4. Help Jake build his emergency fund.

a. Determine how much Jack should have in liquid assets in order to have a comfortable liquidity ratio.

b. Calculate how much he must save each month to fill his emergency fund within 12 months.

5. Jake is considering changing to the extended repayment plan on his student loans. If he does this, the loans will take 20 years to pay off instead of 10.

a. Calculate his new monthly payments for all of his student loans if the term changes to 20-years.

b. How much lower will his total students loan payment be if he changes to the 20-year repayment plan?

c. Is this something Jake should consider doing to help him achieve his other cash management goals?

6. Using the figures you calculated in #1-5, give Jake a final and comprehensive set of recommendations for what he should do to balance his budget and reach his goals. Jake may not be able to accomplish all of his goals, so you will need to either adjust his goals (like buying a cheaper car/house) or prioritize which goals he should focus on first. Be specific, creative, and as realistic as possible.

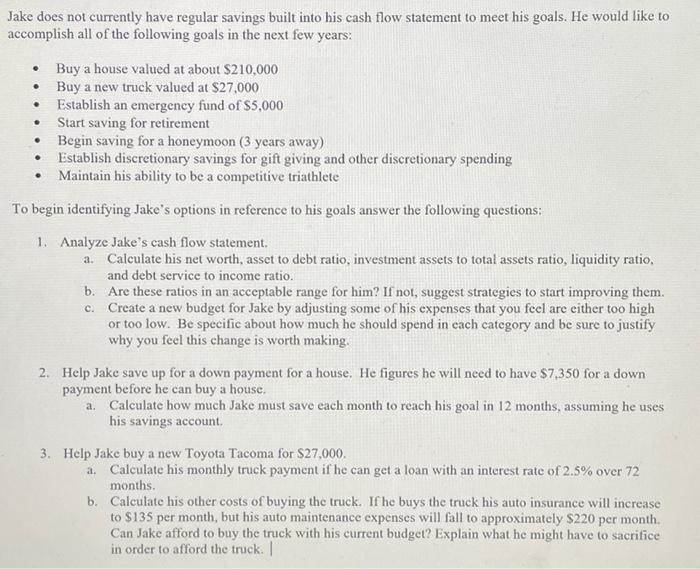

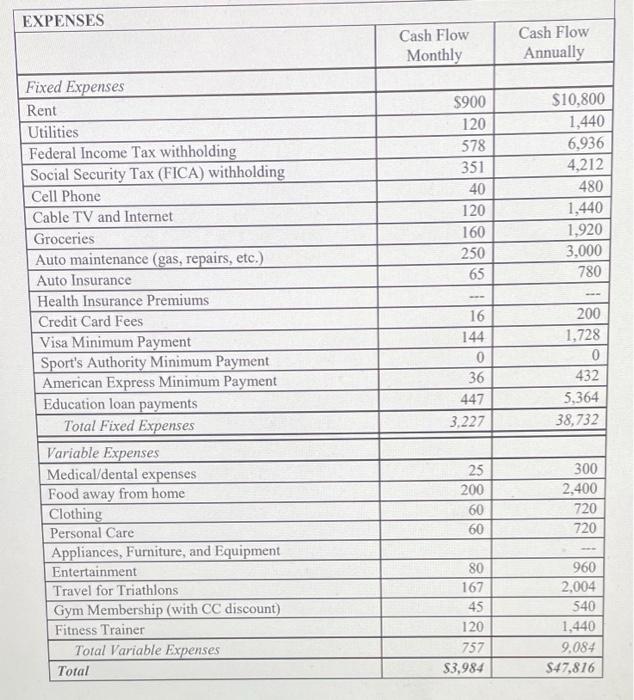

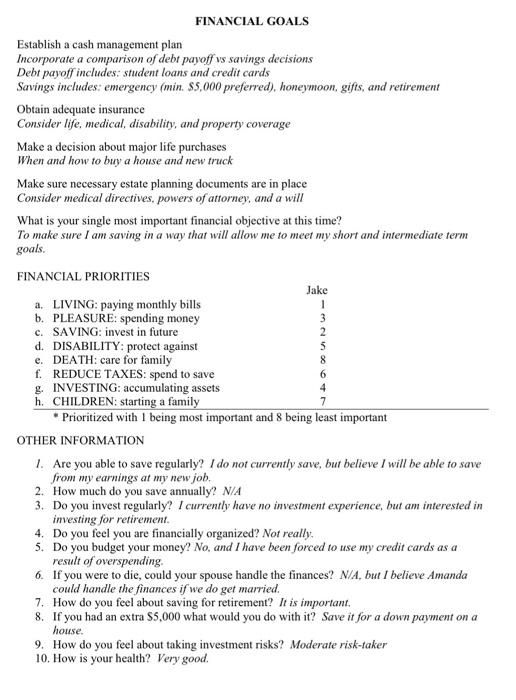

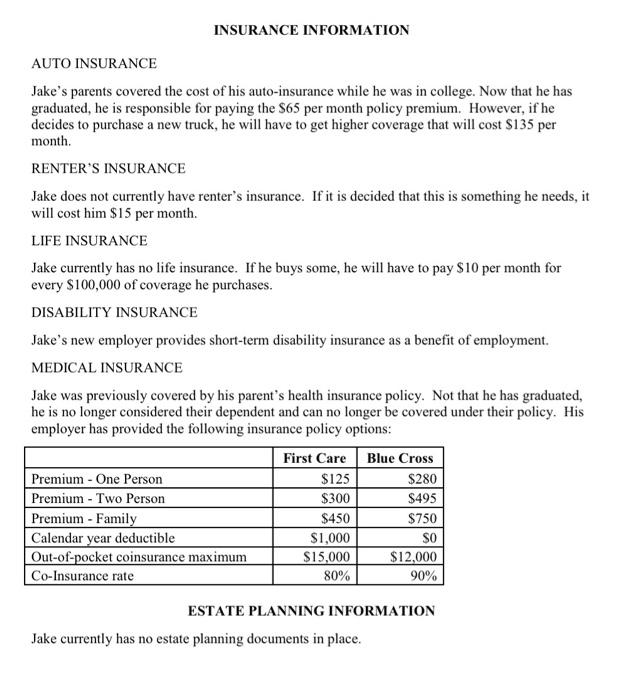

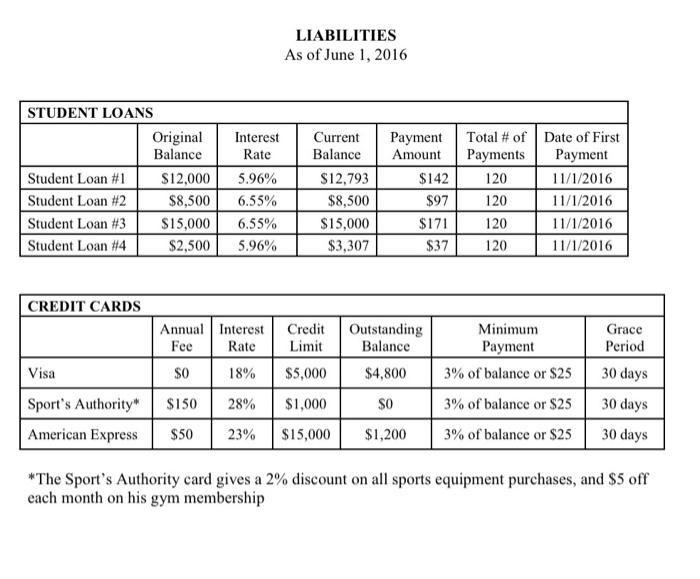

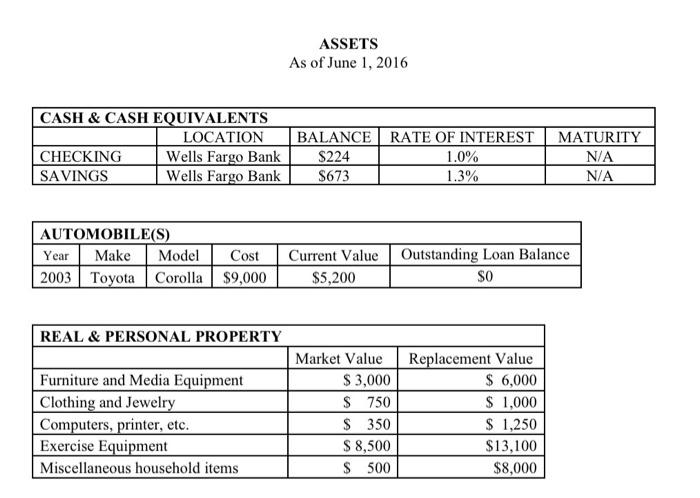

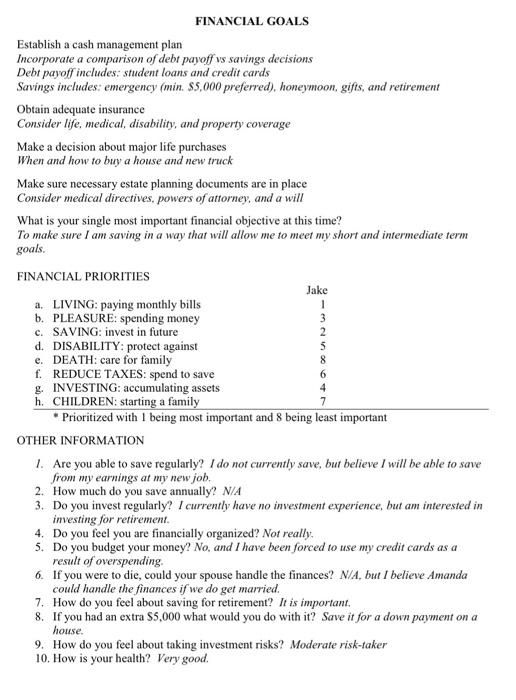

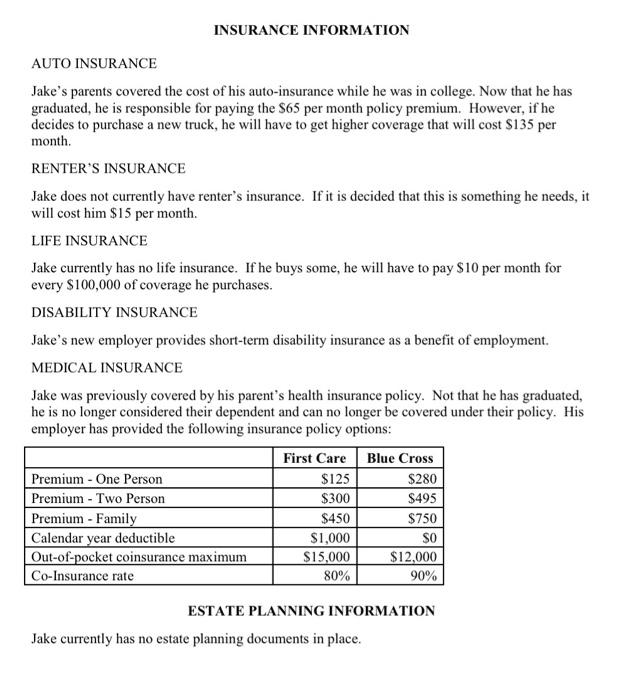

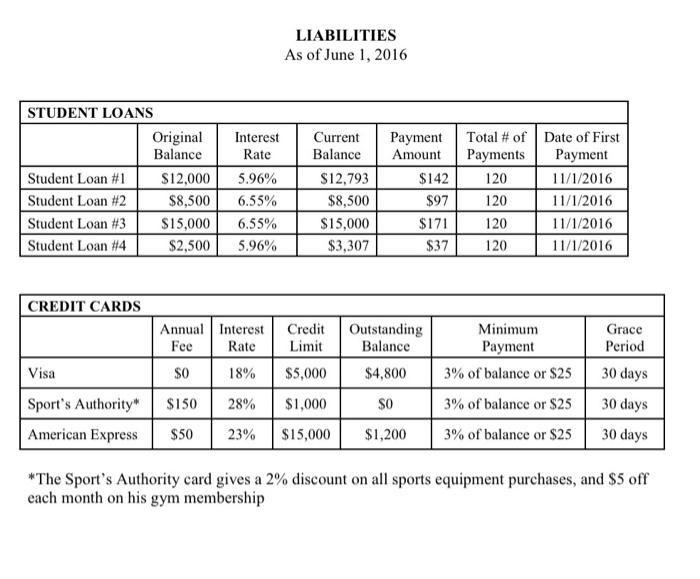

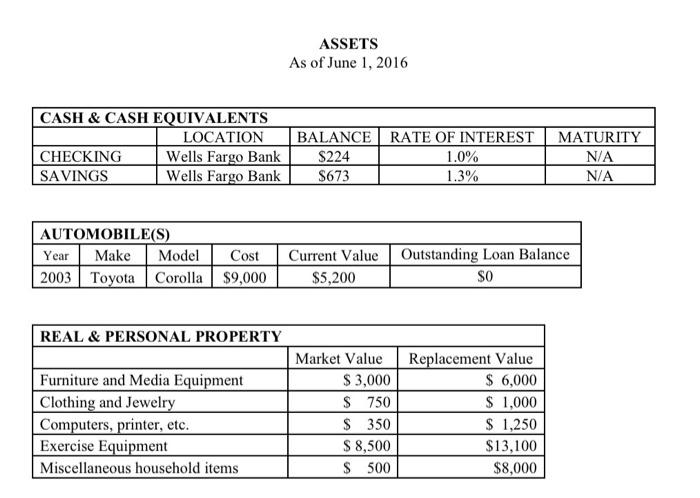

. . Jake does not currently have regular savings built into his cash flow statement to meet his goals. He would like to accomplish all of the following goals in the next few years: Buy a house valued at about $210,000 Buy a new truck valued at $27,000 Establish an emergency fund of $5,000 Start saving for retirement Begin saving for a honeymoon (3 years away) Establish discretionary savings for gift giving and other discretionary spending Maintain his ability to be a competitive triathlete . . . To begin identifying Jake's options in reference to his goals answer the following questions: 1. Analyze Jake's cash flow statement a. Calculate his net worth, asset to debt ratio, investment assets to total assets ratio, liquidity ratio, and debt service to income ratio. b. Are these ratios in an acceptable range for him? If not, suggest strategies to start improving them. c. Create a new budget for Jake by adjusting some of his expenses that you feel are either too high or too low. Be specific about how much he should spend in each category and be sure to justify why you feel this change is worth making. 