Question

4) Now we will focus on the two efficient frontiers: one of three assets in Exhibit 5 and one of five assets in Exhibit 8.

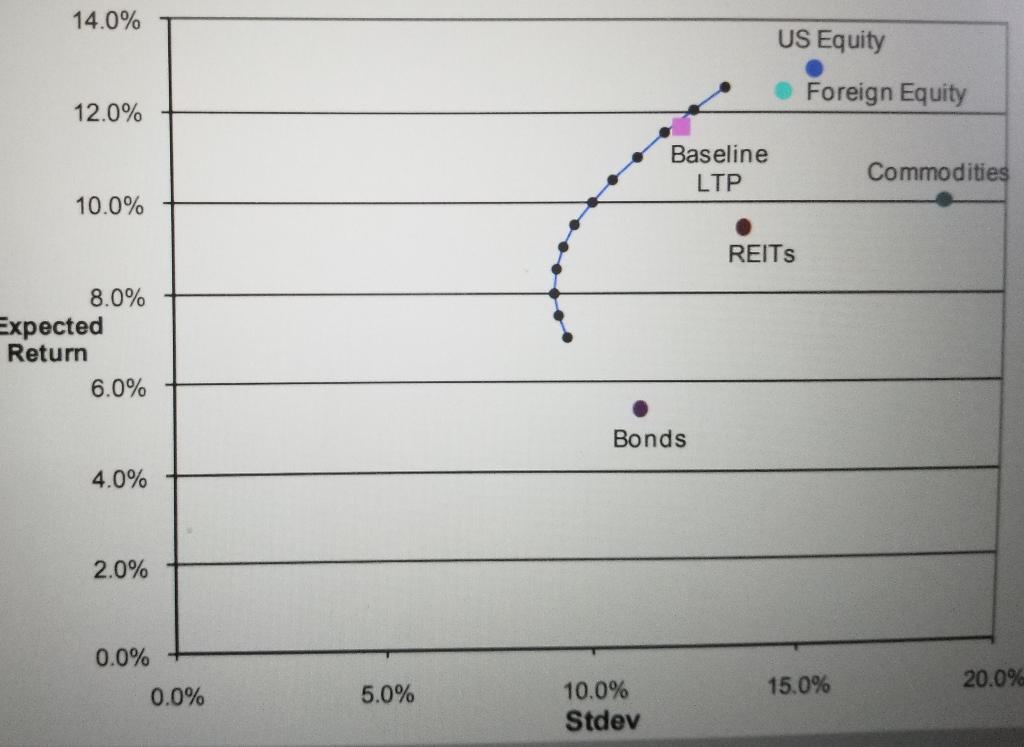

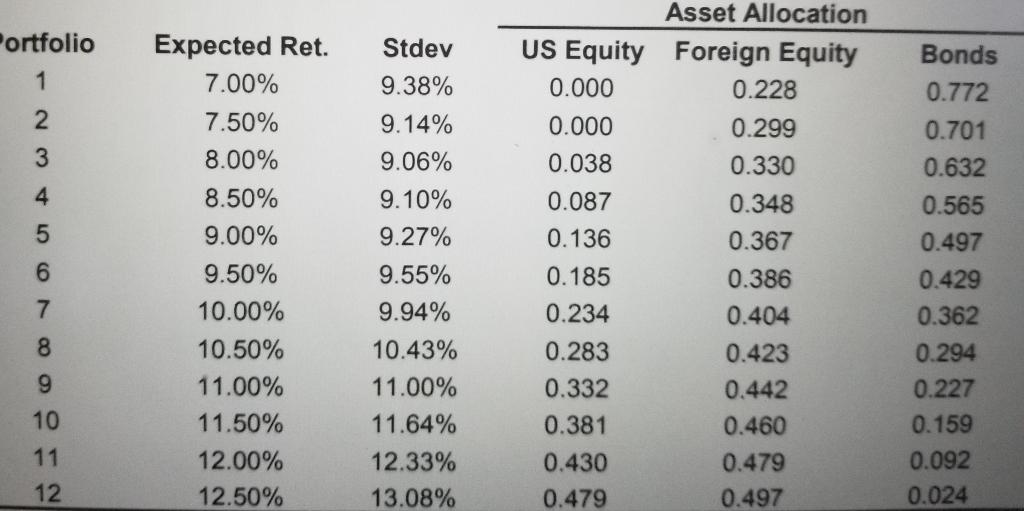

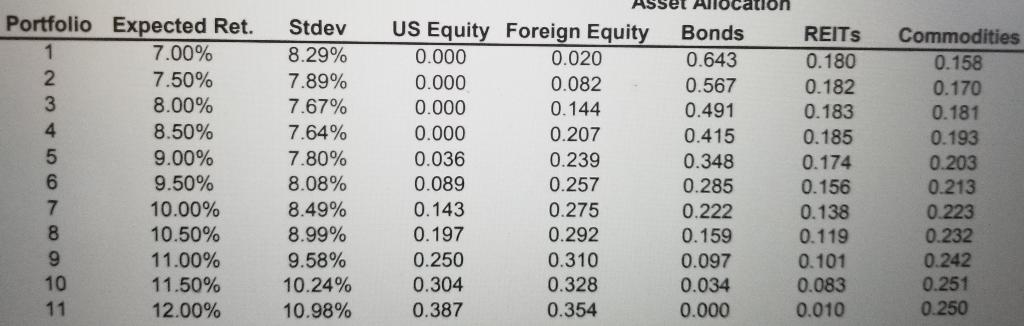

4) Now we will focus on the two efficient frontiers: one of three assets in Exhibit 5 and one of five assets in Exhibit 8. We know (from our chapter 6), the optimal portfolios are the tangency portfolios given the risk-free asset is STP (return of 3.2%). For simplicity, let find the optimal portfolio of three assets as the portfolio that have the highest Sharpe ratio out of the 12 portfolios in Exhibit 5. Let call this optimal portfolio O3-asset. Similarly, find the optimal portfolio of five assets, portfolio O5-asset, based on Exhibit 8.

4) Now we will focus on the two efficient frontiers: one of three assets in Exhibit 5 and one of five assets in Exhibit 8. We know (from our chapter 6), the optimal portfolios are the tangency portfolios given the risk-free asset is STP (return of 3.2%). For simplicity, let find the optimal portfolio of three assets as the portfolio that have the highest Sharpe ratio out of the 12 portfolios in Exhibit 5. Let call this optimal portfolio O3-asset. Similarly, find the optimal portfolio of five assets, portfolio O5-asset, based on Exhibit 8.

- Draw a graph with the two efficient frontiers and show the two optimal portfolios.

