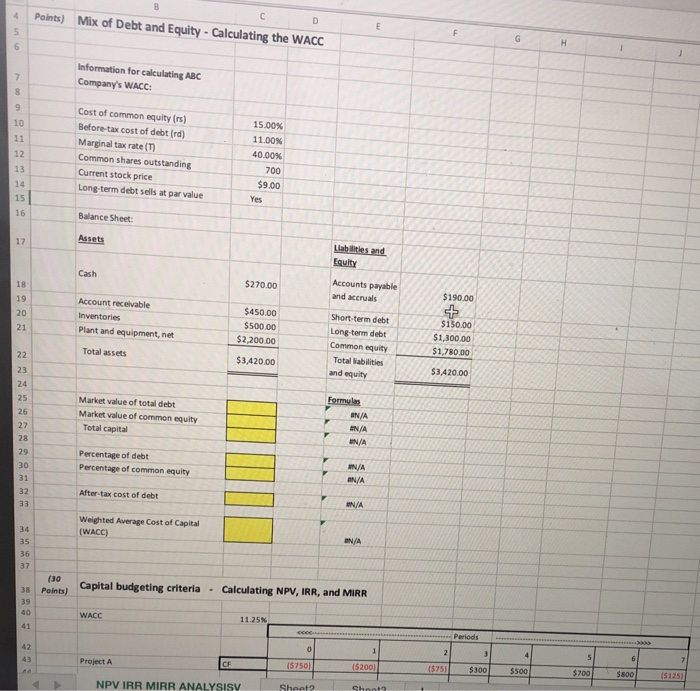

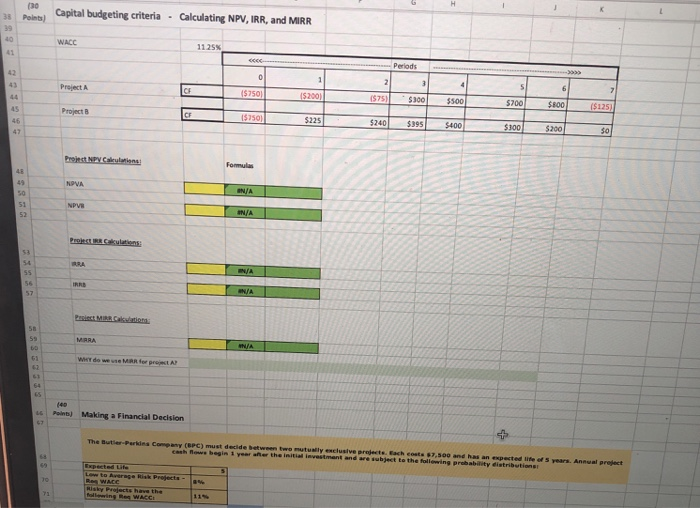

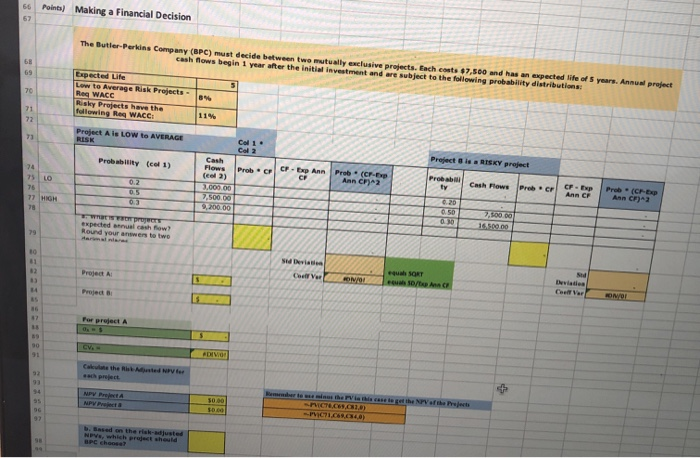

4 Points) Mix of Debt and Equity - Calculating the WACC Information for calculating ABC Company's WACC: Cost of common equity (rs) Before-tax cost of debt (rd) Marginal tax rate (1) Common shares outstanding Current stock price Long-term debt sells at par value 15.00% 11.00% 40.00% 700 $9.00 Yes Balance Sheet: Assets Liabilities and Equity Cash $270.00 Accounts payable and accruals $190.00 Account receivable Inventories Plant and equipment, net $450.00 $500.00 $2,200.00 Short-term debt Long-term debt Common equity Total abilities and equity $150.00 $1,300.00 $1,780.00 Total assets $3.420.00 $3,420.00 Market value of total debt Market value of common equity Total capital Formulas IN/A ANA #N/A Percentage of debt Percentage of common equity #N/A AN/A After tax cost of debt #N/A Weighted Average Cost of Capital (WACC) N/A (30 Points) Capital budgeting criteria - Calculating NPV, IRR, and MIRR WACC 1125 Periods Proiect A CE (57501 52001 (525 $300 $500 VoIev Sheet2 Points) Capital budgeting criteria - Calculating NPV, IRR, and MIRR 157501 52001 "S900 S500 57001 $800 ($1251 Project 157501 5225 $240 995 $400 $100 $200 $0l P ANENC es NA NA Making Financial Decision The Burrs C Anal prest eny (PC) met derde between este predete. Each OD areas an experties cash flowe begin 1 year aer the initial investment and are subject to the following probability distributioner Low to Average Projects 66 Pins Making a Financial Decision The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each cost 07,500 and has an expected life of years. Annual project cash flows begin 1 year after the initial investment and are subject to the following probability distributions Expected Lite Low to Average Risk Projects Re WACC isley Projects have the following Reg WACC 11% Project A la LOW to AVERAGE RISK E RISKY project Probability (cel 1) Flow. Prob. CP. Ann P . (Poe Ann CFA 2 Cash Flows Pre l CF. Exp Ann CF Prob (CPExp Ann CF2 0.5 expected annual cash flow Round your awenste