Answered step by step

Verified Expert Solution

Question

1 Approved Answer

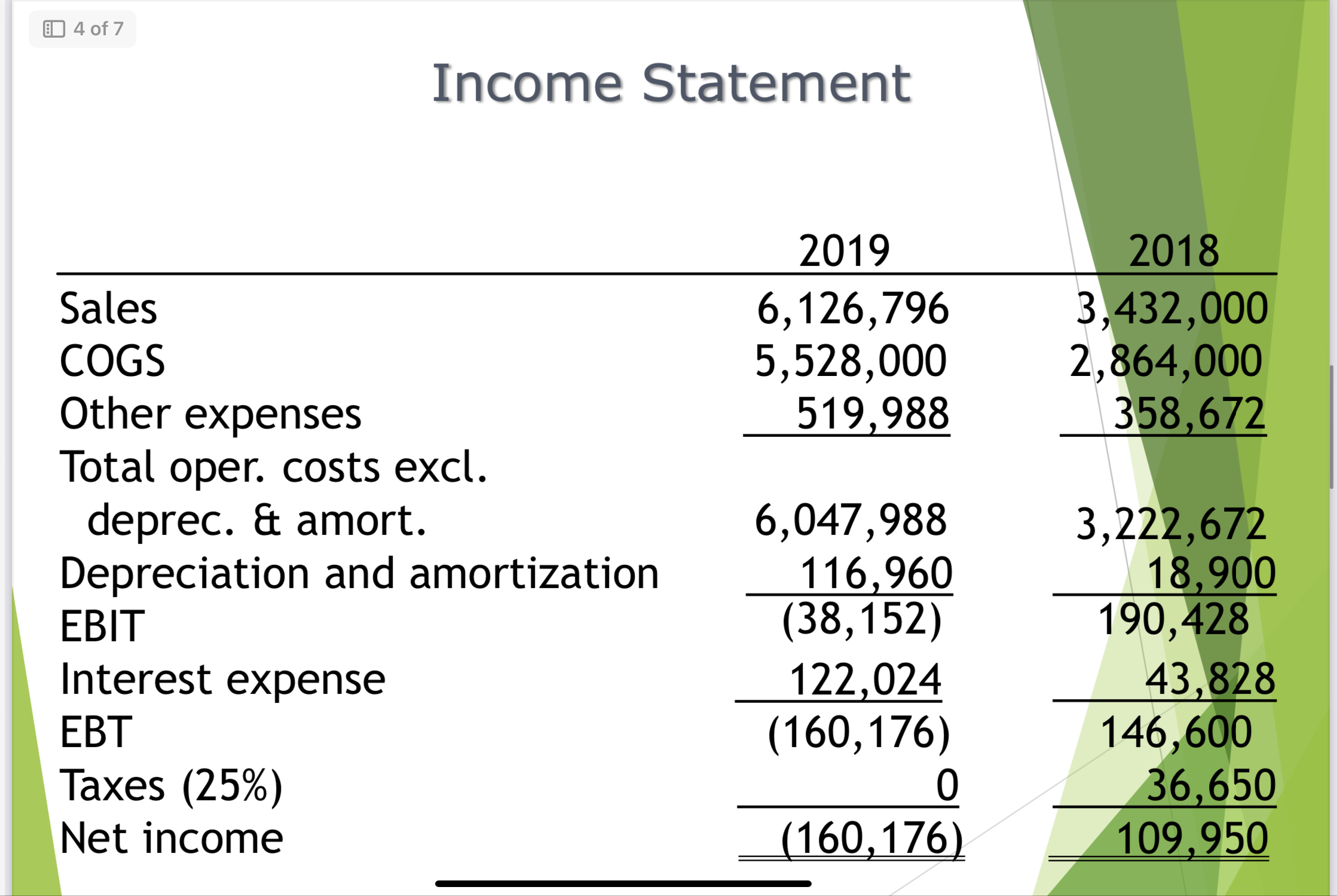

4 of 7 Income Statement 2019 2018 Sales 6,126,796 3,432,000 COGS 5,528,000 2,864,000 Other expenses 519,988 358,672 Total oper. costs excl. deprec. & amort.

