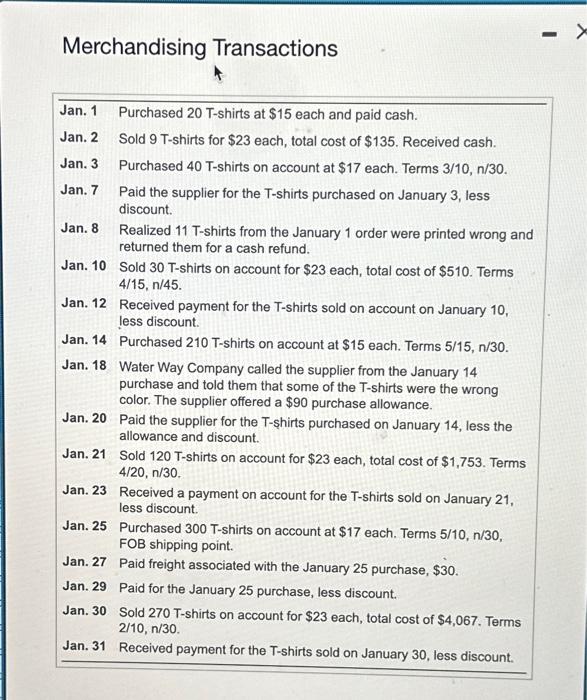

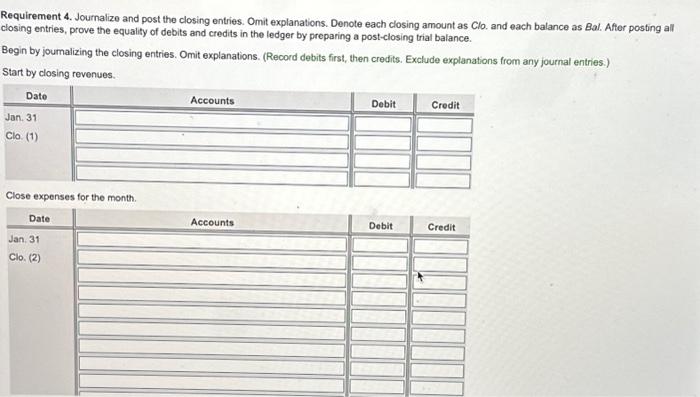

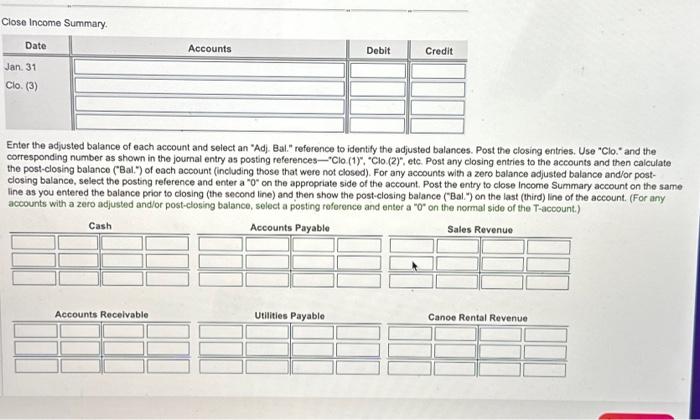

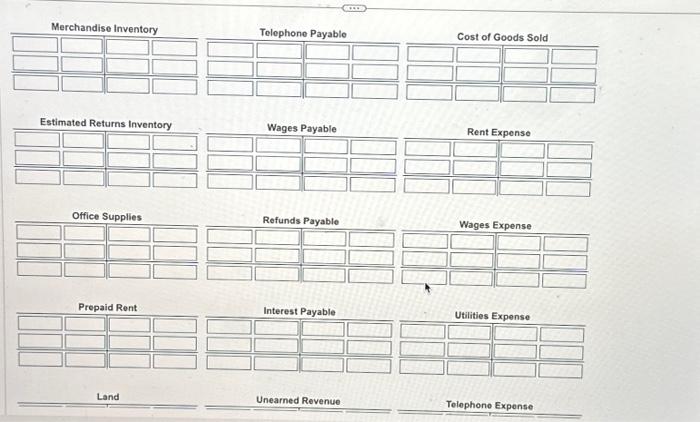

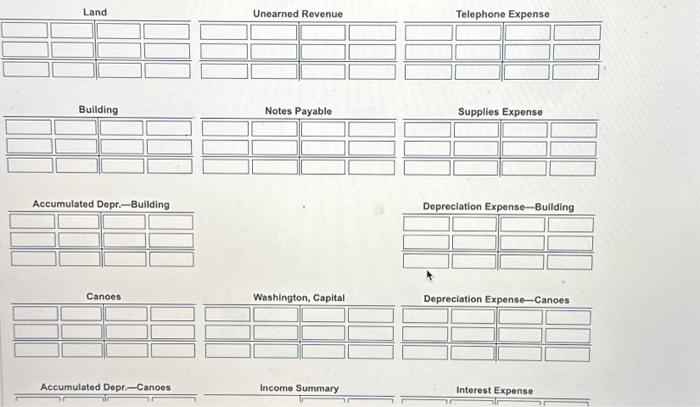

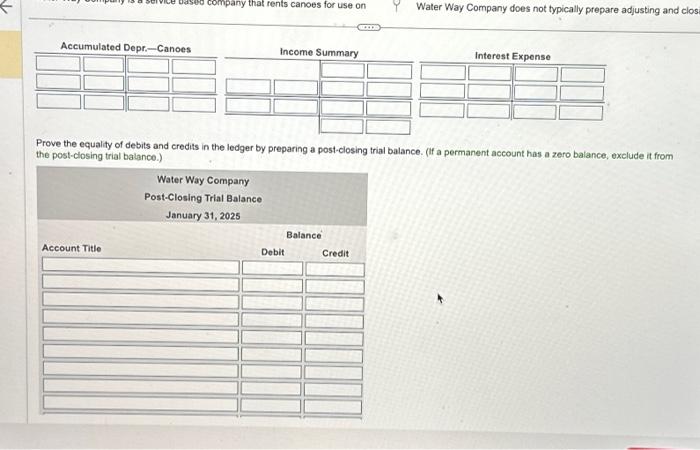

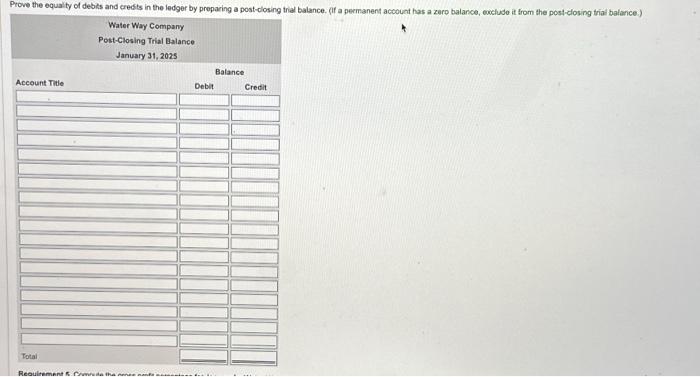

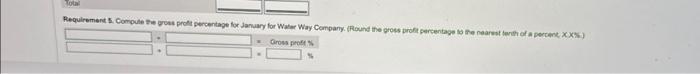

4. Journalize and post the closing entries. Omit explanations. Denote each closing amount as Clo. and each balance as Bal. After posting all clsing entries, prove the equality of debits and credits in the ledger by preparing a post-ciosing trial balance. 5. Compute the gross profit percentage for January for Water Way Company. Merchandising Transactions Jan. 1 Purchased 20 T-shirts at \$15 each and paid cash. Jan. 2 Sold 9 T-shirts for $23 each, total cost of $135. Received cash. Jan. 3 Purchased 40 T-shirts on account at $17 each. Terms 3/10,n/30. Jan. 7 Paid the supplier for the T-shirts purchased on January 3 , less discount. Jan. 8 Realized 11T-shirts from the January 1 order were printed wrong and returned them for a cash refund. Jan. 10 Sold 30T-shirts on account for $23 each, total cost of $510. Terms 4/15,n/45. Jan. 12 Received payment for the T-shirts sold on account on January 10 , less discount. Jan. 14 Purchased 210 T-shirts on account at $15 each. Terms 5/15,n/30. Jan. 18 Water Way Company called the supplier from the January 14 purchase and told them that some of the T-shirts were the wrong color. The supplier offered a $90 purchase allowance. Jan. 20 Paid the supplier for the T-shirts purchased on January 14 , less the allowance and discount. Jan. 21 Sold 120 T-shirts on account for $23 each, total cost of $1,753. Terms 4/20,n/30. Jan. 23 Received a payment on account for the T-shirts sold on January 21 , less discount. Jan. 25 Purchased 300 T-shirts on account at $17 each. Terms 5/10,n/30, FOB shipping point. Jan. 27 Paid freight associated with the January 25 purchase, $30. Jan. 29 Paid for the January 25 purchase, less discount. Jan. 30 Sold 270 T-shirts on account for $23 each, total cost of $4,067. Terms 2/10,n/30. Jan. 31 Received payment for the T-shirts sold on January 30 , less discount. Requirement 4. Journalize and post the closing entries. Omit explanations. Denote each closing amount as Clo. and each balance as Bal. After posting all closing entries, prove the equalify of debits and credits in the ledger by preparing a post-closing trial balance. Begin by joumalizing the closing entries. Omit explanations. (Record debits first, then credits. Exclude explanations from any journal entries.) Start by closing revenues. Close expenses for the month. Close Income Summary. Enter the adjusted balance of each account and seiect an "Adj. Bal." reference to identify the adjusted balances. Post the closing entries. Use "Clo." and the corresponding number as shown in the journal entry as posting references-"Clo (1)", "Clo.