2. Help Jake save up for a down payment for a house, He figures he will need to have $7,350 for a down payment before he can buy a house. a. Calculate how much Jake must save each month to reach his goal in 12 months, assuming he uses his savings account 3. Help Jake buy a new Toyota Tacoma for $27,000 a. Calculate his monthly truck payment if he can get a loan with an interest rate of 2.5% over 72 months. b. Calculate his other costs of buying the truck. If he buys the truck his auto insurance will increase to $135 per month, but his auto maintenance expenses will fall to approximately $220 per month Can Jake afford to buy the truck with his current budget? Explain what he might have to sacrifice in order to afford the truck. EXPENSES Cash Flow Monthly Cash Flow Annually $900 120 578 351 40 120 160 250 65 $10,800 1,440 6,936 4,212 480 1,440 1,920 3.000 780 Fixed Expenses Rent Utilities Federal Income Tax withholding Social Security Tax (FICA) withholding Cell Phone Cable TV and Internet Groceries Auto maintenance (gas, repairs, etc.) Auto Insurance Health Insurance Premiums Credit Card Fees Visa Minimum Payment Sport's Authority Minimum Payment American Express Minimum Payment Education loan payments Total Fixed Expenses Variable Expenses Medical/dental expenses Food away from home Clothing Personal Care Appliances, Furniture, and Equipment Entertainment Travel for Triathlons Gym Membership (with CC discount) Fitness Trainer Total Variable Expenses Total 16 144 0 36 447 3.227 200 1,728 0 432 5,364 38,732 25 200 60 60 300 2,400 720 720 80 167 45 120 757 $3,984 960 2,004 540 1,440 9,084 S47,816 FINANCIAL GOALS Establish a cash management plan Incorporate a comparison of debt payoff vs savings decisions Debt payoff includes: student loans and credit cards Savings includes: emergency (min. $5,000 preferred), honeymoon, gifts, and retirement Obtain adequate insurance Consider life, medical, disability, and property coverage Make