Answered step by step

Verified Expert Solution

Question

1 Approved Answer

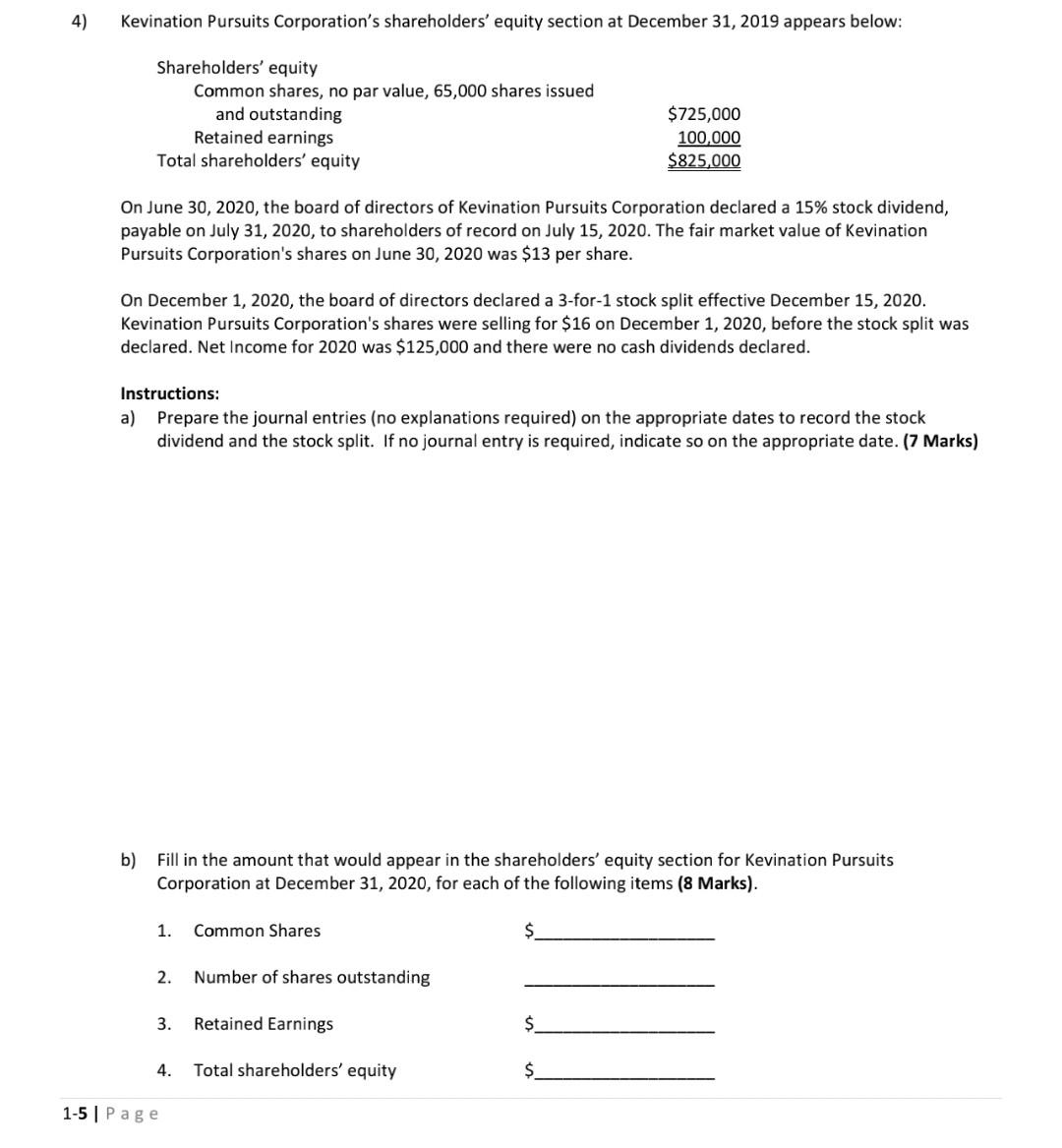

4) Kevination Pursuits Corporation's shareholders' equity section at December 31, 2019 appears below: Shareholders' equity Common shares, no par value, 65,000 shares issued and outstanding

4) Kevination Pursuits Corporation's shareholders' equity section at December 31, 2019 appears below: Shareholders' equity Common shares, no par value, 65,000 shares issued and outstanding Retained earnings Total shareholders' equity $725,000 100,000 $825,000 On June 30, 2020, the board of directors of Kevination Pursuits Corporation declared a 15% stock dividend, payable on July 31, 2020, to shareholders of record on July 15, 2020. The fair market value of Kevination Pursuits Corporation's shares on June 30, 2020 was $13 per share. On December 1, 2020, the board of directors declared a 3-for-1 stock split effective December 15, 2020. Kevination Pursuits Corporation's shares were selling for $16 on December 1, 2020, before the stock split was declared. Net Income for 2020 was $125,000 and there were no cash dividends declared. Instructions: a) Prepare the journal entries (no explanations required) on the appropriate dates to record the stock dividend and the stock split. If no journal entry is required, indicate so on the appropriate date. (7 Marks) b) Fill in the amount that would appear in the shareholders' equity for Kevination Pursuits Corporation at December 31, 2020, for each of the following items (8 Marks). 1. Common Shares $ 2. Number of shares outstanding 3. Retained Earnings $ 4. Total shareholders' equity $ 1-5 Page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started