two SORT CV. VO helicasete the Netherler HPV, which preget weld 4 Points) Mix of Debt and Equity - Calculating the WACC Information for calculating ABC Company's WACC: Cost of common equity (rs) Before-tax cost of debt (rd) Marginal tax rate (1) Common shares outstanding Current stock price Long-term debt sells at par value 15.00% 11.00% 40.00% 700 $9.00 Yes Balance Sheet: Assets Liabilities and Equity Cash $270.00 Accounts payable and accruals $190.00 Account receivable Inventories Plant and equipment, net $450.00 $500.00 $2,200.00 Short-term debt Long-term debt Common equity Total abilities and equity $150.00 $1,300.00 $1,780.00 Total assets $3.420.00 $3,420.00 Market value of total debt Market value of common equity Total capital Formulas IN/A ANA #N/A Percentage of debt Percentage of common equity #N/A AN/A After tax cost of debt #N/A Weighted Average Cost of Capital (WACC) N/A (30 Points) Capital budgeting criteria - Calculating NPV, IRR, and MIRR WACC 1125 Periods Proiect A CE (57501 52001 (525 $300 $500 VoIev Sheet2 Points) Capital budgeting criteria - Calculating NPV, IRR, and MIRR 157501 52001 "S900 S500 57001 $800 ($1251 Project 157501 5225 $240 995 $400 $100 $200 $0l P ANENC es NA NA Making Financial Decision The Burrs C Anal prest eny (PC) met derde between este predete. Each OD areas an experties cash flowe begin 1 year aer the initial investment and are subject to the following probability distributioner Low to Average Projects 66 Pins Making a Financial Decision The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each cost 07,500 and has an expected life of years. Annual project cash flows begin 1 year after the initial investment and are subject to the following probability distributions Expected Lite Low to Average Risk Projects Re WACC isley Projects have the following Reg WACC 11% Project A la LOW to AVERAGE RISK E RISKY project Probability (cel 1) Flow. Prob. CP. Ann P . (Poe Ann CFA 2 Cash Flows Pre l CF. Exp Ann CF Prob (CPExp Ann CF2 0.5 expected annual cash flow Round your awenste two SORT CV. VO helicasete the Netherler HPV, which preget weld