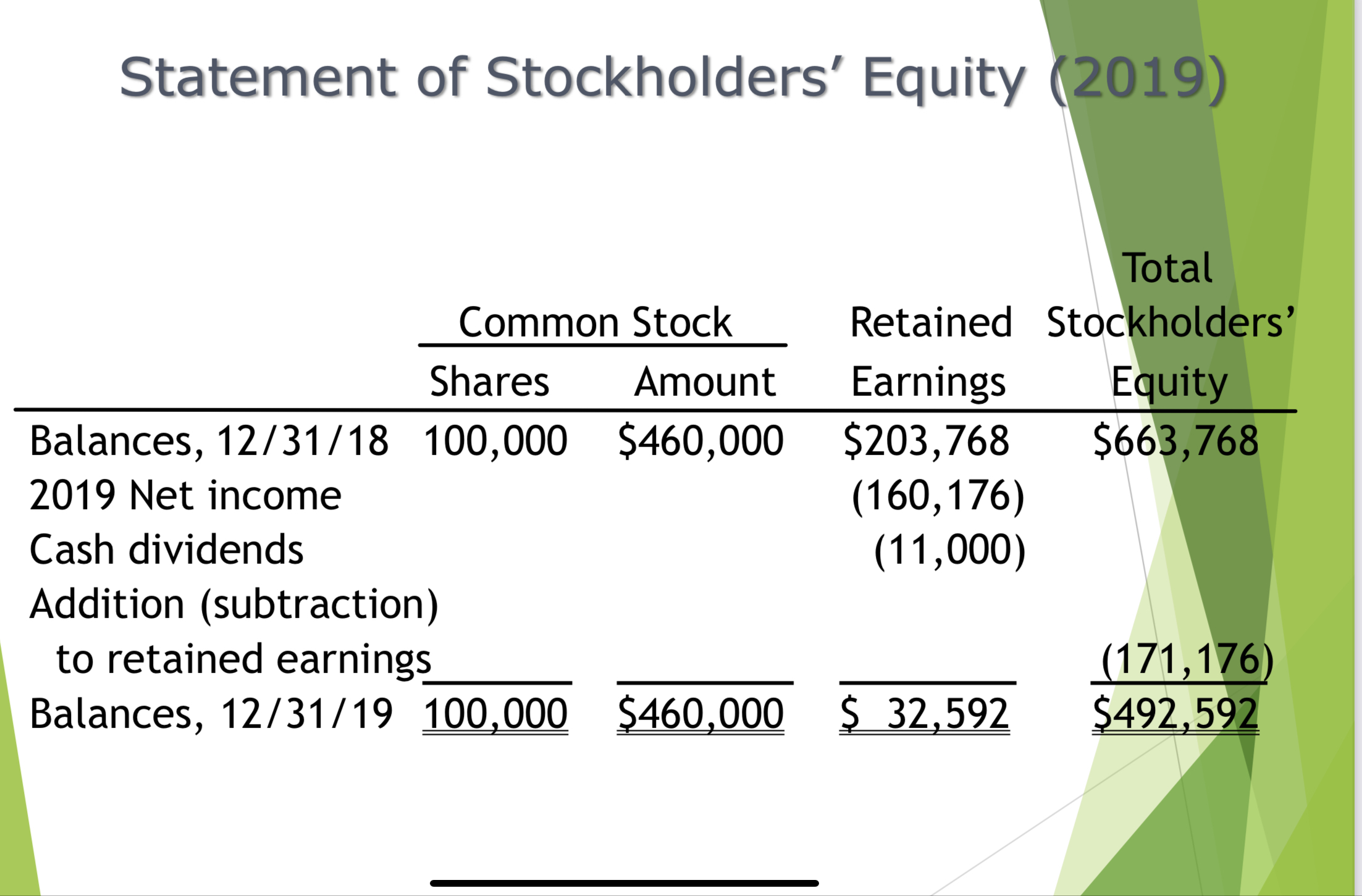

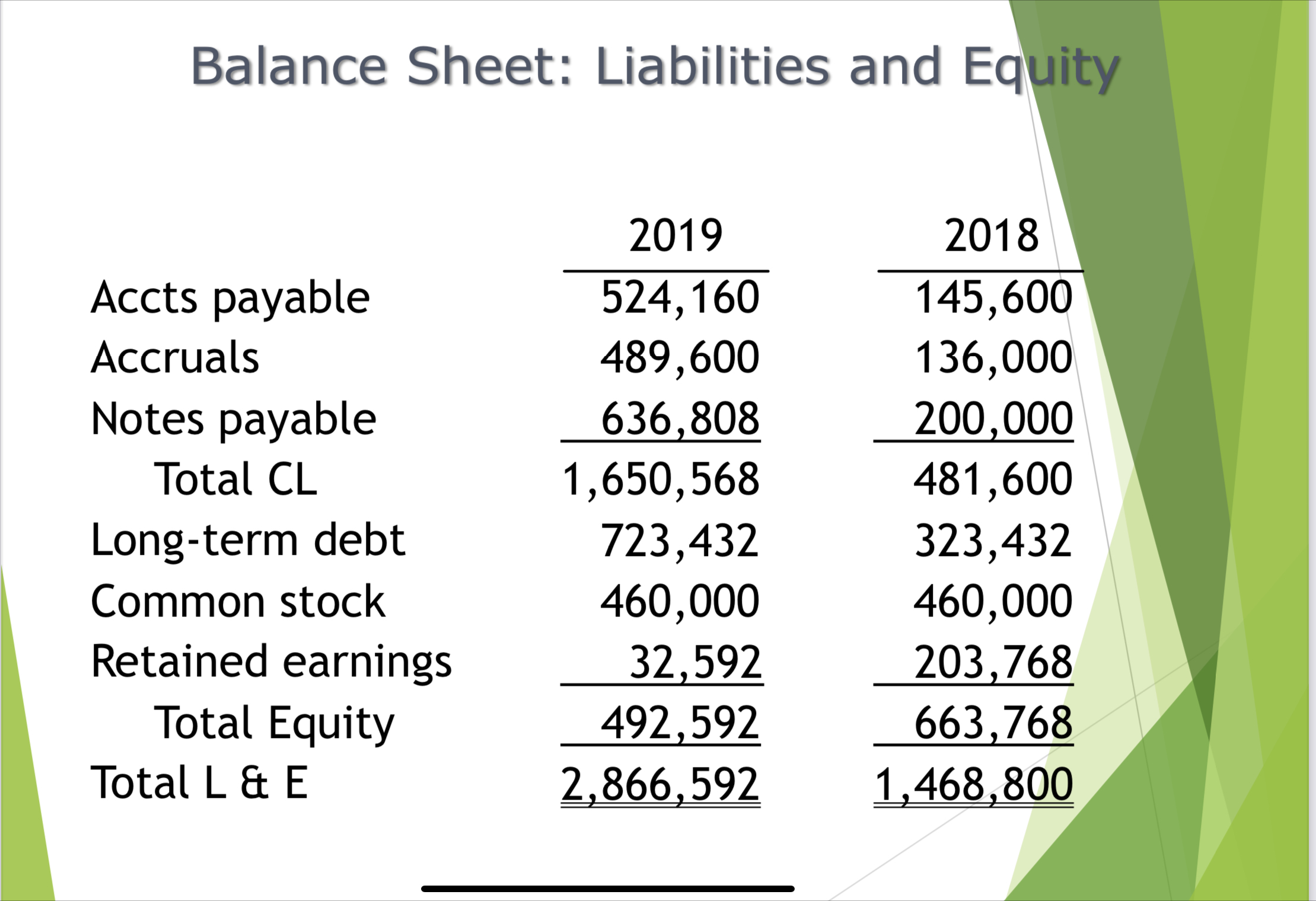

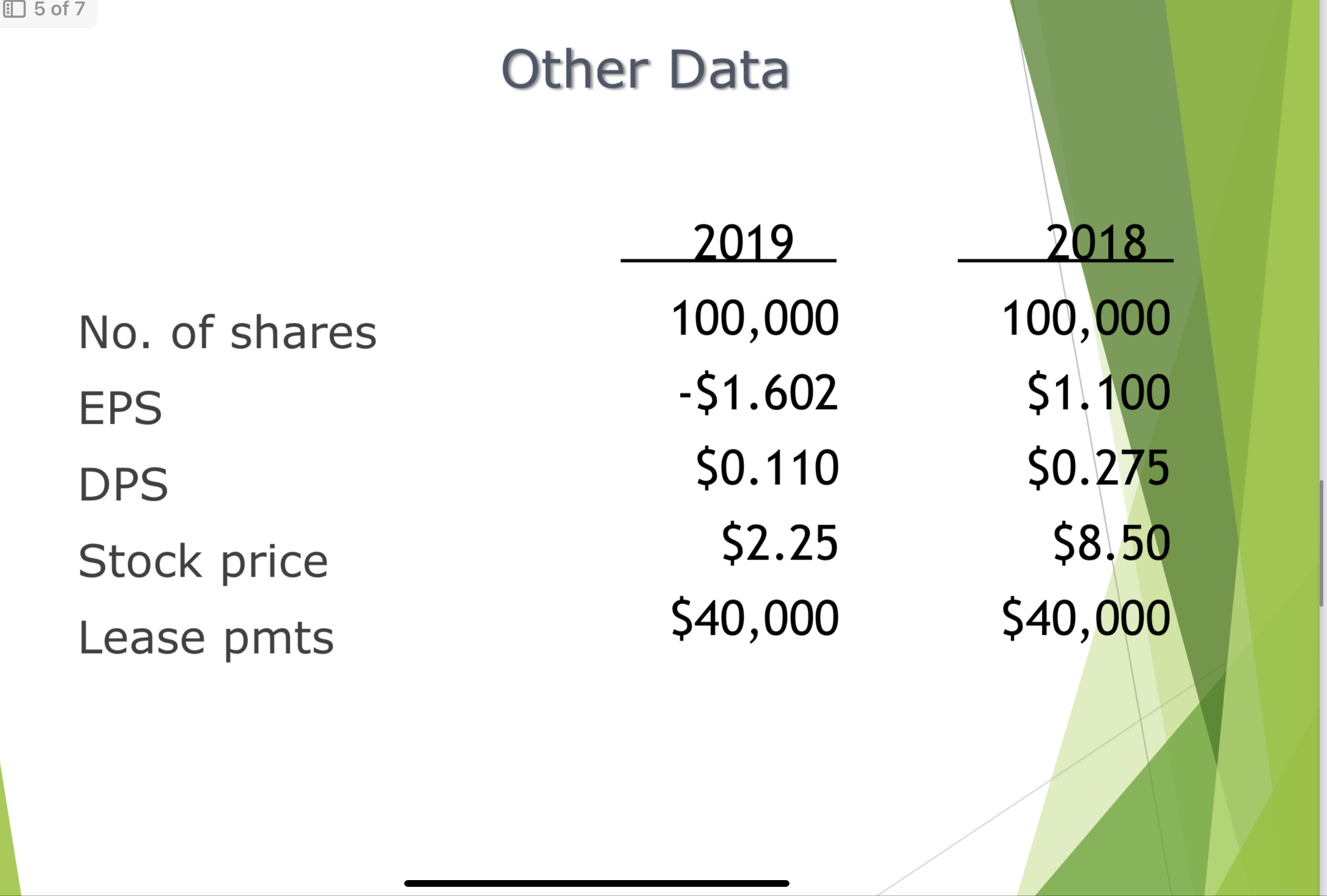

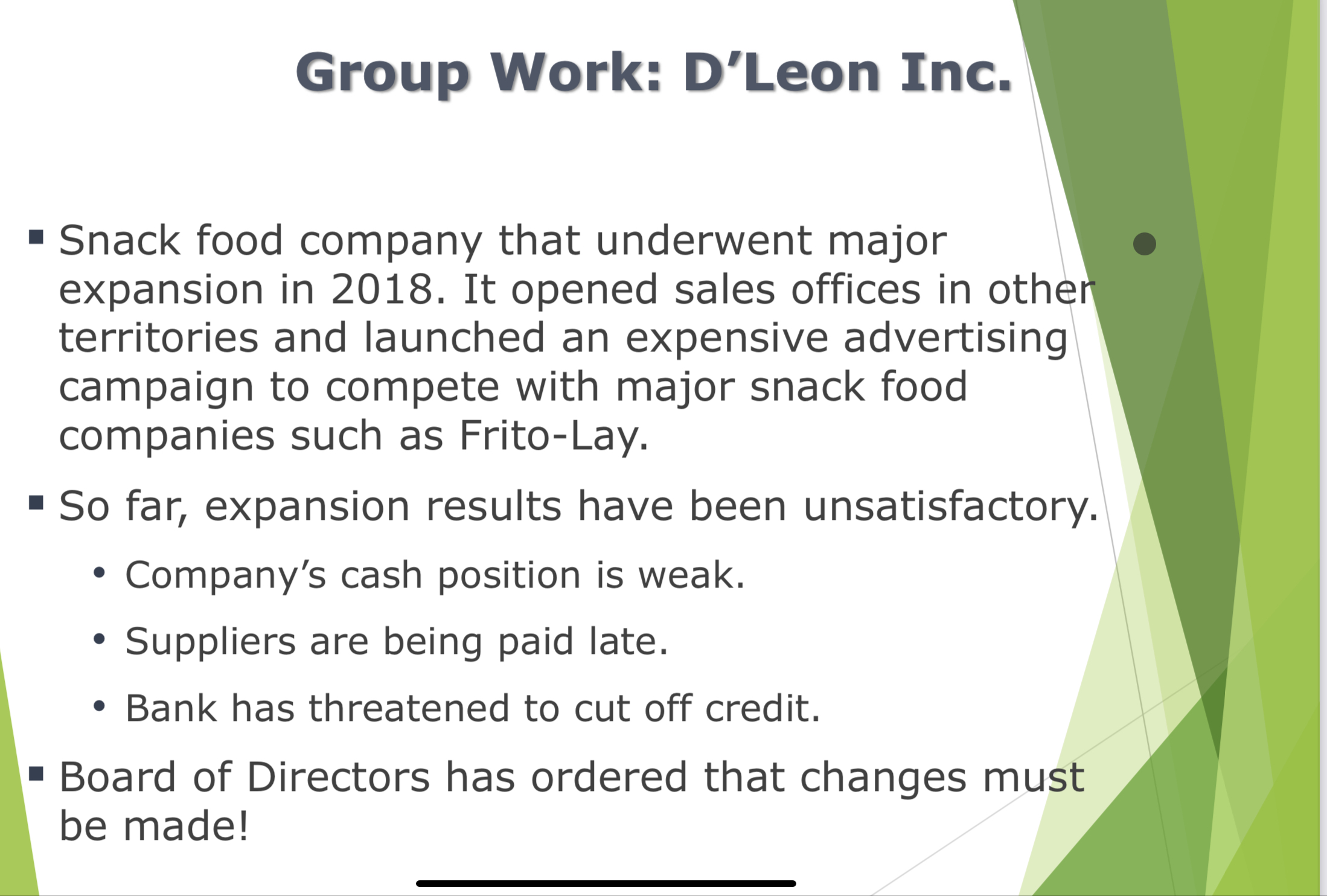

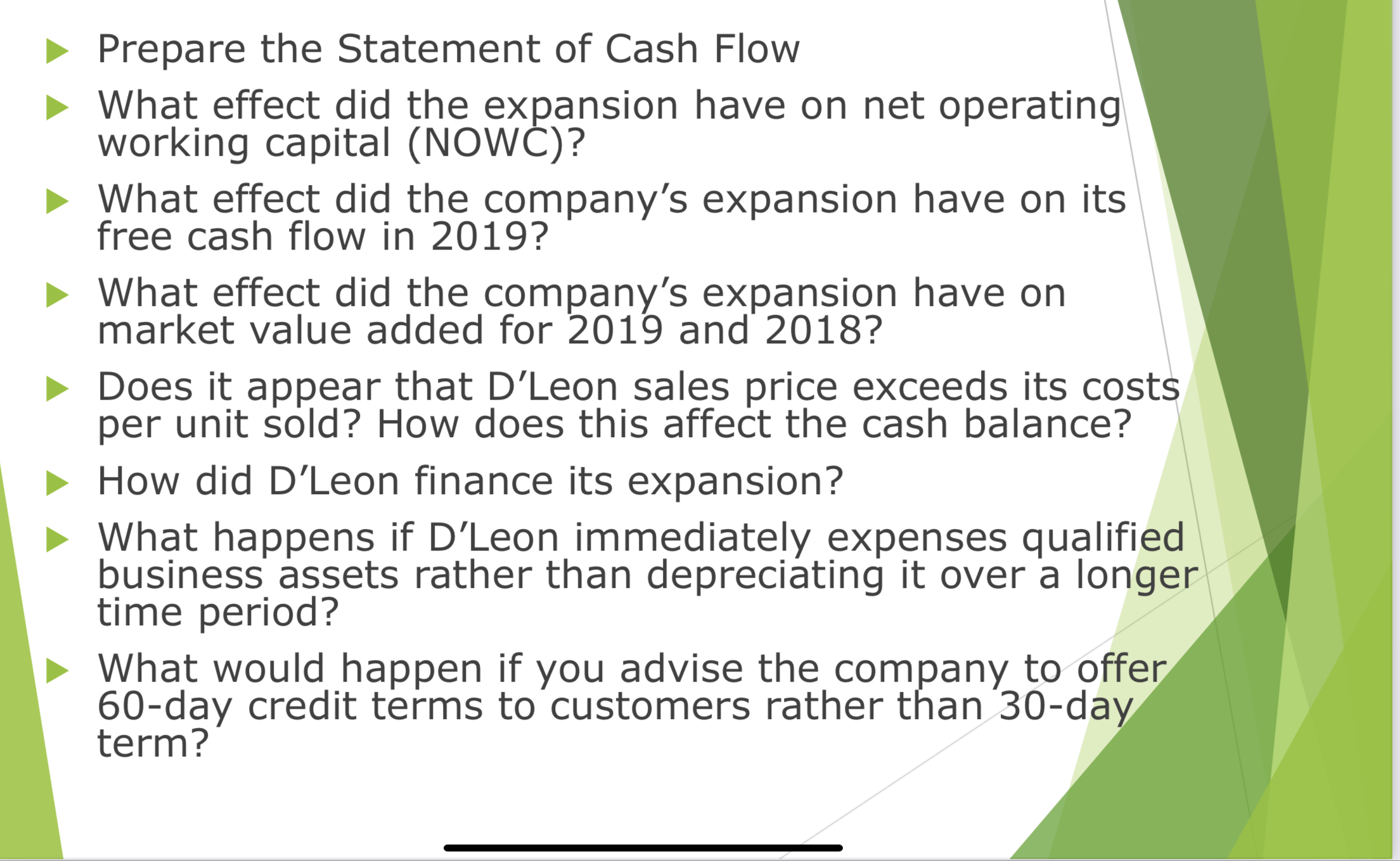

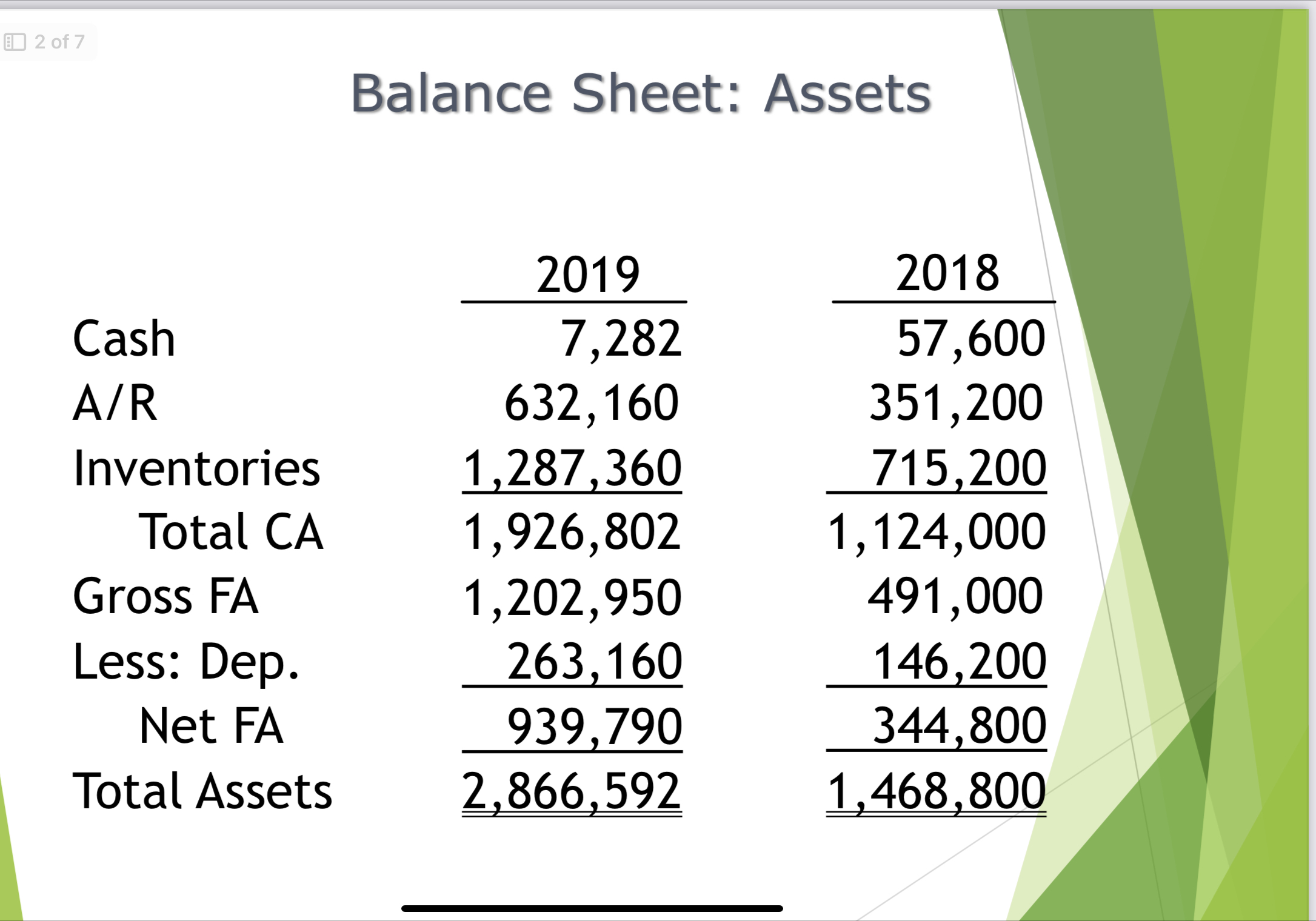

4 of 7 Income Statement 2019 2018 Sales 6,126,796 3,432,000 COGS 5,528,000 2,864,000 Other expenses 519,988 358,672 Total oper. costs excl. deprec. & amort. 