Question

4: On March 2 nd , Krazy Kids also purchases shoes to sell in the store for $4,500 with an additional 15% sales tax for

4: On March 2nd, Krazy Kids also purchases shoes to sell in the store for $4,500 with an additional 15% sales tax for cash. What is the entry that Krazy Kids will make when they purchase the shoes from Merchandise Mart? Make sure to use the proper journal entry form we learned in Module 1 (including date, description, etc.)

5: On March 20th, Krazy Kids pays the amount due to the Merchandise Mart for the first transactions above on March 1st. What is the journal entry that Krazy Kids would make to record the payment? Make sure to use the proper journal entry form we learned in Module 1 (including date, description, etc.)

6: On March 21st, Krazy Kids purchases hats from Merchandise Mart on account. The hats cost $1,000 and are sold FOB Destination. The seller had already paid the shipping charges of $100, but will add it to the invoice if necessary. What is the entry that Krazy Kids will make when they purchase the hats from Merchandise Mart? Make sure to use the proper journal entry form we learned in Module 1 (including date, description, etc.)

7: Krazy kids has a grand opening sale on April 1st and sells merchandise to a customer for $2,500 and collects an additional 15% sales tax. The customer pays cash. In looking at the inventory records, the inventory sold had a cost of $400. What is the journal entry that Krazy Kids would make to record the sale? Make sure to use the proper journal entry form we learned in Module 1 (including date, description, etc.)

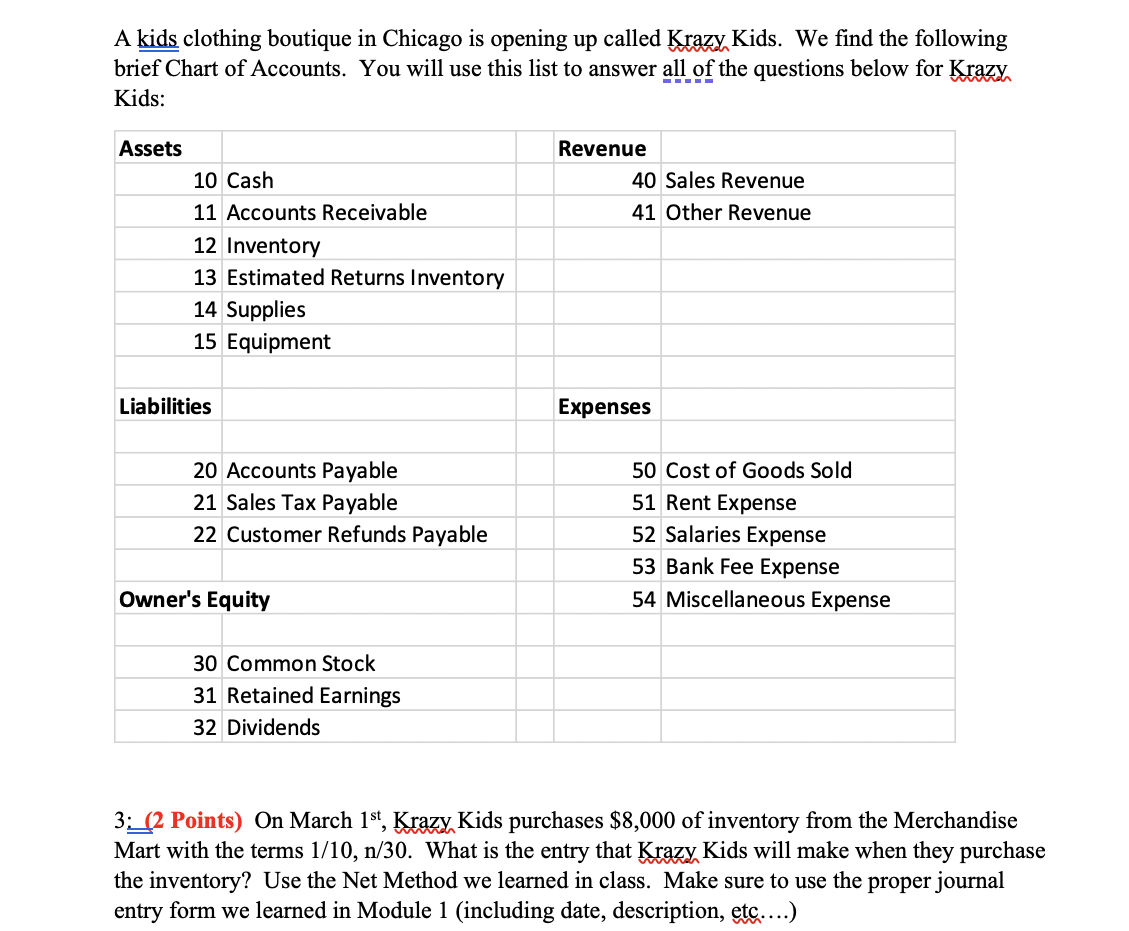

A kids clothing boutique in Chicago is opening up called Krazy Kids. We find the following brief Chart of Accounts. You will use this list to answer all of the questions below for Krazy. Kids: Assets 10 Cash 11 Accounts Receivable Revenue 40 Sales Revenue 41 Other Revenue 12 Inventory 13 Estimated Returns Inventory 14 Supplies 15 Equipment Liabilities Expenses 20 Accounts Payable 21 Sales Tax Payable 22 Customer Refunds Payable 50 Cost of Goods Sold 51 Rent Expense 52 Salaries Expense 53 Bank Fee Expense 54 Miscellaneous Expense Owner's Equity 30 Common Stock 31 Retained Earnings 32 Dividends 3:_(2 Points) On March 1st, Krazy Kids purchases $8,000 of inventory from the Merchandise Mart with the terms 1/10, n/30. What is the entry that Krazy Kids will make when they purchase the inventory? Use the Net Method we learned in class. Make sure to use the proper journal entry form we learned in Module 1 (including date, description, etc....)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started