Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DEF Computer Manufacturing purchased a new Assembly Macine for $362,000 at the beginning of year 1. The assembly machine has an estimated residual value

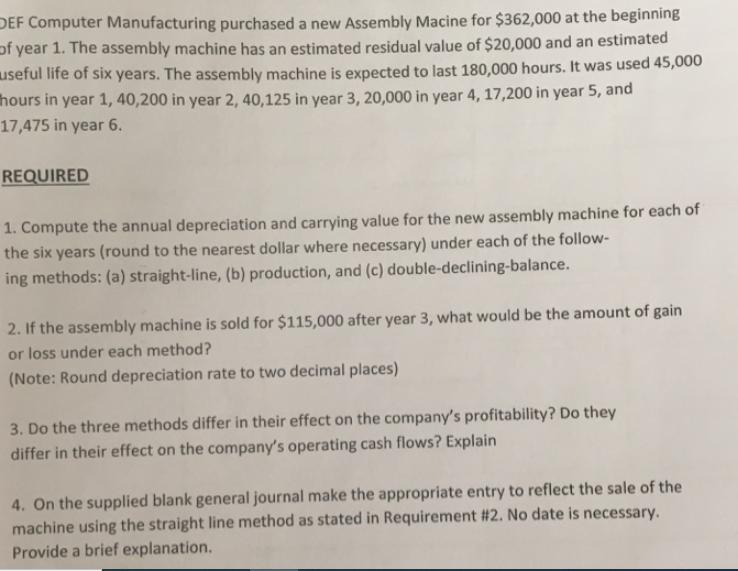

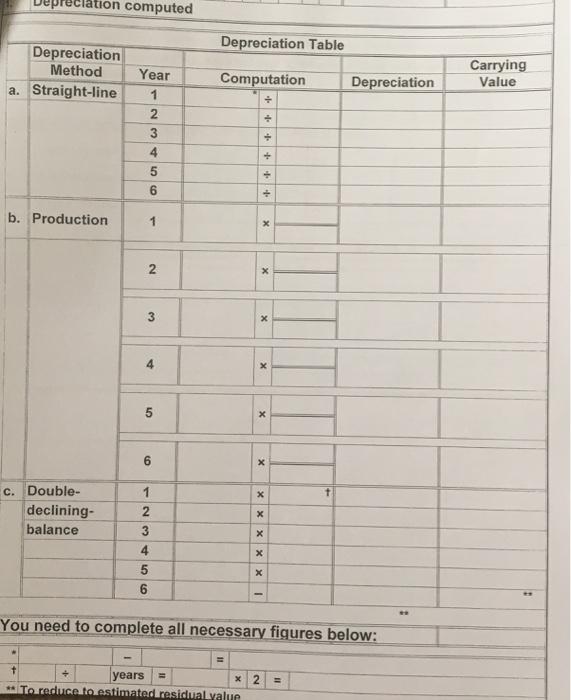

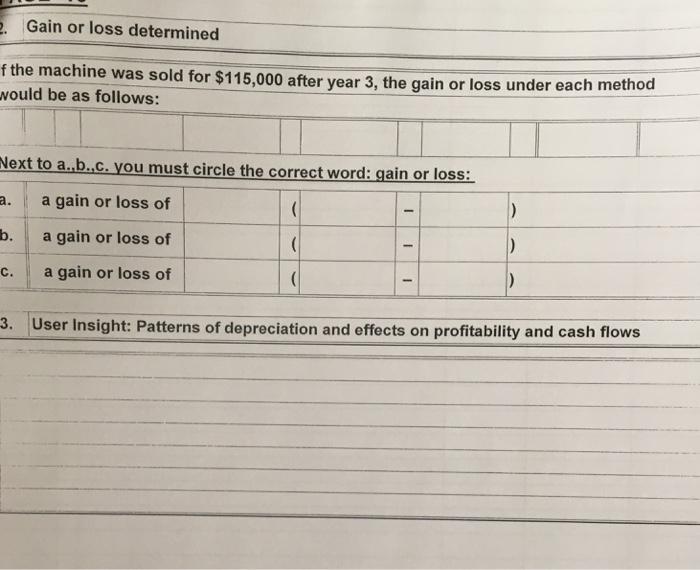

DEF Computer Manufacturing purchased a new Assembly Macine for $362,000 at the beginning of year 1. The assembly machine has an estimated residual value of $20,000 and an estimated useful life of six years. The assembly machine is expected to last 180,000 hours. It was used 45,000 hours in year 1, 40,200 in year 2, 40,125 in year 3, 20,000 in year 4, 17,200 in year 5, and 17,475 in year 6. REQUIRED 1. Compute the annual depreciation and carrying value for the new assembly machine for each of the six years (round to the nearest dollar where necessary) under each of the follow- ing methods: (a) straight-line, (b) production, and (c) double-declining-balance. 2. If the assembly machine is sold for $115,000 after year 3, what would be the amount of gain or loss under each method? (Note: Round depreciation rate to two decimal places) 3. Do the three methods differ in their effect on the company's profitability? Do they differ in their effect on the company's operating cash flows? Explain 4. On the supplied blank general journal make the appropriate entry to reflect the sale of the machine using the straight line method as stated in Requirement #2. No date is necessary. Provide a brief explanation. ion computed Depreciation Table Depreciation Method Carrying Value Year Computation Depreciation a. Straight-line b. Production c. Double- declining- balance 4 6. You need to complete all necessary figures below: %3D years ** To reduce to estimated residual yalue %3! %3D 234 56 1, 2. 4, 6, 122 - Gain or loss determined f the machine was sold for $115,000 after year 3, the gain or loss under each method would be as follows: Next to a.,b.,c. you must circle the correct word: gain or loss: a. a gain or loss of b. a gain or loss of . a gain or loss of 3. User Insight: Patterns of depreciation and effects on profitability and cash flows GENERAL JOURNAL ate Page Description Posting Ret. Debit Credit PAGE 19 DEF Computer Manufacturing purchased a new Assembly Macine for $362,000 at the beginning of year 1. The assembly machine has an estimated residual value of $20,000 and an estimated useful life of six years. The assembly machine is expected to last 180,000 hours. It was used 45,000 hours in year 1, 40,200 in year 2, 40,125 in year 3, 20,000 in year 4, 17,200 in year 5, and 17,475 in year 6. REQUIRED 1. Compute the annual depreciation and carrying value for the new assembly machine for each of the six years (round to the nearest dollar where necessary) under each of the follow- ing methods: (a) straight-line, (b) production, and (c) double-declining-balance. 