Answered step by step

Verified Expert Solution

Question

1 Approved Answer

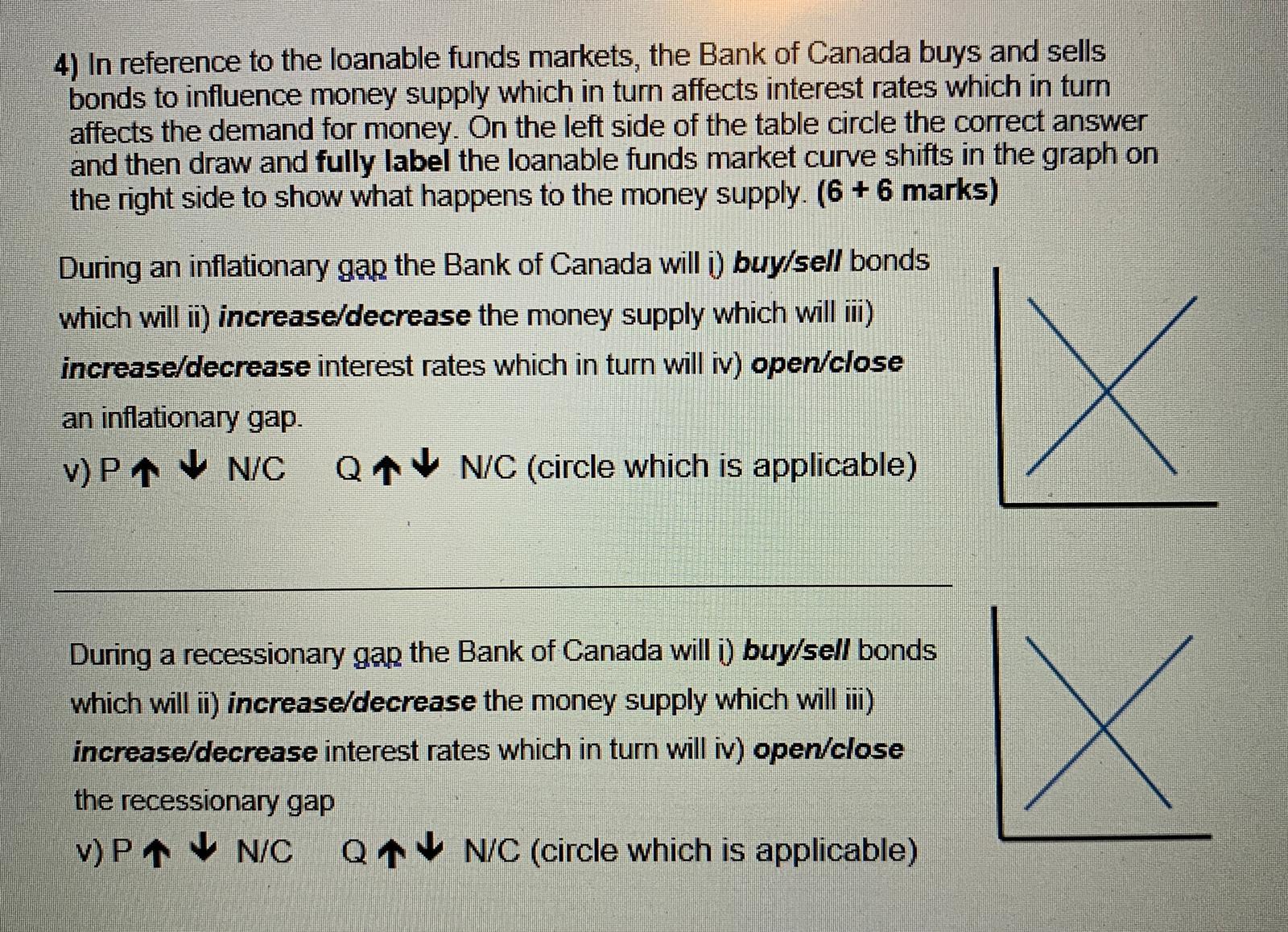

4) In reference to the loanable funds markets, the Bank of Canada buys and sells bonds to influence money supply which in turn affects

4) In reference to the loanable funds markets, the Bank of Canada buys and sells bonds to influence money supply which in turn affects interest rates which in turn affects the demand for money. On the left side of the table circle the correct answer and then draw and fully label the loanable funds market curve shifts in the graph on the right side to show what happens to the money supply. (6 + 6 marks) During an inflationary gap the Bank of Canada will i) buy/sell bonds which will ii) increase/decrease the money supply which will i) increase/decrease interest rates which in turn will iv) open/close an inflationary gap. v) P1 V N/C QV N/C (circle which is applicable) During a recessionary gap the Bank of Canada will i) buy/sell bonds which will ii) increase/decrease the money supply which will ii) increase/decrease interest rates which in turn will iv) open/close the recessionary gap v) P V N/C QV N/C (circle which is applicable)

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Loanable fund market is the market where funds will be mobilized from the surplus economic unit to t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started