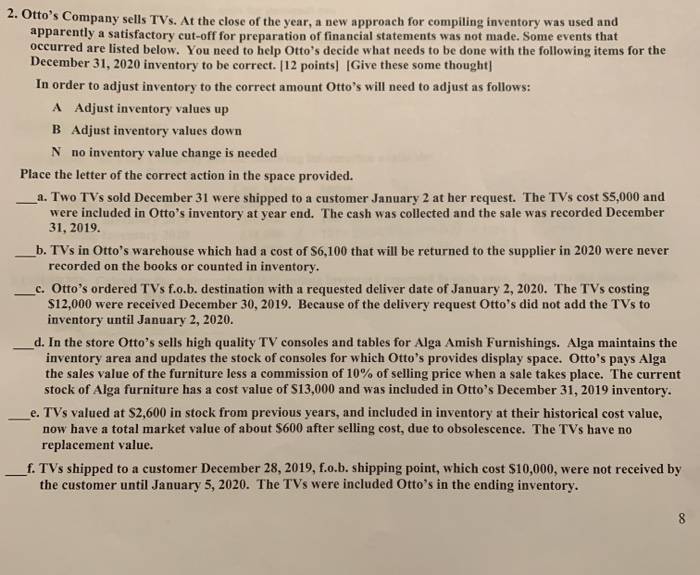

4. Otto's Company sells TVs. At the close of the year, a new approach for compiling inventory was used and apparently a satisfactory cut-off for preparation of financial statements was not made. Some events that occurred are listed below. You need to help Otto's decide what needs to be done with the following items for the December 31, 2020 inventory to be correct. [12 points) [Give these some thought] In order to adjust inventory to the correct amount Otto's will need to adjust as follows: A Adjust inventory values up B Adjust inventory values down N no inventory value change is needed Place the letter of the correct action in the space provided. a. Two TVs sold December 31 were shipped to a customer January 2 at her request. The TVs cost $5,000 and were included in Otto's inventory at year end. The cash was collected and the sale was recorded December 31, 2019. _b. TVs in Otto's warehouse which had a cost of $6,100 that will be returned to the supplier in 2020 were never recorded on the books or counted in inventory. _c. Otto's ordered TVs f.o.b. destination with a requested deliver date of January 2, 2020. The TVs costing $12,000 were received December 30, 2019. Because of the delivery request Otto's did not add the TVs to inventory until January 2, 2020. d. In the store Otto's sells high quality TV consoles and tables for Alga Amish Furnishings. Alga maintains the inventory area and updates the stock of consoles for which Otto's provides display space. Otto's pays Alga the sales value of the furniture less a commission of 10% of selling price when a sale takes place. The current stock of Alga furniture has a cost value of $13,000 and was included in Otto's December 31, 2019 inventory. TVs valued at $2,600 in stock from previous years, and included in inventory at their historical cost value, now have a total market value of about $600 after selling cost, due to obsolescence. The TVs have no replacement value. f. TVs shipped to a customer December 28, 2019, f.o.b. shipping point, which cost $10,000, were not received by the customer until January 5, 2020. The TVs were included Otto's in the ending inventory