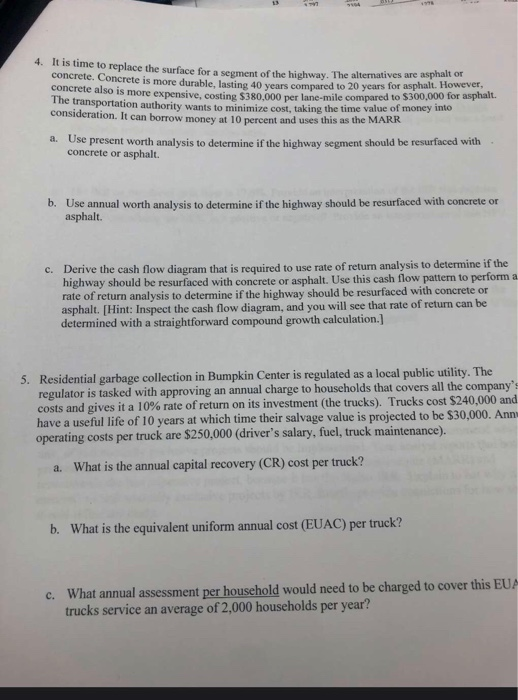

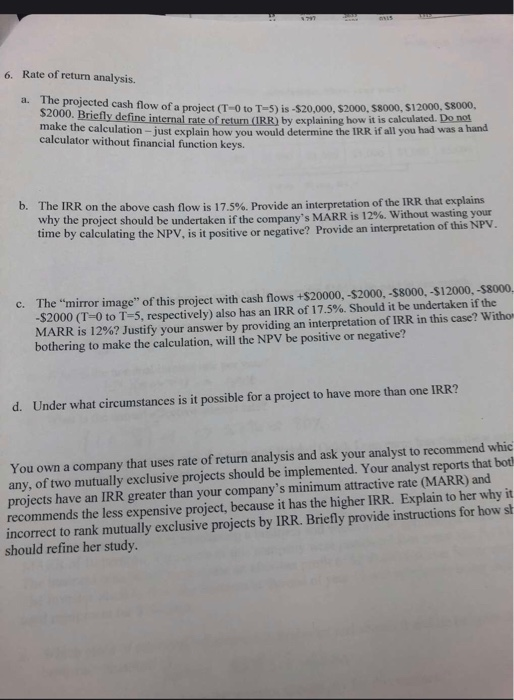

4. It is time to replace the surface for a segment of the highway. The alternatives are concrete. Concrete is more durable lasting 40 years compared to 20 years for asphalt. However ment of the highway. The alternatives are asphalt or concrete also is more expensive also is more expensive, costing $380.000 ner Lane-mile compared to $300,000 for asphalt. The transportation authority wants to minimize cost taking the time value of money into consideration. It can borrow money at 10 percent and uses this as the MARR a. Use present worth analysis to determine if the highway seament should be resurfaced with concrete or asphalt. b. Use annual worth analysis to determine if the highway should be resurfaced with concrete or asphalt. c. Derive the cash flow diagram that is required to use rate of return analysis to determine if the highway should be resurfaced with concrete or asphalt. Use this cash flow patter to perform a rate of return analysis to determine if the highway should be resurfaced with concrete or asphalt. (Hint: Inspect the cash flow diagram, and you will see that rate of return can be determined with a straightforward compound growth calculation. 5. Residential garbage collection in Bumpkin Center is regulated as a local public utility. The regulator is tasked with approving an annual charge to households that covers all the company's costs and gives it a 10% rate of return on its investment (the trucks). Trucks cost $240,000 and have a useful life of 10 years at which time their salvage value is projected to be $30,000. Anni operating costs per truck are $250,000 (driver's salary, fuel, truck maintenance). a. What is the annual capital recovery (CR) cost per truck? b. What is the equivalent uniform annual cost (EUAC) per truck? c. What annual assessment per household would need to be charged to cover this EUA trucks service an average of 2.000 households per year? 6. Rate of return analysis. a. The projected cash fl projected cash flow of a proiect (T-Oto T-5) is $20.000. S2000. $8000, $12000, 8000, S2000. Briefly define internal rate of return (IRR) by explaining how it is calculated. volini basit is calculated. Do not make the calculation - just explain how you would determine the IRR if all you had was a hand calculator without financial function keys. b. The IRR on the above cash flow is 17.5%. Provide an interpretation of the IRR that explains why the project should be undertaken if the company's MARR is 12%. Without wasting your time by calculating the NPV, is it positive or negative? Provide an interpretation of this NPV. c. The "mirror image of this project with cash flows +$20000,-$2000,-$8000, -$12000,-$8000. -S2000 (T=0 to T-5, respectively) also has an IRR of 17.5%. Should it be undertaken if the MARR is 12%? Justify your answer by providing an interpretation of IRR in this case? Withor bothering to make the calculation, will the NPV be positive or negative? d. Under what circumstances is it possible for a project to have more than one IRR? You own a company that uses rate of return analysis and ask your analyst to recommend whic any, of two mutually exclusive projects should be implemented. Your analyst reports that both projects have an IRR greater than your company's minimum attractive rate (MARR) and recommends the less expensive project, because it has the higher IRR. Explain to her why it incorrect to rank mutually exclusive projects by IRR. Briefly provide instructions for how st should refine her study. 