balanced growth funds and managed capital growth funds. For each of these funds, discuss the types of investments the fund might accumulate and explain the purpose of the investment strategies. If Jaleel is identified as a risk averse investor, which type of fund would you recommend Jaleel to consider investing? (4 marks) b) The following information on the performance of three funds A, B and C in Australia. Calculate the Coefficient of variation, Sharpe and Jensen Indices of performance for these funds and interpret the results. (4 marks) Average return Standard deviation (%) (%) Beta 34.95 1.641 - Fund Market Risk-free rate Fund A Fund B Fund 19.50 10.75 0.873 14.82 28.65 25.70 1.251 1.005 12.33 c) Obtain information on the following two funds: Colonial First State Developing Companies Fund Vanguard Australian Shares High Yield Fund . Compare the risks to investors presented by each of these fund and identify the types of investors that would favour these funds. (2 marks)