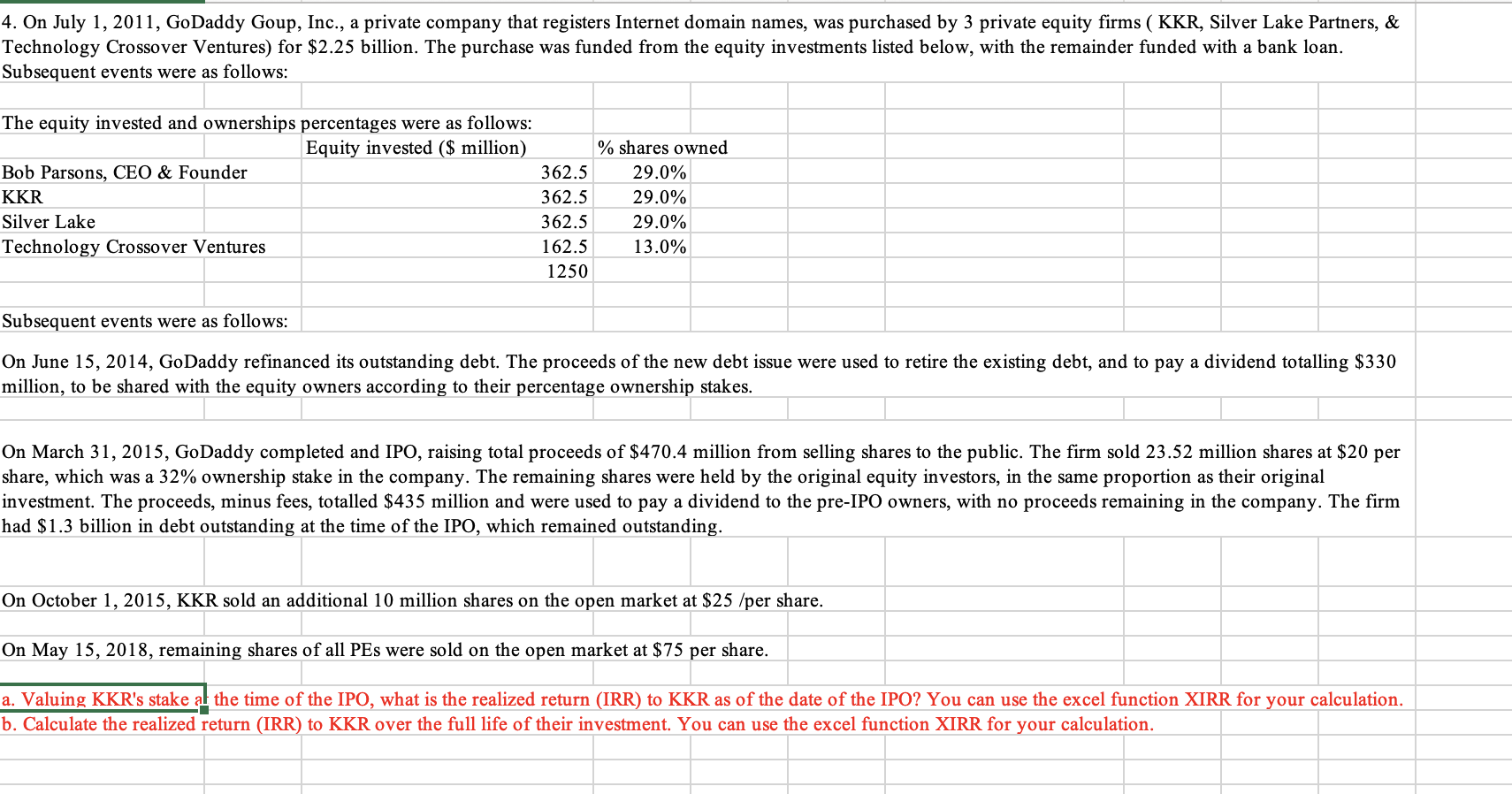

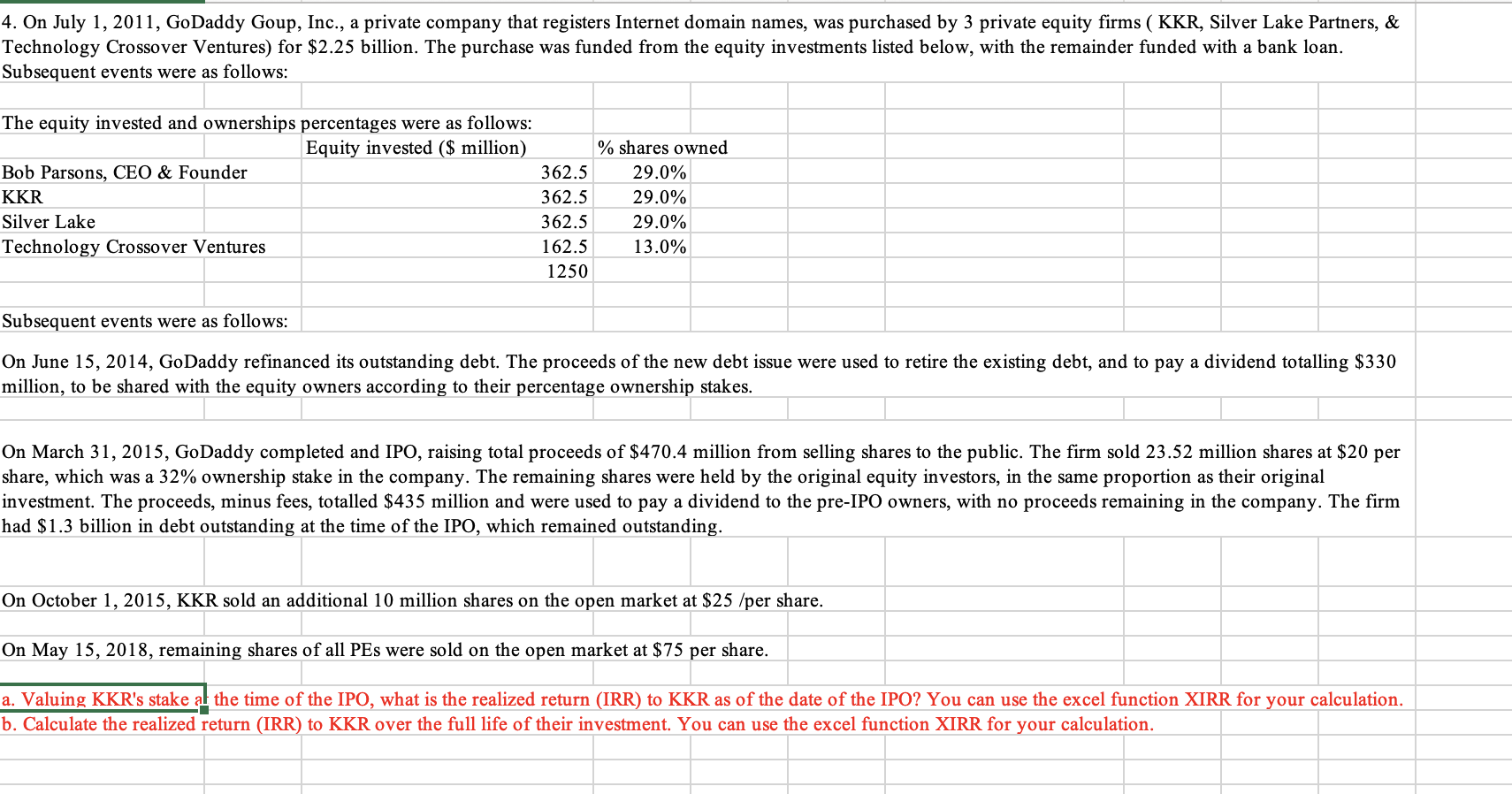

4. On July 1, 2011, GoDaddy Goup, Inc., a private company that registers Internet domain names, was purchased by 3 private equity firms ( KKR, Silver Lake Partners, & Technology Crossover Ventures) for $2.25 billion. The purchase was funded from the equity investments listed below, with the remainder funded with a bank loan. Subsequent events were as follows: The equity invested and ownerships percentages were as follows: Equity invested ($ million) Bob Parsons, CEO & Founder 362.5 KKR 362.5 Silver Lake 362.5 Technology Crossover Ventures 162.5 1250 % shares owned 29.0% 29.0% 29.0% 13.0% Subsequent events were as follows: On June 15, 2014, GoDaddy refinanced its outstanding debt. The proceeds of the new debt issue were used to retire the existing debt, and to pay a dividend totalling $330 million, to be shared with the equity owners according to their percentage ownership stakes. On March 31, 2015, GoDaddy completed and IPO, raising total proceeds of $470.4 million from selling shares to the public. The firm sold 23.52 million shares at $20 per share, which was a 32% ownership stake in the company. The remaining shares were held by the original equity investors, in the same proportion as their original investment. The proceeds, minus fees, totalled $435 million and were used to pay a dividend to the pre-IPO owners, with no proceeds remaining in the company. The firm had $1.3 billion in debt outstanding at the time of the IPO, which remained outstanding. On October 1, 2015, KKR sold an additional 10 million shares on the open market at $25 /per share. On May 15, 2018, remaining shares of all PEs were sold on the open market at $75 per share. a. Valuing KKR's stake at the time of the IPO, what is the realized return (IRR) to KKR as of the date of the IPO? You can use the excel function XIRR for your calculation. b. Calculate the realized return (IRR) to KKR over the full life of their investment. You can use the excel function XIRR for your calculation. 