(2)", etc. Post any closing entries to the accounts and then calculate the post-closing balance ("Bal.") of each account (including those that were not closed). For any accounts with a zero balance adjusted balance and/or postclosing balance, select the posting reference and enter a " 0 " on the appropriate side of the account. Post the entry to close Income Summary account on the same line as you entered the balance prior to closing (the second line) and then show the post-closing balance ("Bal.") on the last (third) line of the account. (For any accounts with a zero adjusted and/or post-closing balance, select a posting reforence and enter a " 0 " on the nermal side of the T-account.) Estimated Returns Inventory Wages Payable Rent Expense Office Supplies Refunds Payable Wages Expense Prepaid Rent Interest Payable Utilities Expense Land Unearned Revenue Telephone Expense Land Unearned Revenue Building Accumulated Depr,-Bullding Canoes Notes Payable Telephone Expense Supplies Expense Depreciation Expense-Building Washington, Capital Income Summary Depreciation Expense-Canoes Accumulated Depr:-Canoes Prove the equality of debits and credits in the ledger by preparing a post-closing trial balance. (if a permanent account has a zero balance, exclude it from the post-closing trial balance.) Prove the equalty of debis and credis in the ledger by proparing a post-closing trial balance. (If a permanent account has a zarp balarce, exclude it from the post-closing trial balance.) Water Way Company Post-Closing Trial Balance January 31,2025 Balance Account Title Credit - Comsings 4. Journalize and post the closing entries. Omit explanations. Denote each closing amount as Clo. and each balance as Bal. After posting all clsing entries, prove the equality of debits and credits in the ledger by preparing a post-ciosing trial balance. 5. Compute the gross profit percentage for January for Water Way Company. Merchandising Transactions Jan. 1 Purchased 20 T-shirts at \$15 each and paid cash. Jan. 2 Sold 9 T-shirts for $23 each, total cost of $135. Received cash. Jan. 3 Purchased 40 T-shirts on account at $17 each. Terms 3/10,n/30. Jan. 7 Paid the supplier for the T-shirts purchased on January 3 , less discount. Jan. 8 Realized 11T-shirts from the January 1 order were printed wrong and returned them for a cash refund. Jan. 10 Sold 30T-shirts on account for $23 each, total cost of $510. Terms 4/15,n/45. Jan. 12 Received payment for the T-shirts sold on account on January 10 , less discount. Jan. 14 Purchased 210 T-shirts on account at $15 each. Terms 5/15,n/30. Jan. 18 Water Way Company called the supplier from the January 14 purchase and told them that some of the T-shirts were the wrong color. The supplier offered a $90 purchase allowance. Jan. 20 Paid the supplier for the T-shirts purchased on January 14 , less the allowance and discount. Jan. 