- Report (in an easy-to-compare format) the risks, returns, Sharpe ratios, and weight of each of five assets for portfolios O3-asset and O5-asset.

14.0% US Equity Foreign Equity 12.0% Baseline LTP Commodities 10.0% REITS 8.0% Expected Return 6.0% Bonds 4.0% 2.0% 0.0% 0.0% 20.0% 5.0% 15.0% 10.0% Stdev Portfolio 2 Bonds 0.772 0.701 0.632 3 4 5 Expected Ret. 7.00% 7.50% 8.00% 8.50% 9.00% 9.50% 10.00% 10.50% 11.00% 11.50% 12.00% 12.50% 6 Asset Allocation US Equity Foreign Equity 0.000 0.228 0.000 0.299 0.038 0.330 0.087 0.348 0.136 0.367 0.185 0.386 0.234 0.404 0.283 0.423 0.332 0.442 0.381 0.460 0.430 0.479 0.479 0.497 Stdev 9.38% 9.14% 9.06% 9.10% 9.27% 9.55% 9.94% 10.43% 11.00% 11.64% 12.33% 13.08% 7 8 0.565 0.497 0.429 0.362 0.294 0.227 0.159 0.092 0.024 9 10 11 12 Portfolio Expected Ret. 1 7.00% 2 7.50% 3 8.00% 4 8.50% 5 9.00% 6 9.50% 7 10.00% 8 10.50% 9 11.00% 10 11.50% 11 12.00% Stdev 8.29% 7.89% 7.67% 7.64% 7.80% 8.08% 8.49% 8.99% 9.58% 10.24% 10.98% Asset Allocation US Equity Foreign Equity Bonds REITs 0.000 0.020 0.643 0.180 0.000 0.082 0.567 0.182 0.000 0.144 0.491 0.183 0.000 0.207 0.415 0.185 0.036 0.239 0.348 0.174 0.089 0.257 0.285 0.156 0.143 0.275 0.222 0.138 0.197 0.292 0.159 0.119 0.250 0.310 0.097 0.101 0.304 0.328 0.034 0.083 0.387 0.354 0.000 0.010 Commodities 0.158 0.170 0.181 0.193 0.203 0.213 0.223 0.232 0.242 0.251 0.250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started