Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. In early 2021, Alejandra decided to renovate Belleza's waiting room. On May 10 , she spent $10,400 for new chairs, a sofa, various lamps,

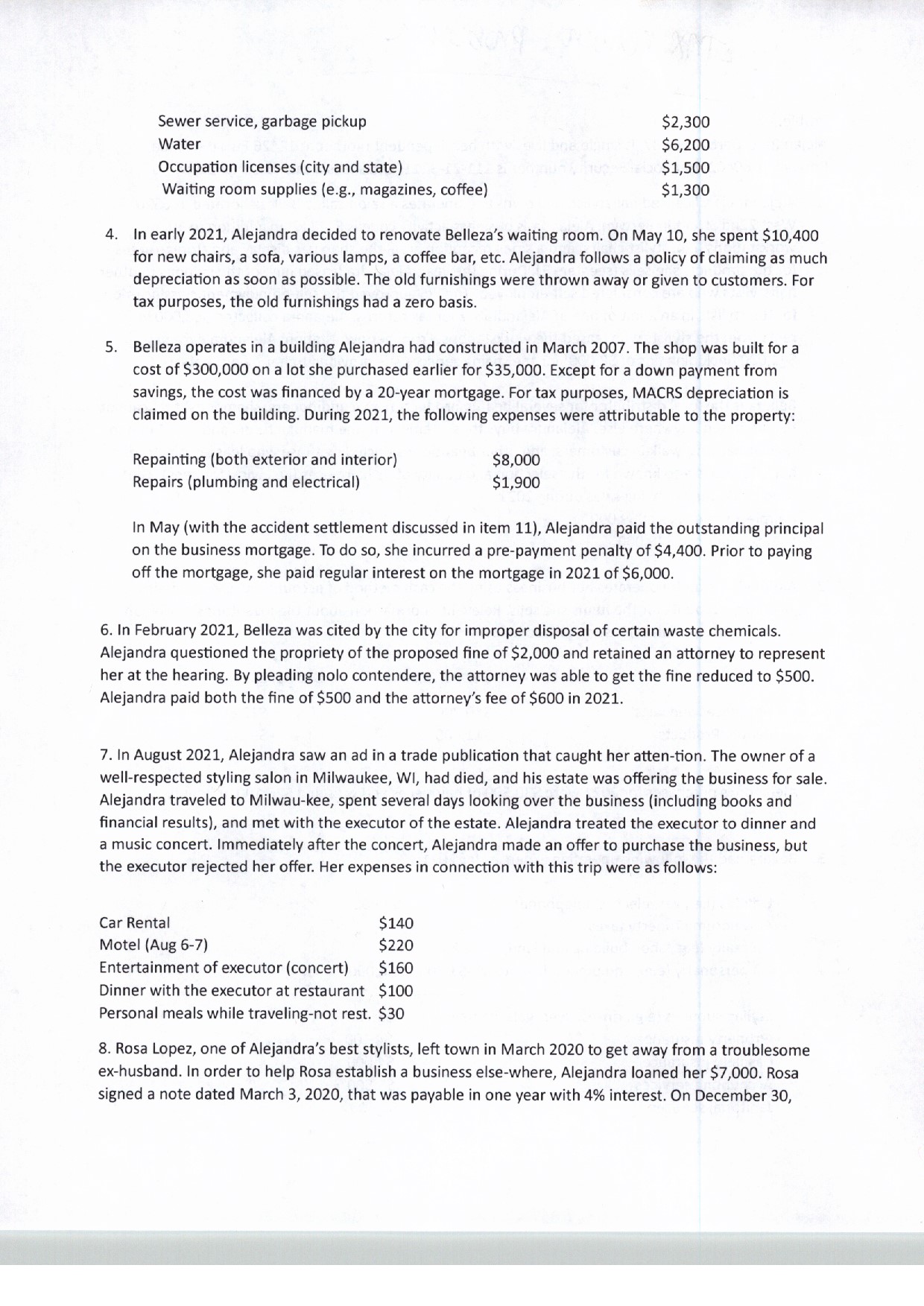

4. In early 2021, Alejandra decided to renovate Belleza's waiting room. On May 10 , she spent $10,400 for new chairs, a sofa, various lamps, a coffee bar, etc. Alejandra follows a policy of claiming as much depreciation as soon as possible. The old furnishings were thrown away or given to customers. For tax purposes, the old furnishings had a zero basis. 5. Belleza operates in a building Alejandra had constructed in March 2007. The shop was built for a cost of $300,000 on a lot she purchased earlier for $35,000. Except for a down payment from savings, the cost was financed by a 20-year mortgage. For tax purposes, MACRS depreciation is claimed on the building. During 2021, the following expenses were attributable to the property: In May (with the accident settlement discussed in item 11), Alejandra paid the outstanding principal on the business mortgage. To do so, she incurred a pre-payment penalty of $4,400. Prior to paying off the mortgage, she paid regular interest on the mortgage in 2021 of $6,000. 6. In February 2021, Belleza was cited by the city for improper disposal of certain waste chemicals. Alejandra questioned the propriety of the proposed fine of $2,000 and retained an attorney to represent her at the hearing. By pleading nolo contendere, the attorney was able to get the fine reduced to $500. Alejandra paid both the fine of $500 and the attorney's fee of $600 in 2021. 7. In August 2021, Alejandra saw an ad in a trade publication that caught her atten-tion. The owner of a well-respected styling salon in Milwaukee, WI, had died, and his estate was offering the business for sale. Alejandra traveled to Milwau-kee, spent several days looking over the business (including books and financial results), and met with the executor of the estate. Alejandra treated the executor to dinner and a music concert. Immediately after the concert, Alejandra made an offer to purchase the business, but the executor rejected her offer. Her expenses in connection with this trip were as follows: 8. Rosa Lopez, one of Alejandra's best stylists, left town in March 2020 to get away from a troublesome ex-husband. In order to help Rosa establish a business else-where, Alejandra loaned her $7,000. Rosa signed a note dated March 3, 2020, that was payable in one year with 4% interest. On December 30 , 4. In early 2021, Alejandra decided to renovate Belleza's waiting room. On May 10 , she spent $10,400 for new chairs, a sofa, various lamps, a coffee bar, etc. Alejandra follows a policy of claiming as much depreciation as soon as possible. The old furnishings were thrown away or given to customers. For tax purposes, the old furnishings had a zero basis. 