4. On July 1, 2011, GoDaddy Goup, Inc., a private company that registers Internet domain names, was purchased by 3 private equity firms ( KKR, Silver Lake Partners, & Technology Crossover Ventures) for $2.25 billion. The purchase was funded from the equity investments listed below, with the remainder funded with a bank loan. Subsequent events were as follows: The equity invested and ownerships percentages were as follows: Equity invested ($ million) Bob Parsons, CEO & Founder 362.5 KKR 362.5 Silver Lake 362.5 Technology Crossover Ventures 162.5 1250 % shares owned 29.0% 29.0% 29.0% 13.0% Subsequent events were as follows: On June 15, 2014, GoDaddy refinanced its outstanding debt. The proceeds of the new debt issue were used to retire the existing debt, and to pay a dividend totalling $330 million, to be shared with the equity owners according to their percentage ownership stakes. On March 31, 2015, GoDaddy completed and IPO, raising total proceeds of $470.4 million from selling shares to the public. The firm sold 23.52 million shares at $20 per share, which was a 32% ownership stake in the company. The remaining shares were held by the original equity investors, in the same proportion as their original investment. The proceeds, minus fees, totalled $435 million and were used to pay a dividend to the pre-IPO owners, with no proceeds remaining in the company. The firm had $1.3 billion in debt outstanding at the time of the IPO, which remained outstanding. On October 1, 2015, KKR sold an additional 10 million shares on the open market at $25 /per share. On May 15, 2018, remaining shares of all PEs were sold on the open market at $75 per share. a. Valuing KKR's stake at the time of the IPO, what is the realized return (IRR) to KKR as of the date of the IPO? You can use the excel function XIRR for your calculation. b. Calculate the realized return (IRR) to KKR over the full life of their investment. You can use the excel function XIRR for your calculation