Answered step by step

Verified Expert Solution

Question

1 Approved Answer

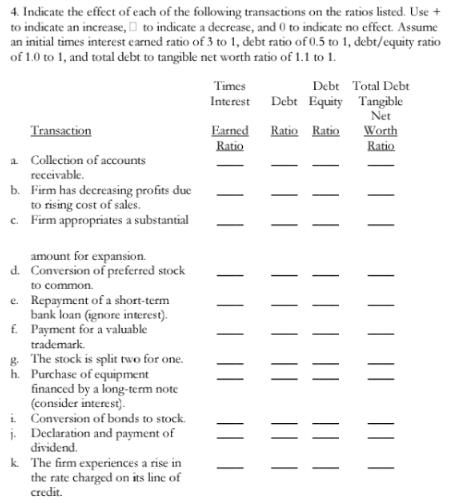

4. Indicate the effect of each of the following transactions on the ratios listed. Use + to indicate an increase, D to indicate a

4. Indicate the effect of each of the following transactions on the ratios listed. Use + to indicate an increase, D to indicate a decrease, and 0 to indicate no effect. Assume an initial times interest earned ratio of 3 to 1, debt ratio of 0.5 to 1, debt/equity ratio of 1.0 to 1, and total debt to tangible net worth ratio of 1.1 to 1. Times Debt Total Debt Interest Debt Equity Tangible Net Worth Ratio Transaction Earned Ratio Ratio Ratio a Collection of accounts receivable. b. Firm has decreasing profits due to rising cost of sales. c. Firm appropriates a substantial amount for expansion. d. Conversion of preferred stock to common. e. Repayment of a short-term bank loan (gnore interest). E Payment for a valuable trademark. g. The stock is split two for one. h. Purchase of equipment financed by a long-term note (consider interest). i Conversion of bonds to stock. j. Declaration and payment of dividend. k The firm experiences a rise in the rate charged on its line of credit.

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a Collection of accounts receivable 0 0 0 0 b Firm has dec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started