5. Belleza operates in a building Alejandra had constructed in March 2007. The shop was built for a cost of $300,000 on a lot she purchased earlier for $35,000. Except for a down payment from savings, the cost was financed by a 20-year mortgage. For tax purposes, MACRS depreciation is claimed on the building. During 2021, the following expenses were attributable to the property: In May (with the accident settlement discussed in item 11), Alejandra paid the outstanding principal on the business mortgage. To do so, she incurred a pre-payment penalty of $4,400. Prior to paying off the mortgage, she paid regular interest on the mortgage in 2021 of $6,000. 6. In February 2021, Belleza was cited by the city for improper disposal of certain waste chemicals. Alejandra questioned the propriety of the proposed fine of $2,000 and retained an attorney to represent her at the hearing. By pleading nolo contendere, the attorney was able to get the fine reduced to $500. Alejandra paid both the fine of $500 and the attorney's fee of $600 in 2021. 7. In August 2021, Alejandra saw an ad in a trade publication that caught her atten-tion. The owner of a well-respected styling salon in Milwaukee, WI, had died, and his estate was offering the business for sale. Alejandra traveled to Milwau-kee, spent several days looking over the business (including books and financial results), and met with the executor of the estate. Alejandra treated the executor to dinner and a music concert. Immediately after the concert, Alejandra made an offer to purchase the business, but the executor rejected her offer. Her expenses in connection with this trip were as follows: 8. Rosa Lopez, one of Alejandra's best stylists, left town in March 2020 to get away from a troublesome ex-husband. In order to help Rosa establish a business else-where, Alejandra loaned her $7,000. Rosa signed a note dated March 3, 2020, that was payable in one year with 4% interest. On December 30

4. In early 2021, Alejandra decided to renovate Belleza's waiting room. On May 10 , she spent $10,400 for new chairs, a sofa, various lamps, a coffee bar, etc. Alejandra follows a policy of claiming as much depreciation as soon as possible. The old furnishings were thrown away or given to customers. For tax purposes, the old furnishings had a zero basis. 5. Belleza operates in a building Alejandra had constructed in March 2007. The shop was built for a cost of $300,000 on a lot she purchased earlier for $35,000. Except for a down payment from savings, the cost was financed by a 20-year mortgage. For tax purposes, MACRS depreciation is claimed on the building. During 2021, the following expenses were attributable to the property: In May (with the accident settlement discussed in item 11), Alejandra paid the outstanding principal on the business mortgage. To do so, she incurred a pre-payment penalty of $4,400. Prior to paying off the mortgage, she paid regular interest on the mortgage in 2021 of $6,000. 6. In February 2021, Belleza was cited by the city for improper disposal of certain waste chemicals. Alejandra questioned the propriety of the proposed fine of $2,000 and retained an attorney to represent her at the hearing. By pleading nolo contendere, the attorney was able to get the fine reduced to $500. Alejandra paid both the fine of $500 and the attorney's fee of $600 in 2021. 