Answered step by step

Verified Expert Solution

Question

1 Approved Answer

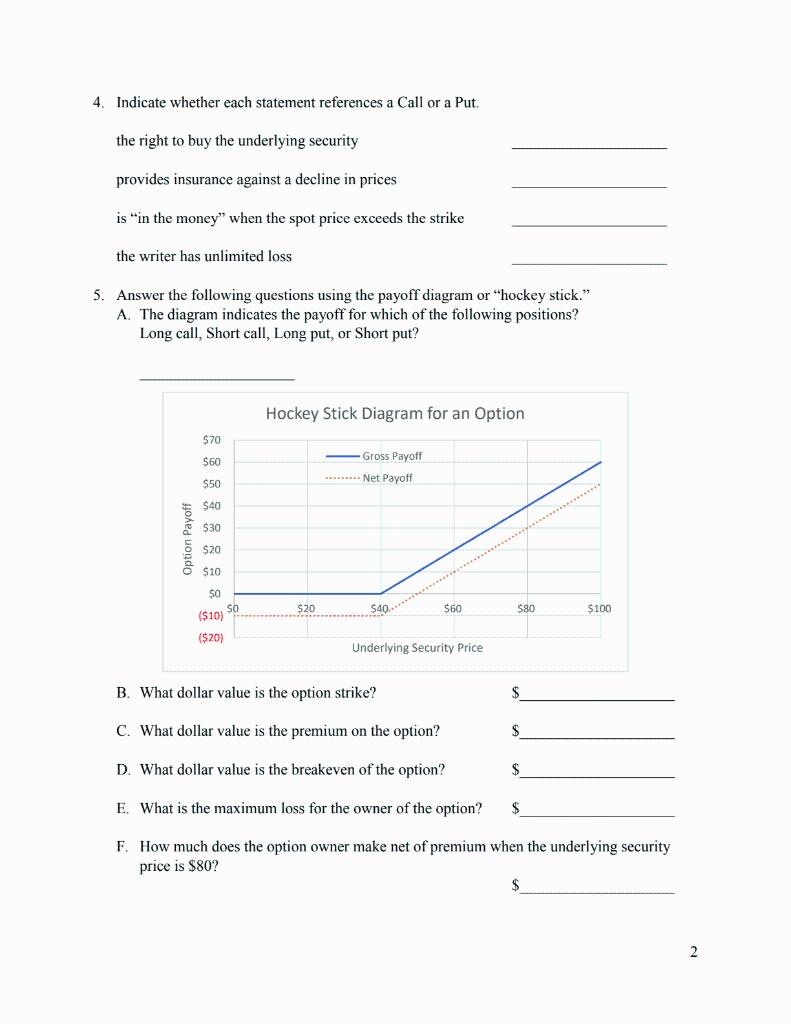

4. Indicate whether each statement references a Call or a Put. the right to buy the underlying security provides insurance against a decline in

4. Indicate whether each statement references a Call or a Put. the right to buy the underlying security provides insurance against a decline in prices is "in the money" when the spot price exceeds the strike the writer has unlimited loss 5. Answer the following questions using the payoff diagram or "hockey stick." A. The diagram indicates the payoff for which of the following positions? Long call, Short call, Long put, or Short put? Option Payoff $70 $60 $50 $40 $30 $20 $10 $0 ($10) ($20) so Hockey Stick Diagram for an Option $20 Gross Payoff ......... Net Payoff $40 $60 Underlying Security Price $80 B. What dollar value is the option strike? C. What dollar value is the premium on the option? D. What dollar value is the breakeven of the option? E. What is the maximum loss for the owner of the option? F. How much does the option owner make net of premium when the underlying security price is $80? $ $ $100 $ 2

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Lets address the first set of statements and then analyze the payoff diagram 4 Indicate whether each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started