2. If the assembly machine is sold for $115,000 after year 3, what would be the amount of gain or loss under each method? (Note: Round depreciation rate to two decimal places) 3. Do the three methods differ in their effect on the company's profitability? Do they differ in their effect on the company's operating cash flows? Explain 4. On the supplied blank general journal make the appropriate entry to reflect the sale of the machine using the straight line method as stated in Requirement #2. No date is necessary. Provide a brief explanation. ion computed Depreciation Table Depreciation Method Carrying Value Year Computation Depreciation a. Straight-line b. Production c. Double- declining- balance 4 6. You need to complete all necessary figures below: %3D years ** To reduce to estimated residual yalue %3! %3D 234 56 1, 2. 4, 6, 122 - Gain or loss determined f the machine was sold for $115,000 after year 3, the gain or loss under each method would be as follows: Next to a.,b.,c. you must circle the correct word: gain or loss: a. a gain or loss of b. a gain or loss of . a gain or loss of 3. User Insight: Patterns of depreciation and effects on profitability and cash flows GENERAL JOURNAL ate Page Description Posting Ret. Debit Credit PAGE 19 DEF Computer Manufacturing purchased a new Assembly Macine for $362,000 at the beginning of year 1. The assembly machine has an estimated residual value of $20,000 and an estimated useful life of six years. The assembly machine is expected to last 180,000 hours. It was used 45,000 hours in year 1, 40,200 in year 2, 40,125 in year 3, 20,000 in year 4, 17,200 in year 5, and 17,475 in year 6. REQUIRED 1. Compute the annual depreciation and carrying value for the new assembly machine for each of the six years (round to the nearest dollar where necessary) under each of the follow- ing methods: (a) straight-line, (b) production, and (c) double-declining-balance. 2. If the assembly machine is sold for $115,000 after year 3, what would be the amount of gain or loss under each method? (Note: Round depreciation rate to two decimal places) 3. Do the three methods differ in their effect on the company's profitability? Do they differ in their effect on the company's operating cash flows? Explain 4. On the supplied blank general journal make the appropriate entry to reflect the sale of the machine using the straight line method as stated in Requirement #2. No date is necessary. Provide a brief explanation. ion computed Depreciation Table Depreciation Method Carrying Value Year Computation Depreciation a. Straight-line b. Production c. Double- declining- balance 4 6. You need to complete all necessary figures below: %3D years ** To reduce to estimated residual yalue %3! %3D 234 56 1, 2. 4, 6, 122 - Gain or loss determined f the machine was sold for $115,000 after year 3, the gain or loss under each method would be as follows: Next to a.,b.,c. you must circle the correct word: gain or loss: a. a gain or loss of b. a gain or loss of . a gain or loss of 3. User Insight: Patterns of depreciation and effects on profitability and cash flows GENERAL JOURNAL ate Page Description Posting Ret. Debit Credit PAGE 19

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A STRAIGHT LINE METHOD YEAR COMPUTATION DEPRECIATION CARRYING VALUE 1 3620002000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started