21 Sold 120 T-shirts on account for $23 each, total cost of $1,753. Terms 4/20,n/30. Jan. 23 Received a payment on account for the T-shirts sold on January 21 , less discount. Jan. 25 Purchased 300 T-shirts on account at $17 each. Terms 5/10,n/30, FOB shipping point. Jan. 27 Paid freight associated with the January 25 purchase, $30. Jan. 29 Paid for the January 25 purchase, less discount. Jan. 30 Sold 270 T-shirts on account for $23 each, total cost of $4,067. Terms 2/10,n/30. Jan. 31 Received payment for the T-shirts sold on January 30 , less discount. Requirement 4. Journalize and post the closing entries. Omit explanations. Denote each closing amount as Clo. and each balance as Bal. After posting all closing entries, prove the equalify of debits and credits in the ledger by preparing a post-closing trial balance. Begin by joumalizing the closing entries. Omit explanations. (Record debits first, then credits. Exclude explanations from any journal entries.) Start by closing revenues. Close expenses for the month. Close Income Summary. Enter the adjusted balance of each account and seiect an "Adj. Bal." reference to identify the adjusted balances. Post the closing entries. Use "Clo." and the corresponding number as shown in the journal entry as posting references-"Clo (1)", "Clo.(2)", etc. Post any closing entries to the accounts and then calculate the post-closing balance ("Bal.") of each account (including those that were not closed). For any accounts with a zero balance adjusted balance and/or postclosing balance, select the posting reference and enter a " 0 " on the appropriate side of the account. Post the entry to close Income Summary account on the same line as you entered the balance prior to closing (the second line) and then show the post-closing balance ("Bal.") on the last (third) line of the account. (For any accounts with a zero adjusted and/or post-closing balance, select a posting reforence and enter a " 0 " on the nermal side of the T-account.) Estimated Returns Inventory Wages Payable Rent Expense Office Supplies Refunds Payable Wages Expense Prepaid Rent Interest Payable Utilities Expense Land Unearned Revenue Telephone Expense Land Unearned Revenue Building Accumulated Depr,-Bullding Canoes Notes Payable Telephone Expense Supplies Expense Depreciation Expense-Building Washington, Capital Income Summary Depreciation Expense-Canoes Accumulated Depr:-Canoes Prove the equality of debits and credits in the ledger by preparing a post-closing trial balance. (if a permanent account has a zero balance, exclude it from the post-closing trial balance.) Prove the equalty of debis and credis in the ledger by proparing a post-closing trial balance. (If a permanent account has a zarp balarce, exclude it from the post-closing trial balance.) Water Way Company Post-Closing Trial Balance January 31,2025 Balance Account Title Credit - Comsings