a decision about major life purchases When and how to buy a house and new truck Make sure necessary estate planning documents are in place Consider medical directives, powers of attorney, and a will What is your single most important financial objective at this time? To make sure I am saving in a way that will allow me to meet my short and intermediate term goals. FINANCIAL PRIORITIES Jake a. LIVING: paying monthly bills 1 b. PLEASURE: spending money c. SAVING: invest in future 2 d. DISABILITY:protect against 5 e. DEATH: care for family f. REDUCE TAXES: spend to save g. INVESTING: accumulating assets h. CHILDREN: starting a family * Prioritized with 1 being most important and 8 being least important OTHER INFORMATION 1. Are you able to save regularly? I do not currently save, but believe I will be able to save from my earnings at my new job. 2. How much do you save annually? NA 3. Do you invest regularly? I currently have no investment experience, but am interested in investing for retirement. 4. Do you feel you are financially organized? Not really 5. Do you budget your money? No, and I have been forced to use my credit cards as a result of overspending 6. If you were to die, could your spouse handle the finances? N/A, but I believe Amanda could handle the finances if we do get married. 7. How do you feel about saving for retirement? It is important. 8. If you had an extra $5,000 what would you do with it? Save it for a down payment on a house. 9. How do you feel about taking investment risks? Moderate risk-taker 10. How is your health? Very good. 8 INSURANCE INFORMATION AUTO INSURANCE Jake's parents covered the cost of his auto-insurance while he was in college. Now that he has graduated, he is responsible for paying the S65 per month policy premium. However, if he decides to purchase a new truck, he will have to get higher coverage that will cost $135 per an month RENTER'S INSURANCE Jake does not currently have renter's insurance. If it is decided that this is something he needs, it will cost him $15 per month. LIFE INSURANCE Jake currently has no life insurance. If he buys some, he will have to pay $10 per month for every $100,000 of coverage he purchases. DISABILITY INSURANCE Jake's new employer provides short-term disability insurance as a benefit of