7. In August 2021, Alejandra saw an ad in a trade publication that caught her atten-tion. The owner of a well-respected styling salon in Milwaukee, WI, had died, and his estate was offering the business for sale. Alejandra traveled to Milwau-kee, spent several days looking over the business (including books and financial results), and met with the executor of the estate. Alejandra treated the executor to dinner and a music concert. Immediately after the concert, Alejandra made an offer to purchase the business, but the executor rejected her offer. Her expenses in connection with this trip were as follows: 8. Rosa Lopez, one of Alejandra's best stylists, left town in March 2020 to get away from a troublesome ex-husband. In order to help Rosa establish a business else-where, Alejandra loaned her $7,000. Rosa signed a note dated March 3, 2020, that was payable in one year with 4% interest. On December 30 , 4. In early 2021, Alejandra decided to renovate Belleza's waiting room. On May 10 , she spent $10,400 for new chairs, a sofa, various lamps, a coffee bar, etc. Alejandra follows a policy of claiming as much depreciation as soon as possible. The old furnishings were thrown away or given to customers. For tax purposes, the old furnishings had a zero basis. 5. Belleza operates in a building Alejandra had constructed in March 2007. The shop was built for a cost of $300,000 on a lot she purchased earlier for $35,000. Except for a down payment from savings, the cost was financed by a 20-year mortgage. For tax purposes, MACRS depreciation is claimed on the building. During 2021, the following expenses were attributable to the property: In May (with the accident settlement discussed in item 11), Alejandra paid the outstanding principal on the business mortgage. To do so, she incurred a pre-payment penalty of $4,400. Prior to paying off the mortgage, she paid regular interest on the mortgage in 2021 of $6,000. 6. In February 2021, Belleza was cited by the city for improper disposal of certain waste chemicals. Alejandra questioned the propriety of the proposed fine of $2,000 and retained an attorney to represent her at the hearing. By pleading nolo contendere, the attorney was able to get the fine reduced to $500. Alejandra paid both the fine of $500 and the attorney's fee of $600 in 2021. 7. In August 2021, Alejandra saw an ad in a trade publication that caught her atten-tion. The owner of a well-respected styling salon in Milwaukee, WI, had died, and his estate was offering the business for sale. Alejandra traveled to Milwau-kee, spent several days looking over the business (including books and financial results), and met with the executor of the estate. Alejandra treated the executor to dinner and a music concert. Immediately after the concert, Alejandra made an offer to purchase the business, but the executor rejected her offer. Her expenses in connection with this trip were as follows: 8. Rosa Lopez, one of Alejandra's best stylists, left town in March 2020 to get away from a troublesome ex-husband. In order to help Rosa establish a business else-where, Alejandra loaned her $7,000. Rosa signed a note dated March 3, 2020, that was payable in one year with 4% interest. On December 30 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started