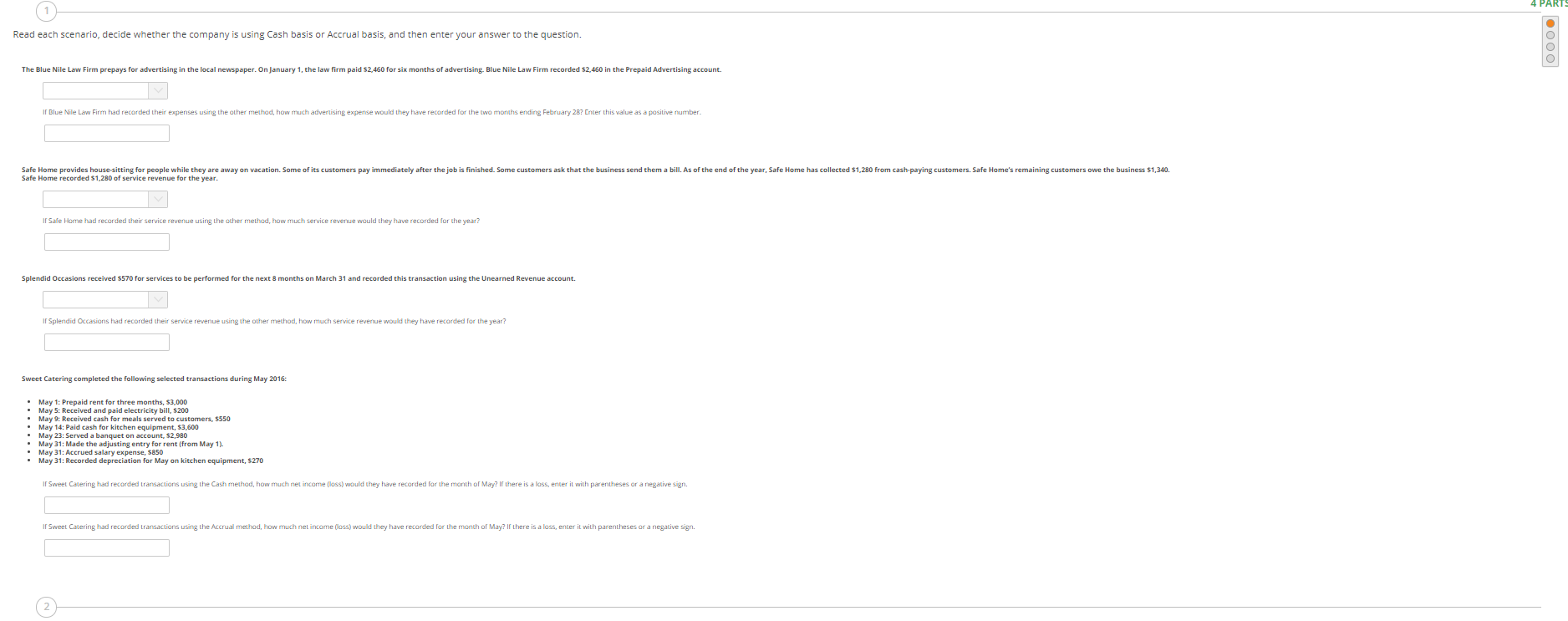

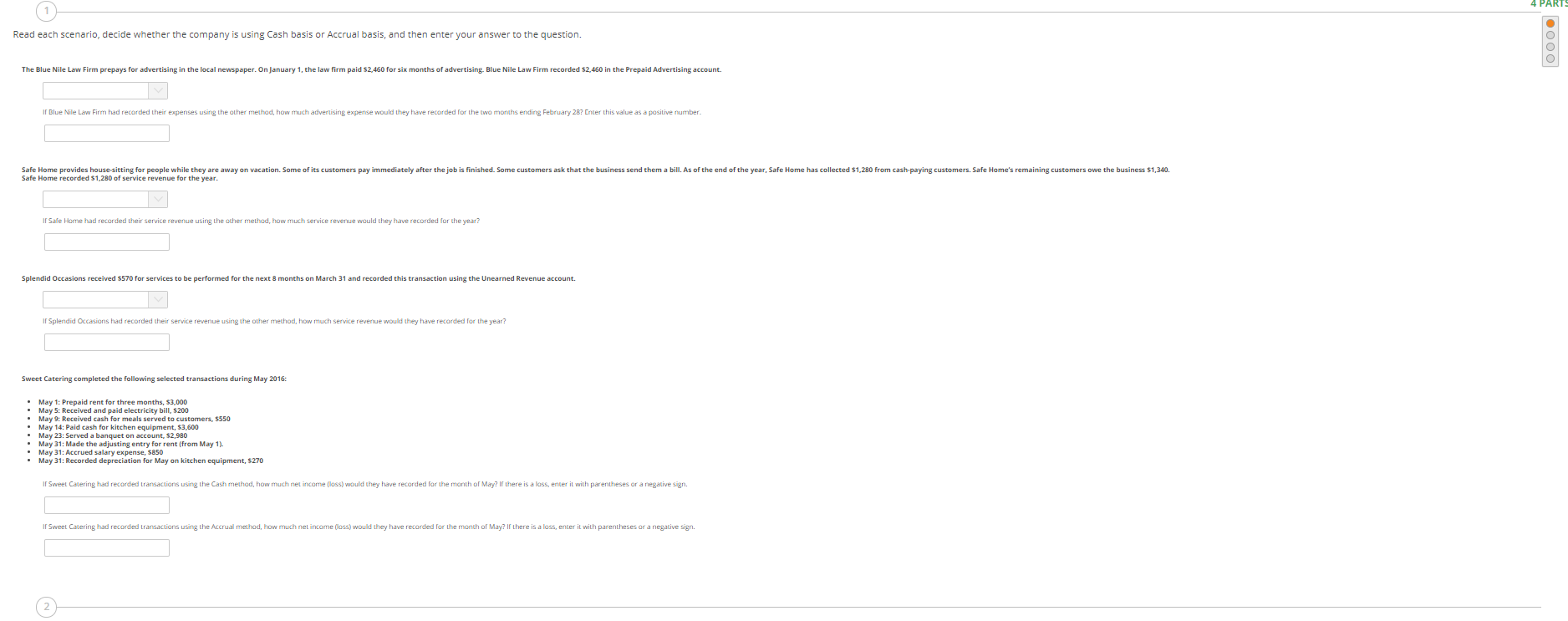

4 PARTS Read each scenario, decide whether the company is using Cash basis or Accrual basis, and then enter your answer to the question. The Blue Nile Law Firm prepays for advertising in the local newspaper. On January 1, the law firm paid $2,460 for six months of advertising. Blue Nile Law Firm recorded $2,460 in the Prepaid Advertising account. If Blue Nile Law Firm had recorded their expenses using the other method, how much advertising expense would they have recorded for the two months ending February 2B? Enter this value as a positive number. Safe Home provides house sitting for people while they are away on vacation. Some of its customers pay immediately after the job is finished. Some customers ask that the business send them a bill. As of the end of the year, Safe Home has collected $1,280 from cash-paying customers. Safe Home's remaining customers owe the business S1,340. Safe Home recorded $1,280 of service revenue for the year. Ir Sale Home had recorded their service revenue using the other method, how much service revenue would they have recorded for the year? Splendid Occasions received $570 for services to be performed for the next 8 months on March 31 and recorded this transaction using the Unearned Revenue account. If Splendid Occasions had recorded their service revenue using the other method, how much service revenue would they have recorded for the year? Sweet Catering completed the following selected transactions during May 2016: May 1: Prepaid rent for three months, 53,000 . May 5: Received and paid electricity bill, $200 May 9: Received cash for meals served to customers, $550 May 14: Paid cash for kitchen equipment, $3,600 May 23: Served a banquet on account, $2,980 May 31: Made the adjusting entry for rent (from May 1). May 31: Accrued salary expense, $850 May 31: Recorded depreciation for May on kitchen equipment, $270 If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign. If Sweet Catering had recorded transactions using the Accrual