employment. MEDICAL INSURANCE Jake was previously covered by his parent's health insurance policy. Not that he has graduated, he is no longer considered their dependent and can no longer be covered under their policy. His employer has provided the following insurance policy options: First Care Blue Cross Premium - One Person $125 $280 Premium - Two Person $300 $495 Premium - Family $450 $750 Calendar year deductible $1,000 SO Out-of-pocket coinsurance maximum $15,000 $12,000 Co-Insurance rate 80% 90% ESTATE PLANNING INFORMATION Jake currently has no estate planning documents in place. LIABILITIES As of June 1, 2016 Current Balance STUDENT LOANS Original Balance Student Loan #1 $12,000 Student Loan #2 $8,500 Student Loan #3 $15,000 Student Loan #4 $2,500 Interest Rate 5.96% 6.55% 6.55% 5.96% $12,793 $8,500 $15,000 $3,307 Payment Amount $142 $97 $171 $37 Total # of Date of First Payments Payment 120 11/1/2016 120 11/1/2016 120 11/1/2016 120 11/1/2016 CREDIT CARDS Annual Interest Fee Rate SO 18% Credit Limit $5,000 Outstanding Balance $4,800 Minimum Payment 3% of balance or $25 Grace Period Visa 30 days 28% $1,000 SO 3% of balance or $25 30 days Sport's Authority | $150 American Express $50 23% $15,000 $1,200 3% of balance or $25 30 days *The Sport's Authority card gives a 2% discount on all sports equipment purchases, and $5 off each month on his gym membership ASSETS As of June 1, 2016 CASH & CASH EQUIVALENTS LOCATION CHECKING Wells Fargo Bank SAVINGS Wells Fargo Bank BALANCE RATE OF INTEREST S224 1.0% $673 1.3% MATURITY N/A N/A AUTOMOBILE(S) Year Make Model Cost 2003 Toyota Corolla $9,000 Current Value $5,200 Outstanding Loan Balance SO REAL & PERSONAL PROPERTY Furniture and Media Equipment Clothing and Jewelry Computers, printer, etc. Exercise Equipment Miscellaneous household items Market Value $ 3,000 $ 750 $ 350 S 8,500 $ 500 Replacement Value $ 6,000 $ 1,000 $ 1,250 $13,100 $8,000 . . Jake does not currently have regular savings built into his cash flow statement to meet his goals. He would like to accomplish all of the following goals in the next few years: Buy a house valued at about $210,000 Buy a new truck valued at $27,000 Establish an emergency fund of $5,000 Start saving for retirement Begin saving for a honeymoon (3 years away) Establish discretionary