6,047,988 3,222,672 Depreciation and amortization 116,960 18,900 EBIT (38,152) 190,428 Interest expense 122,024 43,828 EBT (160,176) 146,600 Taxes (25%) 0 36,650 Net income (160,176) 109,950 Statement of Stockholders' Equity (2019) Total Common Stock Retained Stockholders' Shares Amount Earnings Equity Balances, 12/31/18 100,000 $460,000 $203,768 $663,768 2019 Net income (160,176) Cash dividends (11,000) Addition (subtraction) to retained earnings (171,176) Balances, 12/31/19 100,000 $460,000 $ 32,592 $492,592 Balance Sheet: Liabilities and Equity 2019 2018 Accts payable 524,160 145,600 Accruals 489,600 136,000 Notes payable 636,808 200,000 Total CL 1,650,568 481,600 Long-term debt 723,432 323,432 Common stock 460,000 460,000 Retained earnings 32,592 203,768 Total Equity 492,592 663,768 Total L & E 2,866,592 1,468,800 5 of 7 Other Data 2019 2018 No. of shares 100,000 100,000 -$1.602 $1.100 EPS $0.110 $0.275 DPS $2.25 $8.50 Stock price $40,000 $40,000 Lease pmts Group Work: D'Leon Inc. Snack food company that underwent major expansion in 2018. It opened sales offices in other territories and launched an expensive advertising campaign to compete with major snack food companies such as Frito-Lay. So far, expansion results have been unsatisfactory. . Company's cash position is weak. Suppliers are being paid late. Bank has threatened to cut off credit. Board of Directors has ordered that changes must be made! Prepare the Statement of Cash Flow What effect did the expansion have on net operating working capital (NOW)? What effect did the company's expansion have on its free cash flow in 2019? What effect did the company's expansion have on market value added for 2019 and 2018? Does it appear that D'Leon sales price exceeds its costs per unit sold? How does this affect the cash balance? How did D'Leon finance its expansion? What happens if D'Leon immediately expenses qualified business assets rather than depreciating it over a longer time period? What would happen if you advise the company to offer 60-day credit terms to customers rather than 30-day term? 2 of 7 Balance Sheet: Assets 2019 2018 Cash 7,282 57,600 A/R 632,160 351,200 Inventories 1,287,360 715,200 Total CA 1,926,802 1,124,000 Gross FA 1,202,950 491,000 Less: Dep. 263,160 146,200 Net FA 939,790 344,800 Total Assets 2,866,592 1,468,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started