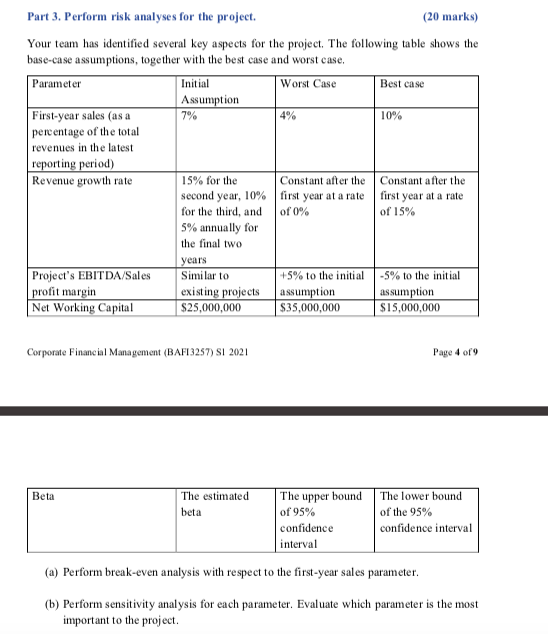

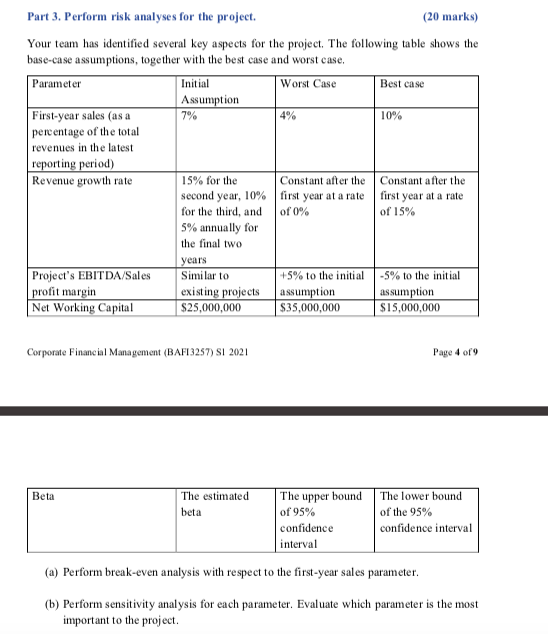

4% Part 3. Perform risk analyses for the project. (20 marks) Your team has identified several key aspects for the project. The following table shows the base-case assumptions, together with the best case and worst case, Parameter Initial Worst Case Best case Assumption First-year sales (as a 7% 10% percentage of the total revenues in the latest reporting period) Revenue growth rate 15% for the Constant after the Constant after the second year, 10% first year at a rate first year at a rate for the third, and of 0% of 15% 5% annually for the final two years Project's EBITDA/Sales Similar to +5% to the initial -5% to the initial profit margin existing projects assumption assumption Net Working Capital $25,000,000 $35,000,000 $15,000,000 Corporate Financial Management (BAFI3257) SI 2021 Page 4 of 9 Beta The estimated The upper bound The lower bound beta of 95% of the 95% confidence confidence interval interval (a) Perform break-even analysis with respect to the first-year sales parameter. (b) Perform sensitivity analysis for each parameter. Evaluate which parameter is the most important to the project 4% Part 3. Perform risk analyses for the project. (20 marks) Your team has identified several key aspects for the project. The following table shows the base-case assumptions, together with the best case and worst case, Parameter Initial Worst Case Best case Assumption First-year sales (as a 7% 10% percentage of the total revenues in the latest reporting period) Revenue growth rate 15% for the Constant after the Constant after the second year, 10% first year at a rate first year at a rate for the third, and of 0% of 15% 5% annually for the final two years Project's EBITDA/Sales Similar to +5% to the initial -5% to the initial profit margin existing projects assumption assumption Net Working Capital $25,000,000 $35,000,000 $15,000,000 Corporate Financial Management (BAFI3257) SI 2021 Page 4 of 9 Beta The estimated The upper bound The lower bound beta of 95% of the 95% confidence confidence interval interval (a) Perform break-even analysis with respect to the first-year sales parameter. (b) Perform sensitivity analysis for each parameter. Evaluate which parameter is the most important to the project