savings for gift giving and other discretionary spending Maintain his ability to be a competitive triathlete . . . To begin identifying Jake's options in reference to his goals answer the following questions: 1. Analyze Jake's cash flow statement a. Calculate his net worth, asset to debt ratio, investment assets to total assets ratio, liquidity ratio, and debt service to income ratio. b. Are these ratios in an acceptable range for him? If not, suggest strategies to start improving them. c. Create a new budget for Jake by adjusting some of his expenses that you feel are either too high or too low. Be specific about how much he should spend in each category and be sure to justify why you feel this change is worth making. 2. Help Jake save up for a down payment for a house, He figures he will need to have $7,350 for a down payment before he can buy a house. a. Calculate how much Jake must save each month to reach his goal in 12 months, assuming he uses his savings account 3. Help Jake buy a new Toyota Tacoma for $27,000 a. Calculate his monthly truck payment if he can get a loan with an interest rate of 2.5% over 72 months. b. Calculate his other costs of buying the truck. If he buys the truck his auto insurance will increase to $135 per month, but his auto maintenance expenses will fall to approximately $220 per month Can Jake afford to buy the truck with his current budget? Explain what he might have to sacrifice in order to afford the truck. EXPENSES Cash Flow Monthly Cash Flow Annually $900 120 578 351 40 120 160 250 65 $10,800 1,440 6,936 4,212 480 1,440 1,920 3.000 780 Fixed Expenses Rent Utilities Federal Income Tax withholding Social Security Tax (FICA) withholding Cell Phone Cable TV and Internet Groceries Auto maintenance (gas, repairs, etc.) Auto Insurance Health Insurance Premiums Credit Card Fees Visa Minimum Payment Sport's Authority Minimum Payment American Express Minimum Payment Education loan payments Total Fixed Expenses Variable Expenses Medical/dental expenses Food away from home Clothing Personal Care Appliances, Furniture, and Equipment Entertainment Travel for Triathlons Gym Membership (with CC discount) Fitness Trainer Total Variable Expenses Total 16 144 0 36 447 3.227 200 1,728 0 432 5,364 38,732 25 200 60 60 300 2,400 720 720 80 167 45 