Question

4.. I need the solution, the full, correct solution!I will give a thumbs up! Suppose that you own a land development company. You have the

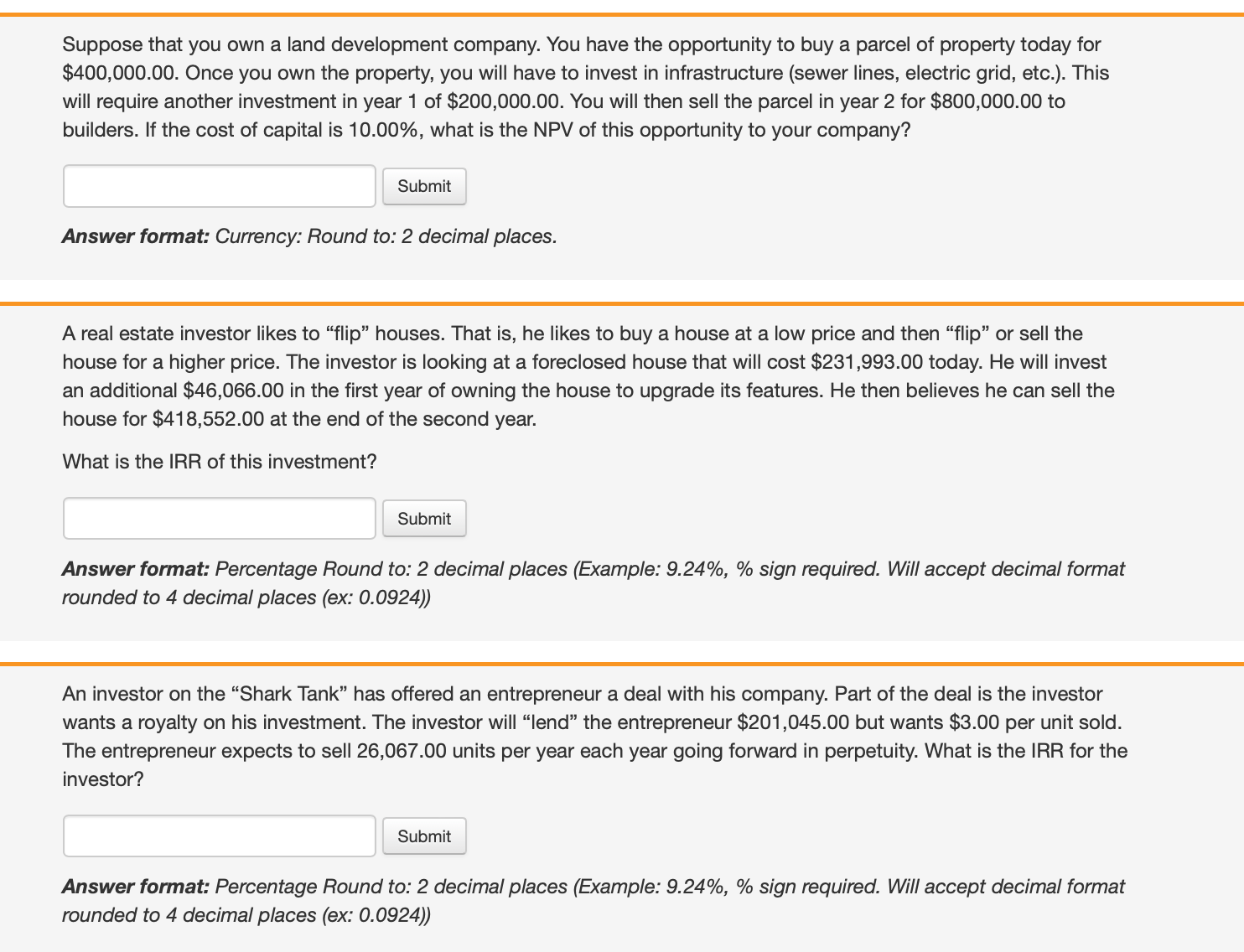

4.. I need the solution, the full, correct solution!I will give a thumbs up!  Suppose that you own a land development company. You have the opportunity to buy a parcel of property today for $400,000.00. Once you own the property, you will have to invest in infrastructure (sewer lines, electric grid, etc.). This will require another investment in year 1 of $200,000.00. You will then sell the parcel in year 2 for $800,000.00 to builders. If the cost of capital is 10.00%, what is the NPV of this opportunity to your company? Answer format: Currency: Round to: 2 decimal places. A real estate investor likes to "flip" houses. That is, he likes to buy a house at a low price and then "flip" or sell the house for a higher price. The investor is looking at a foreclosed house that will cost \$231,993.00 today. He will invest an additional $46,066.00 in the first year of owning the house to upgrade its features. He then believes he can sell the house for $418,552.00 at the end of the second year. What is the IRR of this investment? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) An investor on the "Shark Tank" has offered an entrepreneur a deal with his company. Part of the deal is the investor wants a royalty on his investment. The investor will "lend" the entrepreneur $201,045.00 but wants $3.00 per unit sold. The entrepreneur expects to sell 26,067.00 units per year each year going forward in perpetuity. What is the IRR for the investor? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

Suppose that you own a land development company. You have the opportunity to buy a parcel of property today for $400,000.00. Once you own the property, you will have to invest in infrastructure (sewer lines, electric grid, etc.). This will require another investment in year 1 of $200,000.00. You will then sell the parcel in year 2 for $800,000.00 to builders. If the cost of capital is 10.00%, what is the NPV of this opportunity to your company? Answer format: Currency: Round to: 2 decimal places. A real estate investor likes to "flip" houses. That is, he likes to buy a house at a low price and then "flip" or sell the house for a higher price. The investor is looking at a foreclosed house that will cost \$231,993.00 today. He will invest an additional $46,066.00 in the first year of owning the house to upgrade its features. He then believes he can sell the house for $418,552.00 at the end of the second year. What is the IRR of this investment? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) An investor on the "Shark Tank" has offered an entrepreneur a deal with his company. Part of the deal is the investor wants a royalty on his investment. The investor will "lend" the entrepreneur $201,045.00 but wants $3.00 per unit sold. The entrepreneur expects to sell 26,067.00 units per year each year going forward in perpetuity. What is the IRR for the investor? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started