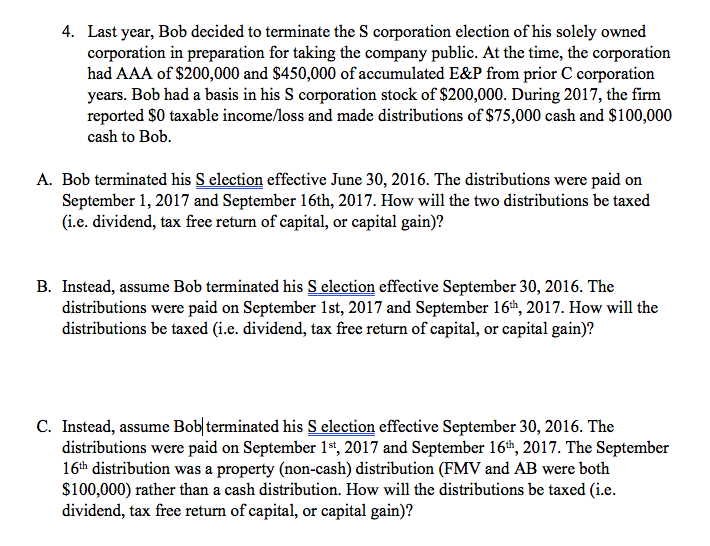

4. Last year, Bob decided to terminate the corporation election of his solely owned corporation in preparation for taking the company public. At the time, the corporation had AAA of $200,000 and $450,000 of accumulated E&P from prior C corporation years. Bob had a basis in his S corporation stock of $200,000. During 2017, the firm reported $0 taxable income/loss and made distributions of $75,000 cash and $100,000 cash to Bob. A. Bob terminated his S election effective June 30, 2016. The distributions were paid on September 1, 2017 and September 16th, 2017. How will the two distributions be taxed (i.e. dividend, tax free return of capital, or capital gain)? B. Instead, assume Bob terminated his S election effective September 30, 2016. The distributions were paid on September 1st, 2017 and September 16th, 2017. How will the distributions be taxed (i.e. dividend, tax free return of capital, or capital gain)? C. Instead, assume Bob terminated his Selection effective September 30, 2016. The distributions were paid on September 1st, 2017 and September 16th, 2017. The September 16th distribution was a property (non-cash) distribution (FMV and AB were both $100,000) rather than a cash distribution. How will the distributions be taxed (i.e. dividend, tax free return of capital, or capital gain)? 4. Last year, Bob decided to terminate the corporation election of his solely owned corporation in preparation for taking the company public. At the time, the corporation had AAA of $200,000 and $450,000 of accumulated E&P from prior C corporation years. Bob had a basis in his S corporation stock of $200,000. During 2017, the firm reported $0 taxable income/loss and made distributions of $75,000 cash and $100,000 cash to Bob. A. Bob terminated his S election effective June 30, 2016. The distributions were paid on September 1, 2017 and September 16th, 2017. How will the two distributions be taxed (i.e. dividend, tax free return of capital, or capital gain)? B. Instead, assume Bob terminated his S election effective September 30, 2016. The distributions were paid on September 1st, 2017 and September 16th, 2017. How will the distributions be taxed (i.e. dividend, tax free return of capital, or capital gain)? C. Instead, assume Bob terminated his Selection effective September 30, 2016. The distributions were paid on September 1st, 2017 and September 16th, 2017. The September 16th distribution was a property (non-cash) distribution (FMV and AB were both $100,000) rather than a cash distribution. How will the distributions be taxed (i.e. dividend, tax free return of capital, or capital gain)