120 757 $3,984 960 2,004 540 1,440 9,084 S47,816 FINANCIAL GOALS Establish a cash management plan Incorporate a comparison of debt payoff vs savings decisions Debt payoff includes: student loans and credit cards Savings includes: emergency (min. $5,000 preferred), honeymoon, gifts, and retirement Obtain adequate insurance Consider life, medical, disability, and property coverage Make a decision about major life purchases When and how to buy a house and new truck Make sure necessary estate planning documents are in place Consider medical directives, powers of attorney, and a will What is your single most important financial objective at this time? To make sure I am saving in a way that will allow me to meet my short and intermediate term goals. FINANCIAL PRIORITIES Jake a. LIVING: paying monthly bills 1 b. PLEASURE: spending money c. SAVING: invest in future 2 d. DISABILITY:protect against 5 e. DEATH: care for family f. REDUCE TAXES: spend to save g. INVESTING: accumulating assets h. CHILDREN: starting a family * Prioritized with 1 being most important and 8 being least important OTHER INFORMATION 1. Are you able to save regularly? I do not currently save, but believe I will be able to save from my earnings at my new job. 2. How much do you save annually? NA 3. Do you invest regularly? I currently have no investment experience, but am interested in investing for retirement. 4. Do you feel you are financially organized? Not really 5. Do you budget your money? No, and I have been forced to use my credit cards as a result of overspending 6. If you were to die, could your spouse handle the finances? N/A, but I believe Amanda could handle the finances if we do get married. 7. How do you feel about saving for retirement? It is important. 8. If you had an extra $5,000 what would you do with it? Save it for a down payment on a house. 9. How do you feel about taking investment risks? Moderate risk-taker 10. How is your health? Very good. 8 INSURANCE INFORMATION AUTO INSURANCE Jake's parents covered the cost of his auto-insurance while he was in college. Now that he has graduated, he is responsible for paying the S65 per month policy premium. However, if he decides to purchase a new truck, he will have to get higher coverage that will cost $135 per an month RENTER'S