Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. If the risk-free rate goes down today, what do you expect to happen to the Sharpe Ratio of the tangency portfolio? (a) The Sharpe

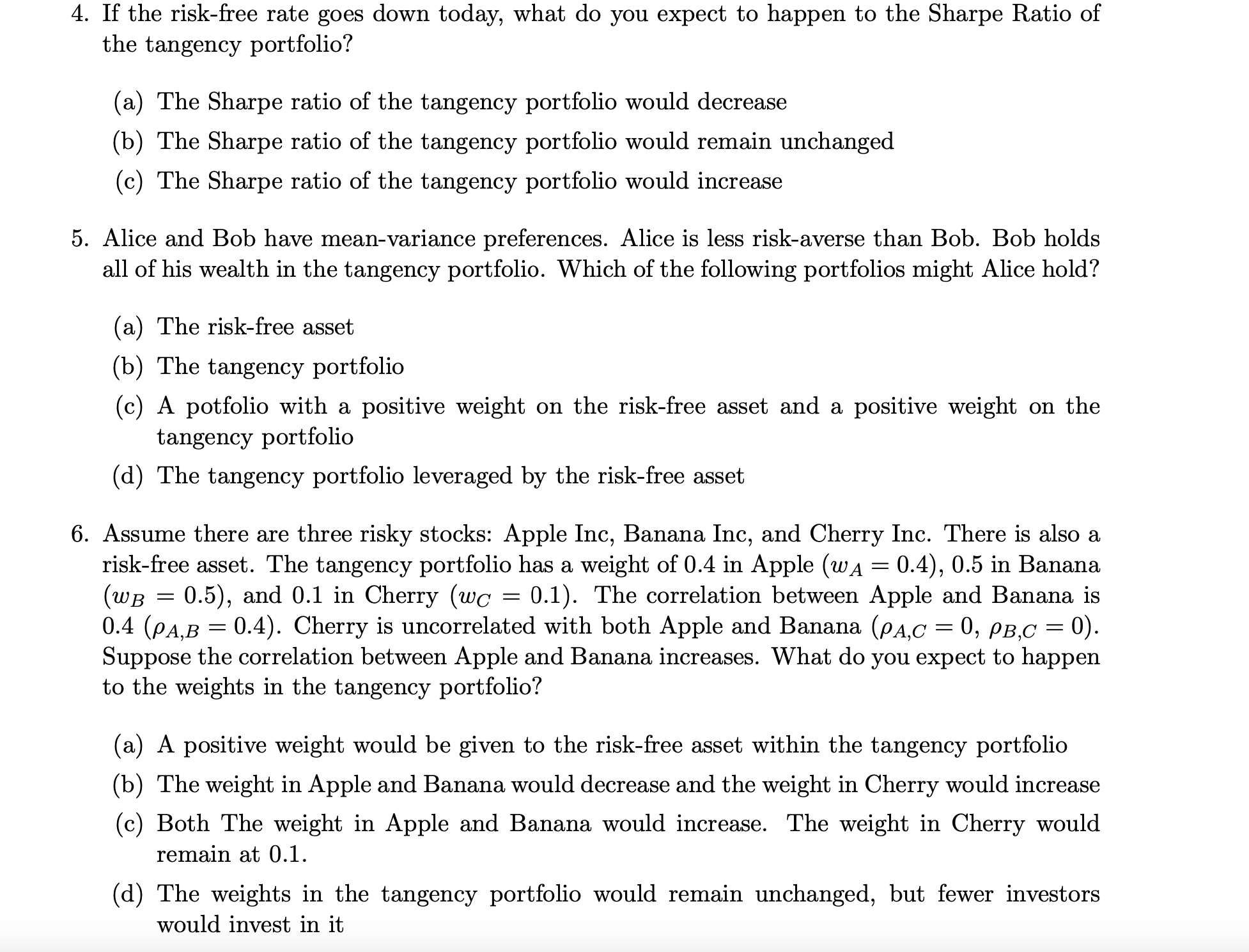

4. If the risk-free rate goes down today, what do you expect to happen to the Sharpe Ratio of the tangency portfolio? (a) The Sharpe ratio of the tangency portfolio would decrease (b) The Sharpe ratio of the tangency portfolio would remain unchanged (c) The Sharpe ratio of the tangency portfolio would increase 5. Alice and Bob have mean-variance preferences. Alice is less risk-averse than Bob. Bob holds all of his wealth in the tangency portfolio. Which of the following portfolios might Alice hold? (a) The risk-free asset (b) The tangency portfolio (c) A potfolio with a positive weight on the risk-free asset and a positive weight on the tangency portfolio (d) The tangency portfolio leveraged by the risk-free asset 6. Assume there are three risky stocks: Apple Inc, Banana Inc, and Cherry Inc. There is also a risk-free asset. The tangency portfolio has a weight of 0.4 in Apple (wA=0.4),0.5 in Banana (wB=0.5), and 0.1 in Cherry (wC=0.1). The correlation between Apple and Banana is 0.4(A,B=0.4). Cherry is uncorrelated with both Apple and Banana (A,C=0,B,C=0). Suppose the correlation between Apple and Banana increases. What do you expect to happen to the weights in the tangency portfolio? (a) A positive weight would be given to the risk-free asset within the tangency portfolio (b) The weight in Apple and Banana would decrease and the weight in Cherry would increase (c) Both The weight in Apple and Banana would increase. The weight in Cherry would remain at 0.1 . (d) The weights in the tangency portfolio would remain unchanged, but fewer investors would invest in it

4. If the risk-free rate goes down today, what do you expect to happen to the Sharpe Ratio of the tangency portfolio? (a) The Sharpe ratio of the tangency portfolio would decrease (b) The Sharpe ratio of the tangency portfolio would remain unchanged (c) The Sharpe ratio of the tangency portfolio would increase 5. Alice and Bob have mean-variance preferences. Alice is less risk-averse than Bob. Bob holds all of his wealth in the tangency portfolio. Which of the following portfolios might Alice hold? (a) The risk-free asset (b) The tangency portfolio (c) A potfolio with a positive weight on the risk-free asset and a positive weight on the tangency portfolio (d) The tangency portfolio leveraged by the risk-free asset 6. Assume there are three risky stocks: Apple Inc, Banana Inc, and Cherry Inc. There is also a risk-free asset. The tangency portfolio has a weight of 0.4 in Apple (wA=0.4),0.5 in Banana (wB=0.5), and 0.1 in Cherry (wC=0.1). The correlation between Apple and Banana is 0.4(A,B=0.4). Cherry is uncorrelated with both Apple and Banana (A,C=0,B,C=0). Suppose the correlation between Apple and Banana increases. What do you expect to happen to the weights in the tangency portfolio? (a) A positive weight would be given to the risk-free asset within the tangency portfolio (b) The weight in Apple and Banana would decrease and the weight in Cherry would increase (c) Both The weight in Apple and Banana would increase. The weight in Cherry would remain at 0.1 . (d) The weights in the tangency portfolio would remain unchanged, but fewer investors would invest in it Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started