4. It is time to replace the surface for a segment of the highway. The alternatives are concrete. Concrete is more durable lasting 40 years compared to 20 years for asphalt. However ment of the highway. The alternatives are asphalt or concrete also is more expensive also is more expensive, costing $380.000 ner Lane-mile compared to $300,000 for asphalt. The transportation authority wants to minimize cost taking the time value of money into consideration. It can borrow money at 10 percent and uses this as the MARR a. Use present worth analysis to determine if the highway seament should be resurfaced with concrete or asphalt. b. Use annual worth analysis to determine if the highway should be resurfaced with concrete or asphalt. c. Derive the cash flow diagram that is required to use rate of return analysis to determine if the highway should be resurfaced with concrete or asphalt. Use this cash flow patter to perform a rate of return analysis to determine if the highway should be resurfaced with concrete or asphalt. (Hint: Inspect the cash flow diagram, and you will see that rate of return can be determined with a straightforward compound growth calculation. 5. Residential garbage collection in Bumpkin Center is regulated as a local public utility. The regulator is tasked with approving an annual charge to households that covers all the company's costs and gives it a 10% rate of return on its investment (the trucks). Trucks cost $240,000 and have a useful life of 10 years at which time their salvage value is projected to be $30,000. Anni operating costs per truck are $250,000 (driver's salary, fuel, truck maintenance). a. What is the annual capital recovery (CR) cost per truck? b. What is the equivalent uniform annual cost (EUAC) per truck? c. What annual assessment per household would need to be charged to cover this EUA trucks service an average of 2.000 households per year? 6. Rate of return analysis. a. The projected cash fl projected cash flow of a proiect (T-Oto T-5) is $20.000. S2000. $8000, $12000, 8000, S2000. Briefly define internal rate of return (IRR) by explaining how it is calculated. volini basit is calculated. Do not make the calculation - just explain how you would determine the IRR if all you had was a hand calculator without financial function keys. b. The IRR on the above cash flow is 17.5%. Provide an interpretation of the IRR that explains why the project should be undertaken if the company's MARR is 12%. Without wasting your time by calculating the NPV, is it positive or negative? Provide an interpretation of this NPV. c. The "mirror image of this project with cash flows +$20000,-$2000,-$8000, -$12000,-$8000. -S2000 (T=0 to T-5, respectively) also has an IRR of 17.5%. Should it be undertaken if the MARR is 12%? Justify your answer by providing an interpretation of IRR in this case? Withor bothering to make the calculation, will the NPV be positive or negative? d. Under what circumstances is it possible for a project to have more than one IRR? You own a company that uses rate of return analysis and ask your analyst to recommend whic any, of two mutually exclusive projects should be implemented. Your analyst reports that both projects have an IRR greater than your company's minimum attractive rate (MARR) and recommends the less expensive project, because it has the higher IRR. Explain to her why it incorrect to rank mutually exclusive projects by IRR. Briefly provide instructions for how st should refine her study