INSURANCE Jake does not currently have renter's insurance. If it is decided that this is something he needs, it will cost him $15 per month. LIFE INSURANCE Jake currently has no life insurance. If he buys some, he will have to pay $10 per month for every $100,000 of coverage he purchases. DISABILITY INSURANCE Jake's new employer provides short-term disability insurance as a benefit of employment. MEDICAL INSURANCE Jake was previously covered by his parent's health insurance policy. Not that he has graduated, he is no longer considered their dependent and can no longer be covered under their policy. His employer has provided the following insurance policy options: First Care Blue Cross Premium - One Person $125 $280 Premium - Two Person $300 $495 Premium - Family $450 $750 Calendar year deductible $1,000 SO Out-of-pocket coinsurance maximum $15,000 $12,000 Co-Insurance rate 80% 90% ESTATE PLANNING INFORMATION Jake currently has no estate planning documents in place. LIABILITIES As of June 1, 2016 Current Balance STUDENT LOANS Original Balance Student Loan #1 $12,000 Student Loan #2 $8,500 Student Loan #3 $15,000 Student Loan #4 $2,500 Interest Rate 5.96% 6.55% 6.55% 5.96% $12,793 $8,500 $15,000 $3,307 Payment Amount $142 $97 $171 $37 Total # of Date of First Payments Payment 120 11/1/2016 120 11/1/2016 120 11/1/2016 120 11/1/2016 CREDIT CARDS Annual Interest Fee Rate SO 18% Credit Limit $5,000 Outstanding Balance $4,800 Minimum Payment 3% of balance or $25 Grace Period Visa 30 days 28% $1,000 SO 3% of balance or $25 30 days Sport's Authority | $150 American Express $50 23% $15,000 $1,200 3% of balance or $25 30 days *The Sport's Authority card gives a 2% discount on all sports equipment purchases, and $5 off each month on his gym membership ASSETS As of June 1, 2016 CASH & CASH EQUIVALENTS LOCATION CHECKING Wells Fargo Bank SAVINGS Wells Fargo Bank BALANCE RATE OF INTEREST S224 1.0% $673 1.3% MATURITY N/A N/A AUTOMOBILE(S) Year Make Model Cost 2003 Toyota Corolla $9,000 Current Value $5,200 Outstanding Loan Balance SO REAL & PERSONAL PROPERTY Furniture and Media Equipment Clothing and Jewelry Computers, printer, etc. Exercise Equipment Miscellaneous household items Market Value $ 3,000 $ 750 $ 350 S 8,500 $ 500 Replacement Value $ 6,000 $ 1,000 $ 1,250 $13,100 $8,000