Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Let T = for i = 0, 1, 2,..., 20 and let p; [2] denote the nominal spot rate that will prevail at

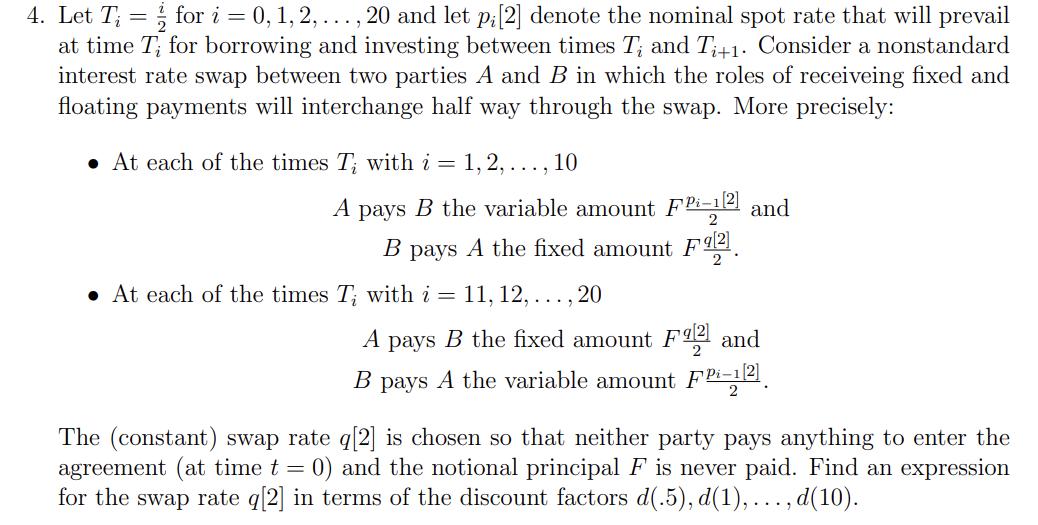

4. Let T = for i = 0, 1, 2,..., 20 and let p; [2] denote the nominal spot rate that will prevail at time T; for borrowing and investing between times T; and Ti+1. Consider a nonstandard interest rate swap between two parties A and B in which the roles of receiveing fixed and floating payments will interchange half way through the swap. More precisely: At each of the times T; with i=1,2,..., 10 A pays B the variable amount FP-12 and B pays A the fixed amount F2. At each of the times T; with i= 11, 12,..., 20 A pays B the fixed amount F2 and B pays A the variable amount FP-1[2] The (constant) swap rate q[2] is chosen so that neither party pays anything to enter the agreement (at time t = 0) and the notional principal F is never paid. Find an expression for the swap rate q[2] in terms of the discount factors d(.5), d(1), ..., d(10).

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To find an expression for the swap rate q2 in terms of the discount factors d5 d1 d10 we can conside...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started