method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign. 4 PARTS Read each scenario, decide whether the company is using Cash basis or Accrual basis, and then enter your answer to the question. The Blue Nile Law Firm prepays for advertising in the local newspaper. On January 1, the law firm paid $2,460 for six months of advertising. Blue Nile Law Firm recorded $2,460 in the Prepaid Advertising account. If Blue Nile Law Firm had recorded their expenses using the other method, how much advertising expense would they have recorded for the two months ending February 2B? Enter this value as a positive number. Safe Home provides house sitting for people while they are away on vacation. Some of its customers pay immediately after the job is finished. Some customers ask that the business send them a bill. As of the end of the year, Safe Home has collected $1,280 from cash-paying customers. Safe Home's remaining customers owe the business S1,340. Safe Home recorded $1,280 of service revenue for the year. Ir Sale Home had recorded their service revenue using the other method, how much service revenue would they have recorded for the year? Splendid Occasions received $570 for services to be performed for the next 8 months on March 31 and recorded this transaction using the Unearned Revenue account. If Splendid Occasions had recorded their service revenue using the other method, how much service revenue would they have recorded for the year? Sweet Catering completed the following selected transactions during May 2016: May 1: Prepaid rent for three months, 53,000 . May 5: Received and paid electricity bill, $200 May 9: Received cash for meals served to customers, $550 May 14: Paid cash for kitchen equipment, $3,600 May 23: Served a banquet on account, $2,980 May 31: Made the adjusting entry for rent (from May 1). May 31: Accrued salary expense, $850 May 31: Recorded depreciation for May on kitchen equipment, $270 If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign. If Sweet Catering had recorded transactions using the Accrual method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign